Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

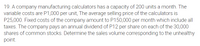

Transcribed Image Text:19. A company manufacturing calculators has a capacity of 200 units a month. The

variable costs are P1,000 per unit, The average selling price of the calculators is

P25,000. Fixed costs of the company amount to P150,000 per month which include all

taxes. The company pays an annual dividend of P12 per share on each of the 30,000

shares of common stocks. Determine the sales volume corresponding to the unhealthy

point.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Alexander Corporation sells its only product for $30 per unit. Its variable costs per unit are 40% of its selling price. Its total fixed costs for the year are $450,000. The company has an average income tax rate of 40 %. How many units must the company sell in order to earn an after tax profit of $360,000 ? Question 12 options: 45,000. 58,334. 1, 750, 020. 75,000.arrow_forwardDuring a slack period, a manufacturer can sell 3000 articles per month at a price of $1.20 each. A $200,000 investment is used which is depreciated over a 20-year life. An annual fixed cost of $20,000 myst be considered well as an annual maintenance cost of $10,000. The production cost is $1.10 per item. The manufacturer's tax rate is 45%. Should the factory shut down?arrow_forwardUnited Snack Company sells 50-pound bags of peanuts to university dormitories for $5 a bag. The fixed costs of this operation are $60,000, while the variable costs of peanuts are $.5 per pound. a. What is the break-even point in bags? b. Calculate the profit or loss on 18,000 bags. c. What is the degree of operating leverage at 20,000 bags ? d. If United Snack Company has an annual interest expense of $10,000, and EBIT $80.000, calculate the degree of financial leverage at 18,000. e. What is the degree of combined leverage at both sales levelarrow_forward

- Last year company A introduced a new product and sold 25,900 units at $97.00 per unit. The product variable expense $67.00 per unit with a fixed price expense of $835,500 per year. a. What is the product's net income or loss last year? b. What is the product break-even point in unit sales and dollar sales? c. Assume the company has conducted a market study that estimates it can increase sales by 5,000 units for each $2.00 reduction in its selling price. If the company would only consider increments of $2.00(e.g. $68,$66, etc) What is the maximum annual profit that can be earned on this product? What sales volume and selling price per unit generate the maximum profit? d. What would be the break-even point in unit sales and dollar sales using the selling price that was determined in the required letter c above? Thank you,arrow_forwardA company’s forecasted sales are $300,000 and its sales at break-even are $180,000. Its margin of safety in dollars is a. $180,000. c. $480,000. e. $300,000. b. $120,000. d. $60,000.arrow_forwardThe Warren Watch Compony sells watches for $25, fixed Costs are $170,000, and variable costs are $15 per watch! watchili 1 ngay 20 a) What is the firm's gain or loss at sales st. of 10,000 watches & Loss, if any, should be indicated by a minus sign. Round your answer to the nearest cent. $ NOM MAX 250 Seb(2 Bek What is the firm's gain or loss at sales of 18,000 watches? Loss, if any, should be indicated by a minus sign. Round your answer to the nearest cent. ( st b) What is the break-even point Cunit sales)? Round your answer to the nearest whole number. Slow EHMNY 2.3arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education