FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

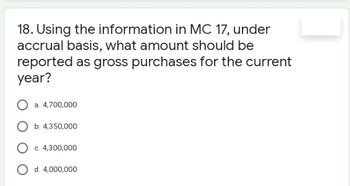

Transcribed Image Text:18. Using the information in MC 17, under

accrual basis, what amount should be

reported as gross purchases for the current

year?

a. 4,700,000

O b. 4,350,000

O c. 4,300,000

O d. 4,000,000

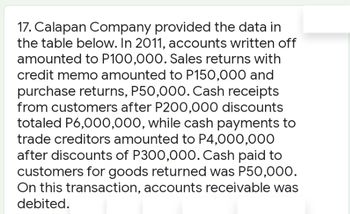

Transcribed Image Text:17. Calapan Company provided the data in

the table below. In 2011, accounts written off

amounted to P100,000. Sales returns with

credit memo amounted to P150,000 and

purchase returns, P50,000. Cash receipts

from customers after P200,000 discounts

totaled P6,000,000, while cash payments to

trade creditors amounted to P4,000,000

after discounts of P300,000. Cash paid to

customers for goods returned was P50,000.

On this transaction, accounts receivable was

debited.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Precious Products Ltd.Income StatementFor the year ended xxxxSales.................................................................... $______Cost of goods sold:Finished goods inventory, beginning.................... $ ______Add: Cost of goods manufactured ....................... ______Goods available for sale...................................... ______Deduct: Finished goods inventory, ending............ ______ ______Gross margin........................................................ ______Selling and administrative expenses:Selling expenses................................................. ______Administrative expenses ..................................... ______ ______Operating income ................................................. $ , .3. Direct labour: $______÷ 10,000 units = $______per unit.Insurance: $______÷ 10,000 units = $______per unit.4. Direct materials:Unit cost: $: $______÷ 10,000 units = $______per unit.Total cost: ______units × $______ per unit =…arrow_forwardABC Company's accounting records reported the followingaccount balances as of December 31, 2028:Inventory ................... $59,000Trademark ................... $16,000Interest revenue ............ $21,000Accounts receivable ......... $44,000Cost of goods sold .......... $30,000Utilities expense ........... $29,000Salaries payable ............ $14,000Accumulated depreciation .... $37,000Land ........................ ?Dividends ................... $ 9,000Notes payable ............... $48,000Common stock ................ ?Rental revenue .............. $35,000Supplies .................... $23,000Income tax expense .......... $18,000Retained earnings ........... $57,000 (at Jan. 1, 2028)Sales revenue ............... $99,000Equipment ................... $74,000Copyright ................... $38,000Accounts payable ............ $41,000Salaries expense ............ $27,000Cash ........................ $19,000Additional information:The total equity at December 31, 2028 was $196,000.Calculate…arrow_forwardpurchase on account on effect on current ratioarrow_forward

- You are given the following data in relation to two items held in inventory. Item A Item B Purchase price Select one: O a. 230 b. 240 O c. 170 d. 196 e. 206 160 40 200 Costs incurred to date 20 10 30 Estimated selling price 170 80 250 Selling costs 24 20 44 What is the aggregate amount at which inventories of these items should be stated in the statement of financial position?arrow_forwardHw 124.arrow_forward2. What is the Cost of Goods Available for Sale for the year? Beginning Inventory: $10,000Purchase for the year: $113,000Freight-in for the shipping under F.O.B Shipping Point term: $5,000Purchase Discount for the year: $12,000Purchase Return for the year: $6,000End of the year physical inventory balance: $35,000arrow_forward

- Using the following excerpts from the Michigan Company's financial statements and the list of terms that follow, please complete the worksheets below to determine cash paid to suppliers for inventory in 2018. From Balance Sheets: Dec. 31, 2018 Inventory Accounts Payable $ 74,000 55,000 Dec. 31, 2017 $82,000 58,000 From Income Statement: 2018 Cost of Goods Sold $520,000 Use these terms to complete the worksheets below: Beginning balance, Cash paid for Ending balance, Inventory inventory Inventory Ending balance, Goods available to Beginning balance, Accounts Payable sell Accounts Payable Inventory Total obligation to Cost of Goods Sold purchased pay inventory costs PLEASE NOTE: Use the term names exactly as shown above and list the items in the same order as shown in the textbook examples. You are to follow the format shown in the textbook. All dollar amounts will be rounded to whole dollars using "$" and commas as needed (i.e. $12,345).arrow_forwardPreviousBalance AnnualPercentageRate (APR)(as a %) MonthlyPeriodicRate FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $2,490.00 % 1 1 4 % $ $1,374.98 $300.00 $arrow_forwardDiaz Fresh discloses the following annual data. For Year Ended December 31 2020 2021 Sales revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $160,000 $240,000 Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80,000 120,000 Its cost of goods sold is based on inventories valued at cost. Assume for each year that all of the beginning inven- tory is sold by year end. Additional information regarding its inventories follows. Inventory LIFO Cost Market January 1, 2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12,000 $16,000 December 31, 2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000 18,000 December 31, 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26,000 20,000 Required a. Prepare the entries to apply the lower-of-cost-or-market rule at December 31, 2020, and 2021. Use an allow- ance account to reduce…arrow_forward

- Using the following information, what is the amount of gross profit? Purchases $ 25,449 Selling expense $ 970 Inventory, September 1 5,138 Inventory, September 30 8,660 Administrative expense 545 Sales 55,013 Rent revenue 844 Interest expense 907 A. $907 B. $21,927 C. $24,542 D. $33,086arrow_forward6. 131 3) Northern Industries accepted a credit card sale for $14,000. The credit card company charges 2%. a. What is the entry for this transaction on the horizontal equation? b. What is the impact of collecting the payment from the credit card company? (Show the individual accounts impacted in the asset section) Assets Liabilities Stockholders' Equity Revenues Expenses Net Income Cash %3D Flow a. b. 4) Here are the inventory purchases and sales for Fraser Company: Inventory Layers Available for Sale: October 1 Beginning Inventory 14 @ $16 $224 9. Study guide - Chapter 5 (with solutions).docx 19 f12 Oly prt sc 114arrow_forwardBeginning inventory and purchases are presented below: November 1 Beginning inventory .............................. 10 units at $61 November 6 purchase ................................................. 40 units at $62 November 14 purchase ............................................... 35 units at $65 November 24 purchase ............................................... 15 units at $63 Assuming the periodic inventory system, on November 30th there are 23 items left in inventory. Determine the Total Cost of the Merchandise Sold and the Total Cost of the Ending Inventory using a) FIFO b) LIFO c) Weighted Average FIFO LIFO Beginning inventory and purchases are presented below: November 1 Beginning inventory .............................. 10 units at $61 November 6 purchase…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education