FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

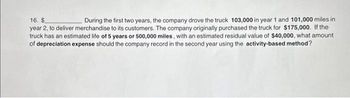

Transcribed Image Text:16. $

During the first two years, the company drove the truck 103,000 in year 1 and 101,000 miles in

year 2, to deliver merchandise to its customers. The company originally purchased the truck for $175,000. If the

truck has an estimated life of 5 years or 500,000 miles, with an estimated residual value of $40,000, what amount

of depreciation expense should the company record in the second year using the activity-based method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 20x0, a company purchased a delivery truck for $30,000. They estimated the useful life of the truck to be 6 years, and the salvage value to be $6,000. On July 1, 20x5, they sold the truck for $7,400. Assuming the company uses straight line depreciation and records depreciation expense monthly, calculate the gain or loss associated with selling the truck.arrow_forwardA company purchases a delivery van for $23,000. The van is estimated to have a four-year service life and a residual value of $2,100. During the four-year period, the company expects to drive the van 110,000 miles. Required: Calculate annual depreciation for the four-year life of the van using each of the following methods. 1. Straight-line 2. Double-declining-balance 3. Activity-based (Actual miles driven each year were 20,000 miles in Year 1; 29,000 miles in Year 2; 22,000 miles in Year 3; and 27,000 miles in Year 4. Note that actual total miles of 98,000 fall short of expectations by 12,000 miles.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate annual depreciation for the four-year life of the van using the straight-line method. (Round your final answers to the nearest whole dollar.) Depreciation expense 3 of 31 ⠀ Next >arrow_forwardWhat is the solution and/or answer to this problem? Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on April 1 for $52,650. The equipment was expected to have a useful life of three years, or 3,780 operating hours, and a residual value of $1,620. The equipment was used for 700 hours during Year 1, 1,300 hours in Year 2, 1,100 hours in Year 3, and 680 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) units-of-activity method, and (c) the double-declining-balance method. Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. a. Straight-line method Year Amount Year 1 $fill in the blank 1 Year 2 $fill in the blank 2 Year 3 $fill in the blank 3 Year 4 $fill in the blank 4 b. Units-of-activity method Year Amount Year 1 $fill…arrow_forward

- I need help with this questionarrow_forwardRequired information [The following information applies to the questions displayed below] NewTech purchases computer equipment for $261,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $30,000. Prepare a table showing depreciation and book value for each of the four years assuming double-declining-balance depreciation. (Enter all amounts as positive values.) Year Year 1 Year 2 Year 3 Year 4 Total Depreciation for the Period Beginning-Year Depreciation Book Value Rate Annual Depreciation End of Period Accumulated Depreciation Year-End Book Value MUABAKANarrow_forwardQuestions # 24-27 are based on the information below: Chubbyville purchases a delivery van for $23,500. Chubbyville estimates a four-year service life and a residual value of $2,500. During the four-year period, the company expects to drive the van 105,000 miles. Actual miles driven were 24,000 miles in Year 1 and 26,000 miles in Year 2. 24. Using the straight-line method, what is the depreciation expense for year 2? A. $5,250 B. $5,875 C. $10,500 D. $11,750 25. Using the straight-line method, what is the book value at the end of year 3? A. $9,750 B. $10,550 C. $7,750 D. $8,250 26. Using double-declining balance method, what is the depreciation expense for year 1? A. $5,250 B. $5,875 C. $11,250 D. $11,750 27. Using the activity-based method, what is the balance in accumulated depreciation at the end of year 2? A. $10,000 B. $4,800 C. $5,200 D. $13,500arrow_forward

- A Kubota tractor acquired on January 8 at a cost of $54,000 has an estimated useful life of 10 years. Assuming that it will have no residual value. a. Determine the depreciation for each of the first two years by the straight-line method. First Year Second Year $ b. Determine the depreciation for each of the first two years by the double-declining-balance method. Do not round the double-declining balance rate. If required, round your final answers to the nearest dollar. First Year Second Yeararrow_forward9. Newson's Courier Service recently purchased a new delivery van for $29,000. The van is estimated to have a useful life of 8 years or 250,000 kilometres. The van will have a residual value of $1,000. The company uses the units-of- production method of depreciation. Assuming the van travelled 36,000 kms. during the first year, what is the depreciation expense for the van in year 1? A. $3,625 B. $3,500 C. $4,032 D. $4,176arrow_forwardA machine with a cost of $75,000 has an estimated residual value of $5,000 and an estimated life of 4 years or 18,000 hours. What is the amount of depreciation for the second full year, using the double-declining-balance method?arrow_forward

- Kingbird Company purchased a truck for $70,300. The company expected the truck to last four years or 100,000 miles, with an estimated residual value of $6,300 at the end of that time. During the second year, the truck was driven 29,000 miles.Compute the depreciation for the second year under each of the methods below. Units-of-activity $enter a dollar amount Double-declining-balance $enter a dollar amountarrow_forwardOn January 1, 20X1, Bixby Inc. purchased equipment costing $75,000. The equipment is estimated to have a residual value of $6,000 and a four-year useful life. Part A: In the following chart, compare how much depreciation expense should be recorded each year of the asset’s life and over all four years if the company uses the straight-line versus the double-declining balance depreciation (DDB) method. Part B: Prepare the entry on 12/31/X2 to record depreciation expense for 20X2, assuming the straight-line depreciation method is used. Year Straight-Line Method DBB Method Year 1 of asset's life Year 2 of asset's life Year 3 of asset's life Year 4 of asset's life Totalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education