FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please Solve In 20mins

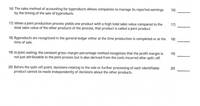

Transcribed Image Text:16) The sales method of accounting for byproducts allows companies to manage its reported earnings

by the timing of the sale of byproducts.

16)

17) When a joint production process yields one product with a high total sales value compared to the

total sales value of the other products of the process, that product is called a joint product.

17)

18) Byproducts are recognized in the general ledger either at the time production is completed or at the

time of sale.

18)

19) In joint costing, the constant gross-margin percentage method recognizes that the profit margin is

not just attributable to the joint process but is also derived from the costs incurred after split-off.

19)

20) Before the split-off point, decisions relating to the sale or further processing of each identifiable

product cannot be made independently of decisions about the other products.

20)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Learning SE MINDTAP evo/index.html?deploymentid=60338517901669990751687760&elSBN=9780357517642&nbld=3626933&snap... ☆ lomework 6300. 1 mancial Lailuialvi vi a spicoubnicel. Hide Feedback Correct X f6 Quantitative Problem 1: You plan to deposit $2,200 per year for 6 years into a money market account with an annual return of 2%. You plan to make your first deposit one year from today. a. What amount will be in your account at the end of 6 years? Do not round intermediate calculations. Round your answer to the nearest cent. 4 b. Assume that your deposits will begin today. What amount will be in your account after 6 years? Do not round intermediate calculations. Round your answer to the nearest cent. 6 Hide Feedback Incorrect F Check My Work Feedback Review the FVAN definition and its equation. Q Search Understand the difference between an ordinary annuity and an annuity due. Be careful about the order of mathematical operations if using the equation. If using a financial calculator, be…arrow_forward• What if the borrowing rate is 10%? S y1 E(rp)-B = ? σ(rp)arrow_forwardWaiting periods. Fill in the number of periods for the following table,, using one of the three methods below: In (FV/PV) In (1 + r) a. Use the waiting period formula, n = b. Use the TVM keys from a calculator. c. Use the TVM function in a spreadsheet. Present Value 760.13 Future Value $ 1,585.01 Interest Rate 3% Number of Periods years (Round to the nearest whole number.)arrow_forward

- 120 SRBBARH ageNOWv2 | Online teach x + SOFTWARE UPDATE takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false macOS Big Sur 11.3.1 is available and w later tonight. еВook 4 Show Me How E Print Item eak-Even Point Radison Inc. sells a product for $75 per unit. The variable cost is $34 per unit, while fixed costs are $494,214. Determine (a) the break-even point in sales units and (b) the break-even point if the selling price were increased to $83 per unit. a. Break-even point in sales units units b. Break-even point if the selling price were increased to $83 per unit units Previous Next Check My Work Save and Exit Submit Assignment for Grading Email Instructor MacBook Airarrow_forwardWhere does the 60% come from? on part a Step 2?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education