ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

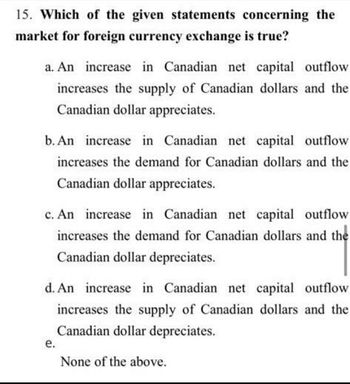

Transcribed Image Text:15. Which of the given statements concerning the

market for foreign currency exchange is true?

a. An increase in Canadian net capital outflow

increases the supply of Canadian dollars and the

Canadian dollar appreciates.

b. An increase in Canadian net capital outflow

increases the demand for Canadian dollars and the

Canadian dollar appreciates.

c. An increase in Canadian net capital outflow

increases the demand for Canadian dollars and the

Canadian dollar depreciates.

d. An increase in Canadian net capital outflow

increases the supply of Canadian dollars and the

Canadian dollar depreciates.

e.

None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 2 of 25 In which situation is a country most likely to choose a flexible exchange rate for its currency? O A. A country believes that its currency will be in low demand in global markets. B. A country worries that the value of its currency could rise and fall unpredictably. C. A country has a reputation for having a strong and stable economy over time. O D. A country wants to make sure that its currency is stable in all economic situations.arrow_forwardIf the exchange rate moves from $1 for one Euro to $1.50 for one Euro, then Select one: a. it becomes more expensive for a European to buy a European product. b. it becomes more expensive for an American investor to save at an American bank. c. it becomes more expensive for an American to buy a Mexican product. d. it becomes more expensive for an American to buy a European product.arrow_forwardIf Boblandia had a flexible exchange rate, it would cost 5 Bobos to purchase a Canadian dollar. The Central Bank of Boblandia (aka, the Bank of Boblandia, or BoB) has fixed the exchange rate, saying it will buy or sell Bobos at C$0.25 for each Bobo. Which of the following is true? O At the fixed exchage rate, supply of Bobos exceeds demand. The BoB's holdings of Canadian dollars will increase. O At the fixed exchage rate, supply of Bobos exceeds demand. The BoB's holdings of Canadian dollars will decrease. O At the fixed exchage rate, supply of Bobos is less than demand. The BoB's holdings of Canadian dollars will increase. O At the fixed exchage rate, supply of Bobos is less than demand. The BoB's holdings of Canadian dollars will decrease.arrow_forward

- A. Canada produces natural resources (coal, natural gas, and others), the demand for which has increased rapidly as China and other emerging economies expand. i. Explain how growth in the demand for Canada's natural resources would affect the demand for Canadian dollars in the foreign exchange market. Explain how the supply of Canadian dollars would change. ii. iii. Explain how the value of the Canadian dollar would change. iv. Illustrate your answer with a graphical analysis. 1arrow_forward3. If the exchange rate changes from 1.50 Canadian dollars per U.S. dollar to 1.67 Canadian dollars per U.S. dollar, we say that the Canadian dollar has appreciated against the U.S. dollar. True Falsearrow_forward1a. Draw foreign currency markets for the US dollar and the European zone euro. Show on eachmodel the impact of US exports of grain to the European zone. Determine the impact on theinternational value of the US dollar and of the euro. b. What will happen to these currencies? (Circle one for each)?US Dollar EuroAppreciate DepreciateDepreciate Appreciatearrow_forward

- See attached.arrow_forward5) Indicate whether each of the following creates a demand for or a supply of European euros in foreign exchange markets: a. Liberty purchases an Airbus plane assembled in France b. Mercedes-Benz decides to build an assembly plant in Knoxville c. A Liberty student decides to spend a year studying at the Sorbonne in Paris d. An Italian manufacturer ships machinery from Rome to Venice on an Egyptian freighter e. It is widely expected that the euro will depreciate in the near futurearrow_forwardA fall in the expected future exchange rate _ the supply of Canadian dollars. A decrease in the world demand for Canadian exports the supply of Canadian dollars. A. decreases; decreases B. increases; does not change C. increases; increases D. decreases; does not changearrow_forward

- 17arrow_forward2. If imports = 500 billion euros, exports = 700 billion euros, purchases of domestic assets by foreign residents = 600 billion euros, and purchases of foreign assets by domestic residents = 800 billion euros, what is the quantity of euros demanded in the market for foreign currency exchange? a. 1,100 billion euros b 600 billion euros c. 500 billion euros d. 200 billion eurosarrow_forward1. Will A Canadian forestry company selling on world markets have a higher or lower exchange rate for the Canadian dollar? Explain why. 2. Will a Canadian company that must import equipment from abroad will have a higher or lower exhange rate for Canadian dollar? Explain why. 3. Make a summary list of the causes and remedies for low levels of economic development.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education