FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

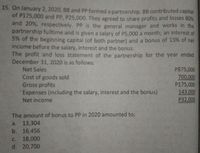

Transcribed Image Text:15. On January 2, 2020, BB and PP formed a partnership. BB contributed capital

of P175,000 and PP, P25,000. They agreed to share profits and losses 80%

and 20%, respectively. PP is the general manager and works in the

partnership fulltime and is given a salary of P5,000 a month; an interest of

5% of the beginning capital (of both partner) and a bonus of 15% of net

income before the salary, interest and the bonus.

The profit and loss statement of the 'partnership for the year ended

December 31, 2020 is as follows:

P875,000

700,000

P175,000

143,000

P32,000

Net Sales

Cost of goods sold

Gross profits

'Expenses (including the salary, interest and the bonus)

Net income

The amount of bonus to PP in 2020 amounted to:

a. 13,304

b. 16,456

18,000

d. 20,700

с.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At December 31, A and B are partners with capital balances of P40, 000 and P20, 000, and they share profits and losses in the ratio of 2:1, respectively. On this date, C invests P17,000 in cash for a one-fifth interest in the capital and profit of the new partnership. Assuming that the bonus method is used, how much should be credited to C's capital account on Decemberarrow_forwardA and B formed a Partnership on January 1, 2020. A contributed capital of P50,000, while B contributed capital of P30,000. The Partnership agreement provides for the following: o Capital accounts are to be credited annually with interest at 5% of the beginning capital. o Partner B is to be paid salary of P2,000 a month. o Partner B is to receive a bonus of 10% based on the net income. The Partnership's income statement for the year ended is as follows: Revenues P101,000 30,000 71,000 Expenses (including salary, interest, and bonus) Net income Determine the amount of bonus.arrow_forward17. Un, Balaba, and Monta are partners with average capital balances during 2020 of P360,000, P180O,000, and P120,000, respectively. Partners receive 10% interest on their average capital balances. After deducting salaries of P90,000 to Un and P60,000 to Monta, the residual profit or loss is divided equally. In 2020, the firm sustained a P99,000 loss before interest and salaries to partners. By what amount should Un's capital account change? P105,000 decrease P33,000 decrease a. С. P21,000 increase b. d. P126,000 increasearrow_forward

- LL, MM and PP are partners with capitals of P40,000; P25,000 and P15,000 respectively. Thepartnership agreement provides that each partner shall be allowed 5% interest on his capital, that LLshall be allowed an annual salary of P8,500, and that MM shall be entitled to a minimum of P14,000per annum including amounts allowed as interest on capital and as share of profit. Profit after interestand salary allowances is to be divided between LL, MM and PP as 5:3:2 respectively. What amountmust be earned by the partnership during 2021 before charges for interest or salary if LL is to receivean aggregate of P20,000 to include interest, salary, and share of profit? a. P38,000b. P50,000c. P38,550d. P35,880arrow_forwardMárasigan, Cabance and Cequina formed a partnership on Jan. 1, 2019. contributed P120,000. Each Salaries were to be allocated as follows: Marasigan, P30,000; Cabance, P30,000; Cequina, P45,000. Drawings were equal to salaries and to be taken out evenly throughout the year. With sufficient partnership profit, Marasigan and Cabance could split a bonus equal to 25% of partnership profit after salaries and bonus (in no event could the bonus go below zero). Remaining profits were to be split as follows: 30% for Marasigan; 30% for Cabance, and 40% for Cequina. For the year, partnership profit was P120,000. Compute the ending capital for each partner: Marasigan, P125,100; Cabance, P125,100, Cequina, P124,800 Marasigan, P126,000; Cabance, P126,000, Cequina, P124,500 Marasigan, P125,500;, Cabance, P125,500, Cequina, P124,000 Marasigan, P155,100; Cabance, P155,100; Cequina, P169,800 a. b. C. d.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education