Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

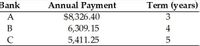

15) Ms. Day needs $20,000 to buy her dream car. In her search for the best (low cost) loan, she has gathered the following information from three local banks. Which bank would you recommend Ms. Day borrow from?

| BANK | ANUAAL PAYMENT |

TERM or YEARS |

|

A |

8,326.40$ | 3 |

| B | 6,309.15$ | 4 |

| C | 5,411.25$ | 5 |

Transcribed Image Text:Bank

Annual Payment

Term (years)

$8,326.40

6,309.15

A

3

В

4

C

5,411.25

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Similar questions

- ** HINT: Look online or look back at your worksheets for "add- on interest" problems! Melanie bought a used car for $10,000. (S)he put $100 down and financed the balance with the dealer at 5% add-on interest. If they agreed to make 36 monthly payments, then: (Round each answer to the nearest penny) What is the total payback amount of the loan? $ What is the amount of each payment? $ /month What is the total amount of interest paid on the loan? $arrow_forwardA man uses a loan program for small businesses to obtain a loan to help expand his vending machine business. The man borrows $25,000 for 2 years with a simple interest rate of 1.3%. Determine the amount of money the man must repay after 2 years.arrow_forwardA friend of yours just bought a new sports car with a $5,000 down payment,and her $30,000 car loan is financed at an interest rate of 0.75% per month for 48 months. After two years, the “Blue Book” value of her vehicle in the used-car marketplace is $15,000. Solve, a. How much does your friend still owe on the car loan immediately after she makes her 24th payment? b. Compare your answer to Part (a) to $15,000. This situation is called being “upside down.” What can she do about it? Discuss your idea(s) with your instructor.arrow_forward

- An acquaintance asks Kara to borrow money today to help her repair her car. The person will be able to repay Kara $500 in one year, and Kara is fully expects she will be repaid on time (risk free). If Kara requires a 5.0% return, what (largest) amount should she lend to her acquaintance?$525.00$495.00$475.00$476.19$471.43arrow_forward5. Kumal wants to sell her townhouse in Whitehorse. She will spend $2100 updating her home. She has $2100 in cash, but she plans to buy a $2100 RRSP. She will need 120 d to pay off any loan. Interest is compounded daily. a) Complete the chart. Option secured personal loan RRSP loan no loan credit card Detalle Buy the RRSP with $2100 cash. Pay for updating with the loan using her home equity as collateral. Pay for updating with the $2100. Buy an RRSP with an RRSP loan. Pay for updating with the $2100. Do not get an RRSP. Buy an RRSP with the $2100. Pay for updating with a credit card with a 30 d grace period. 1125 APR 2.75% 1.75% 0% 20.1% Total amount A-PH1+ 62 b) Which option should Kumal choose? Explain why. c) Which option should Kumal not choose? Explain why. d) Suppose Kumal uses a RRSP loan instead of her credit card. How much interest will she save? What is equity? What is it used for? Total Interest/A-P REFLECTING Suppose Kumal has a loan with simple interest nstead of compound…arrow_forwardPIANO LOANS. Stephanie has her eye on a $150,000 Steinway D Grand Piano. Will a cheery major chord or a depressing minor chord best describe her meeting with a loan officer? Use a calculator to do the math after writing out the proper formula. Round to the nearest dollar. Her credit history allows her to qualify for a 6% (APR, compounded monthly) loan that she plans to pay off over the next 15 years. If her earnings allow her to comfortably make monthly payments of $1200, what is the most she can afford to borrow? b. Alternatively, she can qualify for a 6% (APR, compounded monthly), 20-year loan. If she borrows $150,000, then what would her monthly payment be? c. Finally, suppose Stephanie runs up a lot of credit card debt in college, so that she can only qualify for a 9% (APR, compounded monthly), 20-year loan. If she still wants to buy that $150,000 piano, what will her monthly payment be? 4. а.arrow_forward

- Suppose that you need $30,000 for your last year of college. You could go to a private lending institution and apply for a signature student loan; rates range from 7% to 14%. However, your Aunt Sally is willing to loan you the money from her retirement savings, with no repayment until after graduation. All she asks is that in the meantime you pay her each month the amount of interest that she would otherwise get on her savings (since she needs that to live on), which is 4%.What is your monthly payment to her, and how much interest will you pay her over the year (9 months)?(Fill in the blanks below and give your answers as whole numbers.)The amount of interest per month you would pay Aunt Sally is $__(1)__ .The total interest you will pay her over the year (9 months)is $__(2)__ .arrow_forwardSelecting a Bank. Julie wants to open a bank account with $43. Julie estimates that she will write 23 checks per month and use her ATM card at the home bank. She will maintain a monthly balance of $500. Which bank should Julie choose? Hillsboro Bank First National South Trust Bank Sun Coast Bank ATM charges: Home bank Free Free Free Free Other bank 5 free, then $1.15 per use $1.40 per use $1.40 per use $1.40 per use Checking: Minimum deposit $100 $28 $1 $1 Minimum balance required to avoid fees* N/A N/A $500 N/A Monthly fees $8.66 $10.11 $15.88 $3.61 Check-writing charges 15 free, then $0.85 per check 10 free, then $0.85 per check Unlimited Each check $0.43 * N/A means monthly fees apply irrespective of account balances. Based on the information given in the chart, which bank should Julie…arrow_forwardBusiness /Finance / Q&A Library / elena's son enter college 16 year from now. At the time she would like to have $20,0 elena's son enter college 16 year from now. At the time sh Question elena's son enter college 16 year from now. At the time she would like to have $20,000 available for college expenses. For that pur,her bank will set up an account that pay 7% compounded. If she makes payment into the account at the end of each quarter, what must Elena's payments to be achieve her goal Expert Answer Step 1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education