Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:142

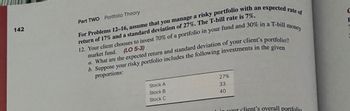

Part TWO Portfolio Theory

For Problems 12-16, assume that you manage a risky portfolio with an expected rate of

return of 17% and a standard deviation of 27%. The T-bill rate is 7%.

12. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill

market fund. (LO 5-3)

a. What are the expected return and standard deviation of your client's portfolio?

b. Suppose your risky portfolio includes the following investments in the given

proportions:

money

27%

Stock A

Stock B

33

Stock C

40

your client's overall portfolio.

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question 2 You invest $1,000,000 in a complete portfolio. The complete portfolio is composed of a risky portfolio with an expected rate of return of 16% and a standard deviation of 20%, and a T-bill with an expected rate of return of 7%. Required: You choose to invest $700,000 of your investment budget in the risky portfolio and the remaining in the T-bill. a) What are the expected return and standard deviation of your complete portfolio? b) Suppose your risky portfolio includes the following investments in the given proportions: Stock A: 40% Stock B: 60% What are the dollar values of your investment in each stock in the risky portfolio? c) What is the Sharpe ratio (S) of your complete portfolio? d) Draw the capital allocation line (CAL) of your complete portfolio on an expected return/standard deviation diagram. Suppose you decide to invest in the risky portfolio a proportion (y) of your total investment budget so that your complete portfolio will have an expected rate of return of…arrow_forwardINV 2 -1b You are considering an investment in a portfolio P with the following expected returns in three different states of nature: Recession Steady Expansion Probability 0.10 0.55 0.35 Return on P -15% 20% 40% The risk-free rate is currently 4%, and the market portfolio M has an expected return of 16% and standard deviation of 20%, and its correlation with P is .7. What is the portfolio P’s beta?arrow_forward2 Problem 2: Consider a market composed of only two risky assets, A and B, with the following properties: a StockA Expected return 25%, SD 20% StockB Expected return 15%, SD 25% a) Suppose their correlation is 0.8. What is the expected return of the following portfolios: one that invests 0% in A, one that invests 10% in A, 20% in A and so on until 100%? Plot the portfolio frontier formed by these portfolios.b) Repeat part (1) under the assumption that the correlation is -0.8.c) Explain in detail what is the intuition behind the difference across the answers you found for part (1) and part (2).arrow_forward

- INV 1 4a You have invested in a portfolio of 60% in risky assets (Portfolio R) and 40% in T-bills. The risky portfolio is described below: E(rR)=12% σR =15% If the T-bill rate is 3%, what is the expected return on your overall portfolio, including both portfolio R and the T-bills?arrow_forward14?arrow_forwardp 19 A portfolio analyst has been asked to allocate investment funds among three different stocks. The relevant data for the stocks is shown in the following table f the goal is to maximize return while maintaining risk within acceptable bounds (in this case, a portfolio standard deviation of no more than 20%, find the proper allocation of the funds to each stock O Ak Risk (Standard Deviation to 5) 25% 12% 10% What is the expected retum of the optimal stock portfolio? Stock A B C O Multiple Choice O Return (R) 20% O 10% 15% 17.9% 15 15 19.15 36.4% Pair of Stocks A to B A to C to C Help Joint Risk (Covariance) 0.05 0.075 -0.05 Save & Exit Submitarrow_forward

- 23. What return should be expected from investing in the market portfolio that is expected to yield 18% if the investment includes all of the investor's funds plus 30% additional funds borrowed at the risk-free rate of 6%? A. 18.6% B. 19.6% C. 21.6% D. 24.0%arrow_forwardquiz 8-15arrow_forward✓ Question 4 FI Two assets, Q & R, each have an expected return of 11.75%. Asset Q's standard deviation is 13% and Asset R's standard deviaion is 13.2%. A rational investor will choose: A. Either asset R or asset Q. B. Asset R. C. Asset Q. Question 5 Answers: 2 An investor whose portfolio is not diversified is subject to: Answers: A. systematic risk. Thursday, June 30, 2022 2:15:10 AM EDT W 4+ *3 B. non-systematic risk. C. both systematic risk and non-systematic risk. E $ 4 F4 R с F5 % 5 T F6 6 H Y F7 & 7 F8 U * 00 8 F9 81 L ( 9 F10 - F11 0 *+ F12 P PrtSc [ # 0 c Del Baarrow_forward

- Question 4?arrow_forward3. Problem 8.07 (Portfolio Required Return) BA eBook Problem Walk-Through Suppose you are the money manager of a $5.02 million investment fund. The fund consists of four stocks with the following investments and betas: Investment $ 260,000 600,000 1,560,000 2,600,000 с D If the market's required rate of return is 12% and the risk-free rate is 5%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. % Stock A B Beta 1.50 (0.50) 1.25 0.75arrow_forwardQ2?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education