Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

a. Prepare a schedule showing the reversal of the temporary differences and the computation of income taxes payable and

b. Prepare

c. Prepare the section of the statement of comprehensive income of Wall Services beginning with "Income from continuing operations before income taxes" for the year ended December 31, 2020.

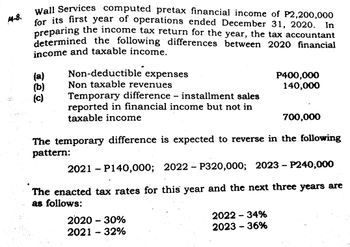

Transcribed Image Text:144-8.

Wall Services computed pretax financial income of P2,200,000

for its first year of operations ended December 31, 2020.

preparing the income tax return for the year, the tax accountant

determined the following differences between 2020 financial

income and taxable income.

(a)

(b)

(c)

Non-deductible expenses

Non taxable revenues

Temporary difference - installment sales

reported in financial income but not in

taxable income

P400,000

140,000

2020 - 30%

2021-32%

700,000

The temporary difference is expected to reverse in the following

pattern:

2022 -34%

2023 – 36%

In

2021 - P140,000; 2022 - P320,000; 2023 - P240,000

The enacted tax rates for this year and the next three years are

as follows:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A-6arrow_forwardThe following information has been obtained for Sheridan Corporation. 1. Prior to 2020, taxable income and pretax financial income were identical. 2. Pretax financial income is $1,634,000 in 2020 and $1,359,000 in 2021. On January 1, 2020, equipment costing $1,260,000 is purchased. It is to be depreciated on a straight-line basis over 5 years for tax purposes and over 8 years for financial reporting purposes. (Hint: Use the half-year convention for tax purposes, as discussed in Appendix 11A.) 3. 4. Interest of $57,000 was earned on tax-exempt municipal obligations in 2021. 5. Included in 2021 pretax financial income is a gain on discontinued operations of $195,000, which is fully taxable. 6. The tax rate is 20% for all periods. 7. Taxable income is expected in all future years.arrow_forwardJohnson Ltd. Paid $64,000 in taxes for 2017, and will use this amount to estimate the quarterly instalment payments due to CRA for 2018. Johnson Ltd. has a December 31 t year end. Prepare the journal entries to record: a) the March 31, 2018 instalment amount payable, b) the instalment payment on April 15, 2018, and c) the December 31, 2018 final tax payable amount if the total yearly taxes owing was actually $59,000. (no entry for the actual payment, just the recognition of the payable amount).arrow_forward

- (To help answer this question, create an Income Taxes Payable T-account and insert the beginning andending balances.) If the company debited Income Tax Expense and credited Income Taxes Payable $700during the year, what is the total amount of the debits recorded in the Income Taxes Payable account?What does the amount of these debits represent?arrow_forwardAt the beginning of 2021, Pitman Co. had pretax financial income of $1,200,000. Additionally, there was a timing difference of $300,000 due to an accounts receivable that will not be collected until the following year. The tax rate us 30%. A. Calculate the total taxable income for 2021. B. Calculate Income tax expense, income tax payable, and the deferred amount for 2021, and create the journal entry.arrow_forwardDo not give answer in image and hand writingarrow_forward

- For tax year 2020, the due date for filing paper forms with the SSA is: a. December 31 b. January 31 c. February 28 d. January 15arrow_forwardIn December 2022, J-Matt, Inc. collected rent in advance from tenants who will begin occupying the rental space in January 2023. For financial reporting purposes, J-Matt recorded the rent as deferred revenue when received in 2022 and will record the rent as revenue in January 2023 when the tenants occupy the rental space. For tax reporting, the rent is taxable in 2022 when collected. The deferred portion of the rent collected in 2022 was $122 million. Taxable income is $540 million in 2022. No temporary differences existed at the beginning of the year, and the tax rate is 25%. Prepare the appropriate journal entry to record J-Matt's provision for income taxes in 2022.arrow_forwardWhat is the amount of net income after tax that Vignette Company should report for the year 2021? Vignette Construction Company changed from completed contract method to the percentage of completion method of accounting for long-term construction contracts during 2021. For tax purposes, the company employs the completed contract method and will continue this approach in the future. The appropriate information related to this change is as follows: Pre-tax Income from Percentage of Completion 2020 2,028,000 1,820,000 Completed Contract 1,534,000 1,248,000 2021 Income tax rate is 35%. What is the amount of net income after tax that Vignette Company should report for the year 2021? Your answerarrow_forward

- Dan plc is preparing its financial statements for the year ended 31 December 20X7. Its initial trial balances show the following balance: Income tax payable on 1 January 20X7 Income tax paid M 337,850 £ 351,083 The income tax paid during the year ended 31 December 20X7 completely settles the 20X6 liability. The total estimated tax due on the profits for the year ended 31 December 20X7 is 402,917 Dan plc should record the following journal at 31 December 20X7 A. Debit Income tax expense £389,684; Credit Income tax payable £51,834, Credit Income tax paid £337,050 B. Debit Income tax expense £389,684, Credit Income tax payable £65,067, Credit Income tax paid £324,617 C. Debit Income tax expense £402,917, Credit Income tax payable £65,067, Credit Income tax paid £337,850 D. Debit Income tax expense £402,917, Credit Income tax payable £51,834; Credit Income tax paid £351,083arrow_forwardUse (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Use the 2020 Federal income taxes tables for the percentage method table and the wage bracket method tablearrow_forwardThe adjusted trial balance of Palm Realtors Ltd. at December 31, 2019, appears below: Palm Realtors Ltd.Adjusted Trial BalanceDecember 31, 2019Cash $ 8,950Accounts receivable 53,530Prepaid rent 2,200Equipment 45,690Accumulated amortization $ 18,930Accounts payable 15,900Interest payable 900Salary payable 3,500Income tax payable 4,700Note payable (due 2025) 19,500Common shares 8,000Retained earnings 29,325Dividends 30,000Commissions 227,480Depreciation expense 6,260Salary expense 140,500Rent expense 26,400Interest expense 1,500Income tax expense 13,205Total $328,235 $328,235 Prepare in good form a classified statement of financial position for Palm Realtors Ltd as at December 31, 2019,arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education