ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

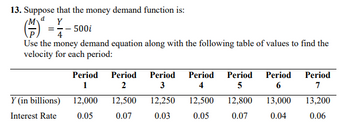

Transcribed Image Text:13. Suppose that the money demand function is:

(--)ª

Use the money demand equation along with the following table of values to find the

velocity for each period:

ay

== - 500i

Y (in billions)

Interest Rate

Period

1

12,000

0.05

Period

2

12,500

0.07

Period

3

12,250

0.03

Period Period

4

5

12,500 12,800

0.05

0.07

Period

6

13,000

0.04

Period

7

13,200

0.06

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Q3. Suppose that the money demand function is given by: Md=$Y (.25-i), where $Y is $100. (a) Derive the bond demand function (B) assuming that wealth is $50. (b) Calculate Md and Bd at interest rates of 5% (use .05) and 10% (use .10). SHOW WORK. (c) How does an increase in the interest rate affect the amount of money people are willing to hold, according to your calculations? How does an increase in the interest rate affect the quantity of bonds people are willing to hold? (d) Suppose the supply of money is currently $20.. Show that the equilibrium interest rate is 5% (.05). (e) Suppose the central bank wants the equilibrium interest rate to rise to 15% (.15). At what level should it set monetary policy? SHOW WORK. What kind of monetary policy (expansionary or contractionary) does this imply?arrow_forward2. Suppose that in 2018 customers deposit $4,000 into their bank accounts. Based on the extended money multiplier calculated in part (1), calculate the total amount which the money supply in the banking system will eventually increase to. Show all steps involved in the calculation. part 1 answer DRR = Ratio (4% or 0.04) CDR = % of money in wallets (3% or 0.03) = (1 + 0.03) / (0.04 + 0.03) = 1.03 / 0.07 Answer = 14.71 Therefor Every $1 in the bank will allow the bank to create $14.71arrow_forward1. Consider the following table with data about monetary aggregates (billions of dollars, seasonally adjusted data): Date May 2012 Nov. 2012 Feb. 2013 May 2013 M1 2,262.6 2,405.5 2,477.9 2,534.7 M2 a) Calculate the annualized growth rate of M1 and M2 for the following periods: May 2012 May 2013 (one year), Nov. 2012-May 2013 (six months), and Feb. 2013-May 2013 (three months). b) Comment on the growth rates of these monetary aggregates. 9,870.3 10,298.3 10,424.7 10,598.9 Source: Federal Reserve System (H.6)arrow_forward

- 4. A common rule used for describing the conduct of monetary policy is the Taylor π = r + 0.5 (²-³) + 0.5(π — ñ), where r is the real rate of rule, given by i interest and it is a target rate of inflation. Assume that the real interest rate at full employment to be constant at 2%. Assume also that the same 2% represents target inflation. a. What is the nominal interest rate i when inflation and output are at their equilibrium target level? b. Suppose that the central bank observes a rate of inflation of 4%. With all other variables at the same level. What is the nominal interest rate the central bank would target according to the Taylor rule?arrow_forward3.Consider an independently run hotel in Krems and briefly discuss how it might be affected by the following scenarios: a) A rise in interest rates b) A fall in unemployment c) A fall in the exchange rate (i.e., the value of the euro decreases) d) A rise in inflationarrow_forward11. If a yield curve looks like the one shown in the figure below, what is the market predicting about the movement of future short-term interest rates? What might the yield curve indicate about the market's predictions for the inflation rate in the future? Yield to Maturity Term to Maturityarrow_forward

- 6. One of the banking innovations in the 1960s was the payment of interest on certain types of demand deposits. Assume that interest is paid on money at the nominal rate Rm, which equals (R − x), where x is the nominal return on bonds, which is exogenously determined by market structures and the cost of servicing deposits. (i) Use Baumol’s transactions demand model to derive the demand function for money. (ii) Generalizing the above demand function to md(y, R, x), shows the behavior of the LM curve for shifts in x and P. (iii) What is the effect of an increase in x on aggregate demand, output and price level in the neoclassical model? (iv) Assuming that both R and x always increase by the expected rate of inflation, do (ii) and (iii) again.arrow_forwardYou are given foreign currency forecasts for a number of currency pairs in Table 1. You are a forextrader and wish to use the forecasts for September 2021 to make a profit. Obtain forward rates for five chosen currency pairs from table 1 with a maturity of September2021.arrow_forwardInterest rates and bond prices vary directly during inflation and inversely during recessions. 1) True 2) Falsearrow_forward

- A large money center bank uses the US treasury yield curve to determine the appropriate level for its lending rates. To compensate for the costs of making a loan, the bank needs to charge 1.8% point more than the expected future interest rate on a Treasury security with the same maturity if it is to make a profit. The manager is considering a loan request from a customer seeking a one year loan that starts 2 years from today. If the two-year Treasury Strip rate is 4.1% and the three-year Treasury strip rate is 5.5%, at what minimum rate should the manager be willing to make the loan commitment?Enter your answer as a % to two decimal places. Assume the expectation theory of rates is valid and all liquidity premiums are zero.arrow_forward. A well-known bank has specialized in adjustable-rate mortgages. They have originated 7 billion USD in adjustable-rate mortgages. This bank generally raises money by borrowing with shorter term loans and issuing fixed-interest rate Certificates of Deposit. The bank has 6 billion in short-term adjustable-rate loans to partly help fund the loan portfolio. The federal reserve has announced an increase in their target interest rate of 50 basis points (0.5%). What is the equation and solution.arrow_forward7) Explain what is meant by the ‘Zero Lower Bound’ in relation to interest rates and suggest how it might be avoided.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education