Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

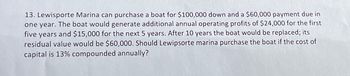

Transcribed Image Text:13. Lewisporte Marina can purchase a boat for $100,000 down and a $60,000 payment due in

one year. The boat would generate additional annual operating profits of $24,000 for the first

five years and $15,000 for the next 5 years. After 10 years the boat would be replaced; its

residual value would be $60,000. Should Lewipsorte marina purchase the boat if the cost of

capital is 13% compounded annually?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Beene Distributing is considering a project that will return $150,000 annually at the end of each year for the next six years. If Beene demands an annual return of 7% and pays for the project immediately, how much is it willing to pay for the project?arrow_forwardRadCo is considering two projects. The first, project A. has $400,000 income after the first year which increases by 8% each year for a total of 5 years. Project B has $450,000 income after the first year which increases by $25,000 each year for a total of 5 years. RadCo can only choose one project. Based on present worth today, which project should RadCo choose? The interest rate is 6% annual compounded annually.arrow_forwardReplacing old equipment at an immediate cost of $50,000 and an additional outlay of $15,000 six years from now will result in savings of $11,000 per year for 7 years. The required rate of return is 5% compounded annually. Compute the net present value and determine if the investment should be accepted or rejected according to the net present value criterion. The net present value of the project is S (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The proposal should be аcсepted. rejected.arrow_forward

- (Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $6,000,000 and would generate annual net cash inflows of $1,100,000 per year for 9 years. Calculate the project's NPV using a discount rate of 5 percent. If the discount rate is 5 percent, then the project's NPV is $___________________(Round to the nearest dollar.)arrow_forward2. Suppose that you are considering speculating on some vacant land located on Bali Hai, an island in the South Pacific. You could acquire the land today for $850,000. You plan on holding it for fifteen years and then selling it. Annual taxes, insurance and upkeep (mowing, clearing of debris, etc.) of the land will be $35,000, paid at the end of the first year. These costs will increase annually at a 2.5% rate until you sell the land at the end of the fifteenth year. If you require an annual rate of return of 20%, what is the minimum amount that you have to net (after commissions, transfer taxes, fees, etc.) on the sale of this land at the end of the final year to earn your required rate of return? (Ignore income taxes)arrow_forwardA project will produce an operating cash flow of $14,600 a year for 7 years. The initial fixed asset investment in the project will be $48,900. The net aftertax salvage value is estimated at $12,000 and will be received during the last year of the project's life. What is the net present value of the project if the required rate of return is 12 percent? Group of answer choices $22,627.54 $23,159.04 $34,627.54 $39,070.26 $41,040.83 please please solve it with a finance calculator and show your work, I know the answer but looking for some easy way to slove it by a finance calculatorarrow_forward

- Your firm needs a machine which costs $120,000, and requires $33,000 in maintenance for each year of its 5 year life. After 5 years, this machine will be replaced. The machine falls into the MACRS 5-year class life category. Assume a tax rate of 35 percent and a discount rate of 15 percent. What is the depreciation tax shield for this project in year 5?arrow_forwardCompany XYZ decides to invest in a $25,000,000 project. The company will finance the project with 50% debt and 50% equity. The term of the loan is interest only, compounded annually, 5%, and over 5 years. The project will allow the company to produce and sell an additional 100,000 widgets at $130 a widget. The cost of producing each widget is 50% of revenue. Furthermore, the project will fully depreciate in 5 years on a straight-line basis and the project will end. The tax rate is 21%. If the company’s required rate on this project is 10%, what is the NPV? The answer is $1,312,798. Please show how to get this answer.arrow_forwardThe FernRod Motorcycle Company invested $150,000 at 4.5% compounded monthly to be used for the expansion of their manufacturing facilities. How much money will be available for the project in 5 1/2 years? (Round your answer to the nearest dollaarrow_forward

- Management of Sunland Home Furnishings is considering acquiring a new machine that can create customized window treatments. The equipment will cost $266,550 and will generate cash flows of $81,750 over each of the next six years. If the cost of capital is 15 percent, what is the MIRR on this project? - MMR = ? %arrow_forwardA project that provides annual cash flows of $14,000 for nine years costs $70,000 today. At what discount rate would you be indifferent between accepting the project and rejecting it? Should you accept the project in the previous question if your cost of capital is equal to 15%?arrow_forwardProject Beta is a project which will last for 7 years and which requires an initial outlay of $3,000. This outlay will be depreciated using straight-line depreciation over the life of the project. It will generate incremental revenue of $1200 per year. The value of incremental, after-tax earnings is $400 per year. The project will require Net Working Capital equal to 10% of incremental revenue. What is the value of incremental free cash flow in Year 0? Question 5Answer a. $-3120 b. $2880 c. $-2880 d. $3120arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education