FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

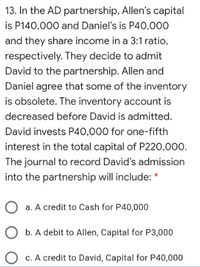

Transcribed Image Text:13. In the AD partnership, Allen's capital

is P140,000 and Daniel's is P40,000

and they share income in a 3:1 ratio,

respectively. They decide to admit

David to the partnership. Allen and

Daniel agree that some of the inventory

is obsolete. The inventory account is

decreased before David is admitted.

David invests P40,000 for one-fifth

interest in the total capital of P220,000.

The journal to record David's admission

into the partnership will include: *

O a. A credit to Cash for P40,000

O b. A debit to Allen, Capital for P3,000

O c. A credit to David, Capital for P40,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.] Meir, Benson, and Lau are partners and share income and loss in a 2:3:5 ratio (in percents: Meir, 20%; Benson, 30%; and Lau, 50%). The partnership's capital balances are as follows: Meir, $86, 000; Benson, $131,000; and Lau, $223,000. Benson decides to withdraw from the partnership. 2. Assume that Benson does not retire from the partnership described in Part 1. Instead, Rhode is admitted to the partnership on February 1 with a 25% equity. Prepare journal entries to record Rhode's entry into the partnership under each separate assumption: Rhode invests (a) $146, 667; (b) $107,067; and (c) $192,134. (Do not round intermediate calculations.)arrow_forwardJayarrow_forwardFluffy, Anjelah, and Lopez are partners and share income and losses as follows: Fluffy, 20%; Anjelah, 30%; and Lopez, 50%. The partnership’s capital balances follow: Fluffy, $330; Anjelah, $270; and Lopez, $400. Lopez decides to withdraw from the partnership. Prepare journal entries to record Lopez’s May 1 withdrawal from the partnership under each separate assumption: a. Lopez sells his interest to Mencia for $500 after Mencia is accepted as a partner. b. Lopez gives his interest to a son-in-law, Madrigal, and Madrigal is accepted as a partner. c. Lopez is paid $400 in partnership cash for his equity. d. Lopez is paid $600 in partnership cash for his equity. e. Lopez is paid $70 in partnership cash plus equipment recorded on the partnership books at $40 less its accumulated depreciation of $10.arrow_forward

- Peters and Chong are partners and share equally in income or loss. Peters' current capital balance is $150,000 and Chong's is $140,000. Peters and Chong agree to accept Aaron with a 30% interest in the partnership. Aaron invests $118,000 in the partnership. The amount credited to Aaron's capital account is: Multiple Choice $122,400. $118,000. $268,000. $80,400. $128,000.arrow_forwardChapter 4 b. Show the comparative capital structure as well as the interest of the partners in relation to the total capital before and after the admission of Camel. b. What is the new profit and loss sharing ratio? c. Show how the P 7,000 will be distributed to the old partners. LE19arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education