Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

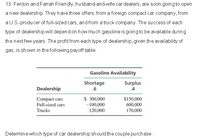

Transcribed Image Text:13. Fenton andFarrah Frien dly, husband-and-wife car dealers, are soon going to open

anew dealership. They have three offers: from a foreign compact car company, from

a U.S.-produ cer of full-sized cars, and from a tru ck company. The success of each

type of dealership will depend on how much gasoline is going to be available during

the nextfew years. The profit from each type of dealership, given the availability of

gas, is shown in thefollowing payoff table:

Gasoline Availability

Shortage

Surplus

Dealership

.6

.4

Compact cars

$ 300,000

$150,000

Full-sized cars

-100,000

600,000

Trucks

120,000

170,000

Determine which type of car dealership should the couple purchase.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 9. A company that sells high-purity laboratory chemicals is considering investing in new equipment that will reduce cardboard costs by better matching the size of the products to be shipped to the size of the shipping container. If the new equipment will cost Php1M to purchase and install, how much must the company save each year for 3 years in order to justify the investment, if the interest rate is 10% per year? A Php66465.26 B Php88465.26 Php302114.80 Php402114.80arrow_forwardAssume that a person's income directly affects their purchasing power for a particular product. We have a customer named John who has a per capita income of $35,102 that is looking to buy a new car. If the current US population is 335,707,897, the current per capita income is $40,363, and total new car sales in 2022 were $1,131,009,556,950; what would John's per capita spend be for a new car, assuming his income directly affects the amount he can spend?arrow_forwardCandle Light Bus Lines Ltd. runs a series of bus routes between cities across Canada. A new route, between Kenora and Thunder Bay, has been planned for next year. The sales manager has come up with a series of possible passengers that would use the route in the upcoming year. She tells you that passengers could range between 20,000 and 40,000 per year and that each ticket would be $25 per trip. Because of the availability of buses to service the route, the estimated passengers would be in increments of 10,000. The controller of the company provides you with the following information: Costs per passenger per trip: Fuel $5 Driver $4 Selling $2 Admin $1 In addition, she informs you that Facility Overhead will be $100,000 and Selling and Admin Overhead will be $50,000, regardless of the number of trips made in the year. Instructions a) Prepare a flexible budget for the company based on the above information for 20,000, 30,000, and 40,000 passengers. b) Assume that there were actually…arrow_forward

- Nikularrow_forwardreases Imagine yourself in the position of Thomas Pierce . president of Greymare Bus Lines. Your firm was established by your grandfather, who was quick to capitalize on the growing demand for transportation between Widdicombe and nearby townships. The company has owned all its vehicles from the time the company was formed: you are now reconsidering that policy. Your operating manager wants to buy a new bus costing $100,000. The bus will last only eight years before going to the scrap yard. You are convinced that investment In the additional equipment is worthwhile. However, the representative of the bus manufacturer has pointed out that her firm would also be willing to lease the bus to you for eight annual payments of $16,200 each. Greymare would remain responsible for all maintenance, Insurance, and operating expenses. If Greymare does not own the bus it cannot depreciate it and therefore, it gives up a valuable depreciation tax shield. We assume depreciation would be calculated…arrow_forwardLeeds Limited is looking to expand its operations and increase its market share in the cell phone industry. To achieve this, they are looking to increase its current productive capacity of 100 000 cell phones a year by at least 6% for each of the next 5 years. It is considering two cell phone making machines and is unsure which to purchase: Cell Phone Machine ABC:Cell Phone Machine ABC can be imported at a landed purchase cost of R160 000 and a further R20 000 transport and installation costs will have to be incurred to get it ready for production. This machine is expected to last 5 years after which it will be sold at its scrap value of R20 000. Net cash flow from the sale of the additional production is expected to be R58 000, R63 000, R68 000, R72 000 and R51 000 respectively over the 5-year lifespan of the machine. This machine will enable Leeds Limited to achieve a 4% increase in productive capacity.Cell Phone Machine XYZ:Cell Phone Machine XYZ can be purchased locally for R190…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education