Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

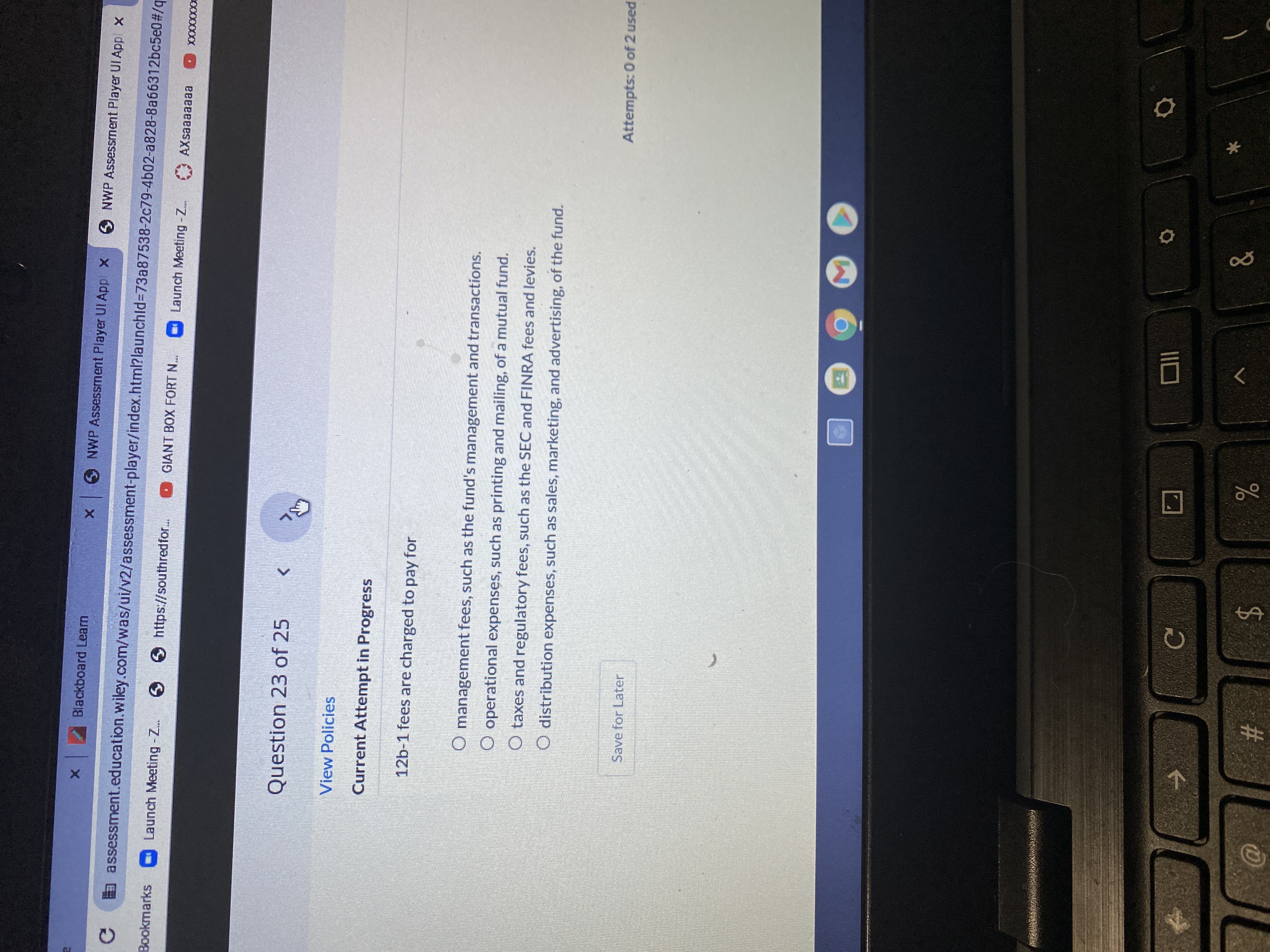

Transcribed Image Text:12b-1 fees are charged to pay for

O management fees, such as the fund's management and transactions.

operational expenses, such as printing and mailing, of a mutual fund.

O taxes and regulatory fees, such as the SEC and FINRA fees and levies.

O distribution expenses, such as sales, marketing, and advertising, of the fund.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 4 Which of the following fund types does not report the payment of bond principal as an expenditure? a. Special revenue fund b. Enterprise fund c. Debt service fund d. General fundarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward1. **Definition of Carried Interests:* - Carried interests are a share of profits that general partners in an investment fund receive as compensation. These interests represent a percentage of the fund's profits and are typically awarded to the fund managers as an incentive to achieve positive returns. The taxation of carried interests involves considerations for both the fund managers and the investors in the fund. 2. **Taxation of Carried Interests:** - The tax treatment of carried interests is a complex process. Typically, fund managers pay taxes on their carried interests at capital gains rates, which are often lower than ordinary income tax rates. This treatment is subject to specific conditions, including holding the investment for a certain period. Investors, on the other hand, may also be subject to tax implications based on their share of profits from the fund. 3. **Impact on Financial Reporting:** - The accounting for tax on carried interests is an essential aspect of…arrow_forward

- To pay off a loan of R7 000 due now and a loan of R2000 due in 14 months' time, Olorato agrees to make three payments in two, five and ten months' time respectively The second payment is to be double the first and the third payment is to be triple the first. What is the size of the payment at month five if interest is calculated at 16% per year, compounded monthly? 1 R4 627,26 12) R3 164,86 13] R3 000,00 H RI 582,43arrow_forwardIdentify which of the following is/are types of distributions of Mutual Fund Trust: a. All of the choices b. Capital Distributions c. Capital Gains d. Eligible Dividends X e. Canadian Interest Incomearrow_forwardThis problem has two parts, part a and part b. Answer each part separately using the same information. Do not mix answers to a and b; they are answered separately. Problem a: Using the list of transactions below, provide all necessary journal entries for the Fund statements. You also need to identify which funds are involved in the transaction, such as the Capital projects fund, Debt service fund Special revenue fund, or Permanent fund. Problem b: Using the same list of transactions, provide all necessary journal entries for the Governmental Activities section in the Government-wide statements. Write “no entry” if no entry is needed. Dunellen City, covered in this problem, issues a $10,000,000 bond at face value. The cash is to be used for the construction of a fire station. Previously undesignated cash of $100,000 from the General Fund is set aside to begin paying the bonds issued in item (1). A state cash grant of $300,000 is received that must be spent in the future for…arrow_forward

- Discuss several mutual fund characteristics that will indicate that the fund is actively managed.arrow_forward7arrow_forwardWhich of the following organizations/entities does a mutual fund appoint to collect money received fromthe fund's purchasers and from portfolio income, as well as to arrange for cash distributions? a) A fundcustodian. b) A fund distributer c) A fund principal. d) A fund managerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education