FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

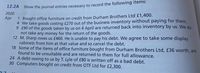

Transcribed Image Text:12.2A

Show the journal entries necessary to record the following items:

2020

1 Bought office furniture on credit from Durham Brothers Ltd £1,400.

4 We take goods costing £270 out of the business inventory without paying for them.

9 £90 of the goods taken by us on 4 April are returned back into inventory by us. We do

not take any money for the return of the goods.

12 M. Sharp owes us £460. He is unable to pay his debt. We agree to take some display

cabinets from him at that value and so cancel the debt.

18 Some of the items of office furniture bought from Durham Brothers Ltd, £36 worth, are

found to be unsuitable and are returned to them for full allowance.

24 A debt owing to us by T. Lyle of £80 is written off as a bad debt.

30 Computers bought on credit from OTF Ltd for £2,300.

Apr

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tomm Wholesalers sells construction equipment to small home builders. The following pertains to Tomm’s credit and cash sales for the month of December 31, 2020. Tomm generally considers 3% of credit sales to be uncollectible and it uses the allowance method. Cash Sales $38,000 Credit Sales $275,000 Prepare the appropriate bad debt journal entry for the month of December. Do not prepare any other journal entries for this problem.arrow_forwardSally Goodenough owes ABC Company $100. ABC has decided that Sally is not going to pay them. ABC will: Group of answer choices do nothing Record bad debt expense of $100 Decrease its allowance for doubtful accounts Increase accounts receivable $100arrow_forwardArchie makes plumbing fittings. He is currently preparing accounts for the year ended 31 December 2021, but his sales book was destroyed in a flood. He has a separate list of the moneys owing by customers at 31 December 2021, which amounted to £41,000 in total. Generally, Archie allows his customers 30 days credit. Archie estimated his sales for the year ended 31 December 2021 at:a) £14,235,000b) £1,170,000c) £488,500d) None of the abovearrow_forward

- Want the Answer please without any failarrow_forward4Aarrow_forwardDo you want to make a double entry? On November 7, 2021, a fire broke out at the store, destroying merchandise worth $12,000. The insurance company has declared that it will only pay out the first $3,000 of the claim under the provisions of the contract. There haven't been any entries made yet to document this.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education