Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:12

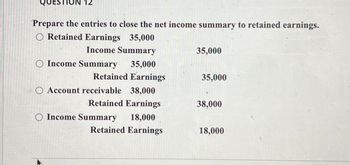

Prepare the entries to close the net income summary to retained earnings.

O Retained Earnings 35,000

Income Summary

35,000

O Income Summary

35,000

Retained Earnings

35,000

Account receivable

38,000

Retained Earnings

38,000

O Income Summary

18,000

Retained Earnings

18,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Subject: accountingarrow_forwardPE.17-09B - Return on total assets A company reports the following income statement and balance sheet information for the current year: Net income Interest expense Average total assets $410,000 90,000 5,000,000 Determine the return on total assets. I %arrow_forwardInstructions On March 31, 20Y9, the balances of the accounts appearing in the ledger of Royal Furnishings Company, a furniture store, are as follows: Accounts Receivable $163,800 Accumulated Depreciation-Building 740,900 Administrative Expenses 526,350 Building 2,507,600 Cash 186,150 Common Stock 304,450 Cost of Goods Sold 3,852,200 Dividends 184,450 Interest Expense 10,200 Inventory 1,022,600 Notes Payable 238,600 Office Supplies 19,050 Retained Earnings 1,267,250 Salaries Payable 7,700 Sales 6,264,600arrow_forward

- Satterfield CompanyIncome StatementsFor the Years Ended December 31 20Y1 20Y0 Fees earned $534,100 $490,000 Operating expenses 328,960 320,000 Net income $205,140 $170,000 Prepare a horizontal analysis of Satterfield Company income statements. Round percent answers to one decimal place. If required, use the minus sign to indicate a decrease in the amount and percentage columns. 20Y1 20Y0 AmountIncrease/(Decrease) PercentIncrease/(Decrease) Fees earned $534,100 $490,000 $fill in the blank 1 fill in the blank 2% Operating expenses 328,960 320,000 $fill in the blank 3 fill in the blank 4 Net income $205,140 $170,000 $fill in the blank 5 fill in the blank 6arrow_forwardNeed help with the second halfarrow_forwardIncome Statement Sales CGS Depr EBIT Interest EBT Taxes Net Income Div Add to RE Balance Sheet Cash AR Inven Current Assets Net Fixed Assets Total Assets AP NP Accrued Wages Current Liab LTD Common Stock Retained Earnings Total Common Eq T. Liab & Equity Year 0 $8,000 1.25 5,000 1.25 600 1.25 $2,400 200 $2,200 550 Use 25% $1,650 $1,200 $ 450 AFN $400 1.25 600 1.25 500 1.25 $1,500 2.500 1.25 $4,000 $ 100 200 100 $ 400 800 1,500 70 1.300 $2,800 $4,000 1" Pass Forecast Year 10,000 200 500 750 625 1875 3,125 5,000 200 2nd Pass Forecast Year 10,000 500 750 625 1875 3,125 5,000 200 1. Calculate the proforma income statement and balance sheet assuming 25% growth (use the constant growth method and assume the company is at full capacity). Assume additional funds needed will come from 60% LTD and 40% from a common stock issue. Interest on the debt is 9% and the common stock will sell for $30 per share and pay $1.00 per share in dividends. (Use balance sheet and income statement on page 1)arrow_forward

- Give the solutuinarrow_forwardProvide a Conclusion and Recommendation for the company.arrow_forwardMultiple-Step and Single-Step In coin Statements The following items were derived from Gold Companys December 31 adjusted trial balance: Additional data: 1. Screen thousand share of common stock have been outstanding the entire year. 2. The income tax rate is 30% on all items of income. Required: 1. Prepare a multiple-st income statement. 2. Prepare a single step income statement. 3. Next Level Discuss how Gold Companys income statement in Requirement I might be different if it used IFRSarrow_forward

- Sales transactions Using transactions listed in P4-2, indicate the effects of each transaction on the liquidity metric working capital and profitability metric gross profit percent. Indicate the gross profit percent for each sale (rounding to one decimal place) in parentheses next to the effect of the sale on the company’s ability to attain an overall gross profit percent of 30%.arrow_forwardReturn on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $661,910Interest expense 116,810Average total assets 6,280,000Determine the return on total assets. If required, round the answer to one decimal place.fill in the blank 1 %arrow_forwardHt.10.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,