FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:11-9 A/ 11-1O A

CengageNOWv2|Online teachin x b PURCHASES JOURNAL J. B. Speci x +

Assignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator3D&inprogress%3false

eBook

4Show Me How

Show Me How

Calculator

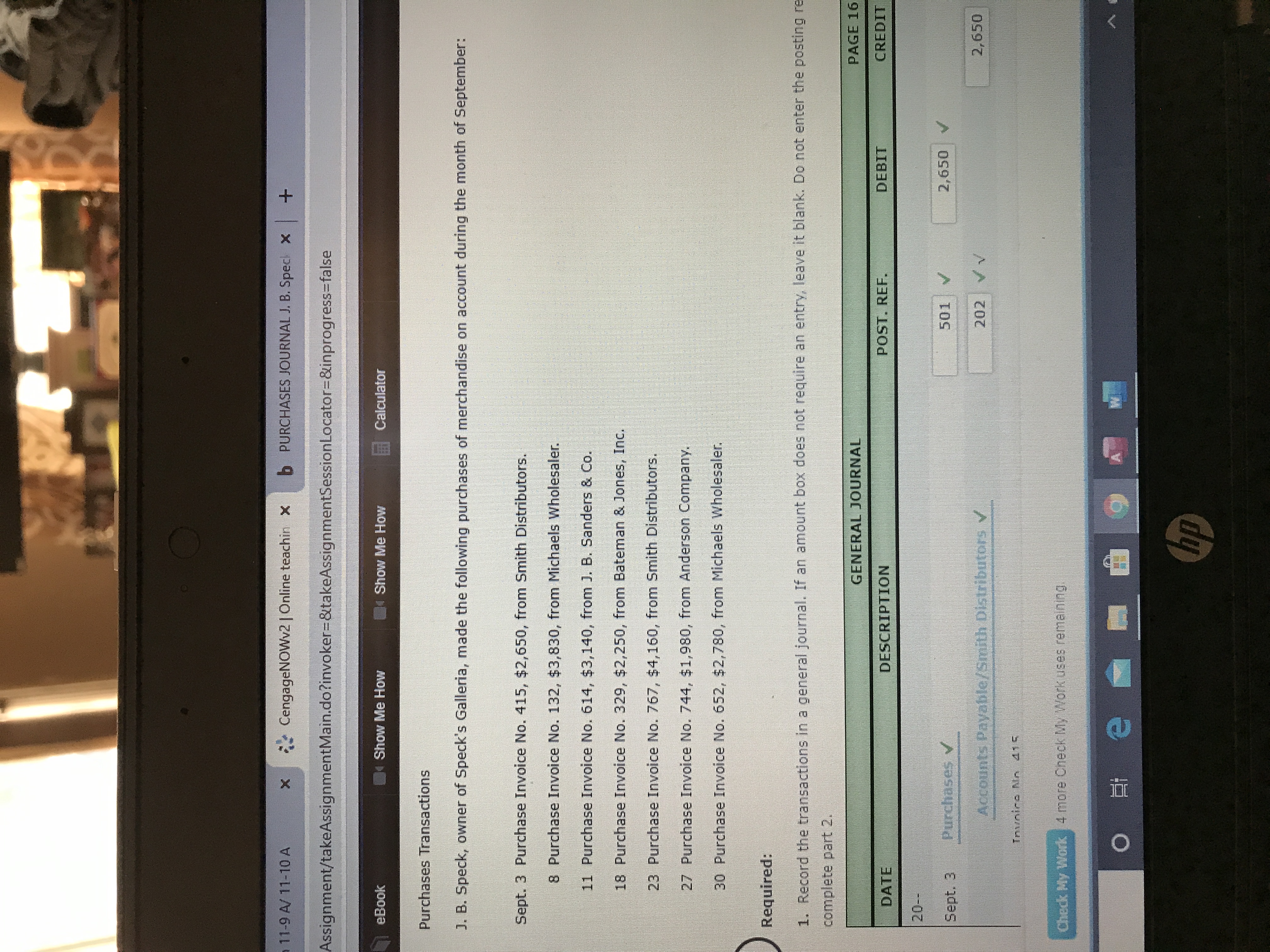

Purchases Transactions

J. B. Speck, owner of Speck's Galleria, made the following purchases of merchandise on account during the month of September:

Sept. 3 Purchase Invoice No. 415, $2,650, from Smith Distributors.

8 Purchase Invoice No. 132, $3,830, from Michaels Wholesaler.

11 Purchase Invoice No. 614, $3,140, from J. B. Sanders & Co.

18 Purchase Invoice No. 329, $2,250, from Bateman & Jones, Inc.

23 Purchase Invoice No. 767, $4,160, from Smith Distributors.

27 Purchase Invoice No. 744, $1,980, from Anderson Company.

30 Purchase Invoice No. 652, $2,780, from Michaels Wholesaler.

Required:

1. Record the transactions in a general journal. If an amount box does not require an entry, leave it blank. Do not enter the posting re

complete part 2.

GENERAL JOURNAL

PAGE 16

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

20--

Sept. 3

Purchases

501 V

2,650

Accounts Payable/Smith Distributors

202 V

2,650

Tnvnire Nn 415

Check My Work 4 more Cneck My Work uses remaining.

hp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 5 5 AutoSave On File 2. K9 O Undo A Home Insert Draw Page Layout Formulas Data 0 X Paste Clipboard 5 B Total credit sales Accounts Receivable.xlsx Saved v . Calibri B IU • XV. fx C 17 Accounts Receivable 18 Allowance for doudtful debts 19 D ✓11 Ready Accessibility: Investigate Font V • Α Α΄ V E V 8- A $ % 98 F == Review View Help G 8 9 Accounts Receivable written off 0 Credit issued to customers for sales returns 1 Recovery of Accounts Receivable, written off 12 as uncollectible in the prior year (not included in the cash collected above) 13 14 15 The following were taken from the Balance Sheet dated Dec 31, 20X4 16 Alignment Search (Alt+C H Sheet1 ex. for income stmt. approach Practice Question Sheet4 22 1 V 620,000 5450 14500 3400 General 96400 9700 J V Number 20 Jeremy Company estimated that bad debts (uncollectible) to be equal to 0.5% of credit sales, net of sales returns 21 22 Calculate the Accounts Receivable and Allowance for doubtful debts accounts balances as at Dec 31, 20X5…arrow_forwardF myCampus Portal Login - for Stu X B 09 Operational and Legal Consid x E (24,513 unread) - sharmarohit81 b My Questions | bartleby A fleming.desire2learn.com/d21/le/content/130754/viewContent/1518900/View?ou=130754 Table of Contents > Week 9: Operational and legal Considerations > Lecture Notes > 09 Operational and Legal Considerations 09 Operational and Legal Considerations - > Calculating Capacity • How many machines do you need? • You expect your sales to be 3,000,000 granola bars (20g each) • How large is your plant? per month • How many workers do you need? The machine: • How much is the investment? Capacity: 100 kgs per hour • What are the operating costs? Requires 2 people to operate it Takes 8 ft x 40 ft space • Cost per machine $15,000 Energy and maintenance: $5 per hour • Cost of material and packaging: $0.12 per bar I Group Project.xlsx Show all 12:35 AM O Type here to search A O 4) ENG 2020-12-09arrow_forwardA ezto.mheducation.com enter B Welcome, Aury - Blackb. Close reading assignmen. E English essay - Google D. M MyOpenMath - Gradebook M Question 3- Chapter 5- pter 5 A G 79 Saved Help Save & Exit SL Check my w Required information (The following information applies to the questions displayed below.] R2 of 2 Laker Company reported the following January purchases and sales data for its only product. Date Jan. 1 Beginning inventory 150 units@ $7.50 = $1,125 Jan. 10 Sales Jan. 20 Purchase Jan. 25 Sales Activities Units Acquired at Cost Units sold at Retail ts 110 units@ $16.50 80 units@ $6.50 = 520 Skipped 90 units@ $16.50 Jan. 30 Purchase 200 units @ $6.00 =1,200 Totals 430 units $2,845 200 units eBook Hint Required: The Company uses a periodic inventory system. For specific identification, ending inventory consists of 230 units, where 200 are from the January 30 purchase, 5 are from the January 20 purchase, and 25 are from beginning inventory. Determine the cost assigned to ending…arrow_forward

- All directions are shown in the picture attachedarrow_forwardoogle Google Se... PMyLab Math | Pears... M Gmail ▸YouTube eBook Journal-Beartooth Co. Sales-Related and Purchase-Related Transactions for Seller and Buyer Using Perpetual Inventory System Instructions Chart of Accounts-Summit Company Chart of Accounts-Beartooth Co. Journal-Sum Aug. The following selected transactions were completed during August between Summit Company and Beartooth Co.: Check My Work E 2 5 1 Summit Company sold merchandise on account to Beartooth Co., $48,000, terms FOB destination, 2/15, n/eom. The cost of the merchandise sold was $28,800. 9 15 16 20 25 Maps City-Data.com - Sta... P MLA Fo Summit Company paid freight of $1,150 for delivery of merchandise sold to Beartooth Co. on August 1. Summit Company sold merchandise on account to Beartooth Co., $66,000, terms FOB shipping point, n/45. The cost of the merchandise sold was $40,000. Beartooth Co. paid freight of $2,300 on August 5 purchase from Summit Company. Summit Company sold merchandise on account to Beartooth…arrow_forwardJasmine Thompson Document2 - Word O Search B Share Home Design Layout References Mailings Review View Help Insert Draw O Find Cut Calibri (Body) 12 A A Aa A E E E EE T AaBbCcDd AaBbCcDd AaBbC AaBbCcC AaB AABBCCD AaBbCcDd AaBbCcDd S Replace Dictate Copy 田 1 Normal 1 No Spac.. Heading 1 Heading 2 Title Subtitle Subtle Em... Emphasis A Select v BIU ab x, x' A v 3 Format Painter Styles Editing Voice pboard Paragraph Font 7 17. The Brown Company's 12/31 Trail Balance totals $10,000. Two adjusting entries are made: 1. Depreciation on machinery $1,000 2. Expiration of Prepaid Insurance $500 Brown's Adjusted Trial Balance will total: a. $9,000 b. $9,500 c. $11,500 d. $11,000 e. $10,500 age 5 of 6 969 words English (United States) Focus ב P Type here to search ENG 1:13 AM US 1/19/2021 127arrow_forward

- 8:33 ull LTE AA v2.cengagenow.com CengageNOWv2 | Online teaching and learning resource from Cengage Learning Close Window Print 1. EX.09-03 O eBook Show Me How Entries for Uncollectible Accounts, using Direct Write-Off Method Journalize the following transactions in the accounts of Champion Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. Sold merchandise on account to Dr. Dale Van Dyken, $30,000. The cost of the 19. merchandise sold was $20,500. July Received $12,000 from Dr. Dale Van Dyken and wrote off the remainder owed on 7. the sale of January 19 as uncollectible. Nov. Reinstated the account of Dr. Dale Van Dyken that had been written off on July 7 2. and received $18,000 cash in full payment. For a compound transaction, if an amount box does not require an entry, leave it blank. Jan. 19-sale Jan. 19-cost July 7 Nov. 2-reinstate Nov. 2-collectionarrow_forward* My Home x : CengageNOWv2 | Online teachin x b Home | bartleby x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false M Gmail YouTube Maps Blackboard HW #10 - Chpt 22 1 eBook E Print Item Schedule of Cash Payments for a Service Company Oakwood Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $124,500 April 115,800 Мay 105,400 Depreciation, insurance, and property taxes represent $26,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 60% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. Oakwood Financial Inc.…arrow_forwardCengage Le Ebooks-Cen TABLE 12-1 F Ch. 12 Quiz 12-table-2p 12-table-1.p x MindTap-C x 12-table-2p New Tab ☆ webassign.net/web/Student/Assignment-Responses/submit/dep-34185538&tags=autosave#Q8 O $886.89 O $1,672.70 Need Help? Read It Submit Answer 13. [-/3 Points] DETAILS MY NOTES BRECMBC9 12.11.014. Use Table 12-2 to solve. ASK YOUR TEACHER PRACTICE ANOTHER Ron Sample is the grand prize winner in a college tuition essay contest awarded through a local organization's scholarship fund. The winner receives $3,000 at the beginning of each year for the next 3 years. How much (in $) should be invested at 8% interest compounded annually to award the prize? (Round your answer to the nearest cent.) Enter a number Need Help? Read It Viewing Saved Work Bevert to Last Response Submit Answer 14. [3/3 Points] DETAILS MY NOTES BRECMBC9 12.III.002. PREVIOUS ANSWERS ASK YOUR TEACHER PRACTICE ANOTHER For the sinking fund, use Table 12-1 to calculate the amount (in $) of the periodic payments needed to…arrow_forward

- Directions attached in picturearrow_forwardule Three Assignment - ACC X A My Home * CengageNOWv2 | Online teachir x m/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator%=&inprogre. eBook 4 Show Me How Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Oct. 1 Inventory 76 units @ $17 7 Sale 51 units 15 Purchase 69 units @ $18 24 Sale 32 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of goods sold on October 24 and (b) the inventory on October 31. a. Cost of goods sold on October 24 1,418 X b. Inventory on October 31 1,116 V Feedback Check My Work a. When the FIFO method is used, costs are included in cost of goods sold in the order in which they were purchased. Think of your inventory in terms of "layers". Determine how much inventory remains from each layer after each sale. b. The ending inventory is made up of the most recent purchases Previous Next Check My Work 10:40 AM (?)…arrow_forward* 00 T 4. File Edit View History Bookmarks Window Help A ezto.mheducation.com Bb Welcome, Aury - Blackb... Close reading assignmen... t Center FEnglish essay - Google D... M MyOpenMath - Gradebook M Question 4 - Chapter 5-.. chapter 5 i Saved Help Save Lopez Company reported the following current-year data for its only product. The company uses a periodic inventory system, and its ending inventory consists of 480 units-160 from each of the last three purchases. 1 Beginning inventory 260 units @ $4.40 = $ 1,144 2,940 5,880 5,616 3,640 $ 19,220 Jan. Mar. 7 Purchase oints 560 units @ $5.25 1,200 units @ $4.90 = 1,080 units @ $5.20 = 560 units @ $6.50 = %3D July 28 Purchase Oct. 3 Purchase Skipped %3D Dec. 19 Purchase %3D Totals 3,660 units eBook Hint Determine the cost assigned to ending inventory and to cost of goods sold for the following. (Do not round intermediate calculations and round your answers to 2 decimal places.) Print References Ending Inventory Cost of Goods Sold (a)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education