FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:118 Using the information given below, prepare an Income Statement, Statement of retained

earnings, and Balance Sheet for Rapid Car Services from the adjusted trial balance.

Cash

Accounts receivable

Office supplies

Vehicles

Accumulated depreciation

Accounts payable

Common stock

Retained earnings

Dividends

Services revenue

Rent expense

Office supplies expense

Utilities expense

Rapid Car Services

Adjusted Trial Balance

December 31

Salaries expense

Depreciation expense Vehicles

Fuel expense

Totals

Vehicles

Debit

$ 33,000

14,200

1,700

100,000

40,000

13,000

2,000

2,500

15,000

50,000

12,000

$ 283,400

Credit

45,000

11,500

20,000

51,900

155,000

$ 283,400

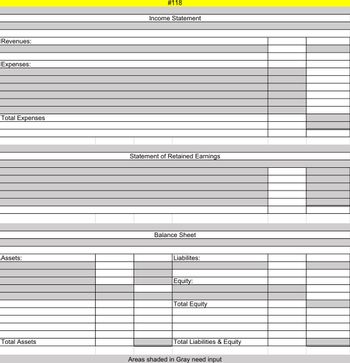

Transcribed Image Text:Revenues:

Expenses:

Total Expenses

Assets:

Total Assets

# 118

Income Statement

Statement of Retained Earnings

Balance Sheet

Liabilites:

Equity:

Total Equity

Total Liabilities & Equity

Areas shaded in Gray need input

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image formatarrow_forwardkaran subject-Accountingarrow_forwardFlingen Inc. reveals the following information in their annual report for FY 2021 Selected Income Statement Items: Sales $10,500,000 Cost of goods sold $5,500,000 Pretax earnings $650,000 Selected Balance Sheet Items: Merchandise inventory $800,000 Total assets $2,500,000 Upper management plans to cut cost of goods sold by 4.5% for the coming year but retain the same sales and weeks of inventory. What is the return on assets estimated to be for 2022? Group of answer choices 33.7% 32.1% 36.8% 34.1%arrow_forward

- Use the following information for the Problems below. Skip to question [The following information applies to the questions displayed below.]Lansing Company’s current-year income statement and selected balance sheet data at December 31 of the current and prior years follow. LANSING COMPANYIncome StatementFor Current Year Ended December 31 Sales revenue $ 127,200 Expenses Cost of goods sold 52,000 Depreciation expense 17,000 Salaries expense 28,000 Rent expense 10,000 Insurance expense 4,800 Interest expense 4,600 Utilities expense 3,800 Net income $ 7,000 LANSING COMPANYSelected Balance Sheet Accounts At December 31 Current Year Prior Year Accounts receivable $ 6,600 $ 7,800 Inventory 2,980 2,040 Accounts payable 5,400 6,600 Salaries payable 1,080 800 Utilities payable 420 260 Prepaid insurance 360 480 Prepaid rent…arrow_forwardThe trial balance of Kingbird Wholesale Company contained the following accounts shown at December 31, the end of the company's fiscal year. Cash Accounts Receivable Inventory Land Kingbird Wholesale Company Trial Balance December 31, 2025 Buildings Accumulated Depreciation-Buildings Equipment Accumulated Depreciation-Equipment Notes Payable Accounts Payable Common Stock Retained Earnings Dividends Sales Revenue Sales Discounts Cost of Goods Sold Salaries and Wages Expense Utilities Expense Maintenance and Repairs Expense Advertising Expense Debit $ 33,200 39,300 71,700 90,700 198,700 82,200 8,700 4,700 708,600 50,000 10,100 7,600 3,900 Credit $ 58,700 39,200 53,400 16,200 158,700 65,900 920,800arrow_forwardThe following is a partial trial balance for General Lighting Corporation as of December 31, 2021: Account Title Sales revenue Interest revenue Loss on sale of investments Cost of goods sold Loss on inventory write-down (obsolescence) Selling expense General and administrative expense Interest expense Debits 29,500 1,330,000 340,000 440,000 220,000 93,000 Complete this question by entering your answers in the tabs below. Credits 3,050,000 94,000 There were 300,000 shares of common stock outstanding throughout 2021. Income tax expense has not yet been recorded. The income tax rate is 25%. Required: 1. Prepare a single-step income statement for 2021, including EPS disclosures. 2. Prepare a multiple-step income statement for 2021, including EPS disclosures.arrow_forward

- On December 31, Hughes Company has the following list of account balances. Additional Resources Accounts Payable $42,600 Equipment $30,500 Accounts Receivable 49,100 Service Revenue 41,800 Accumulated Depreciation, Equipment 19,600 Legal Expense 7,800 Accumulated Depreciation, Buildings 62,100 Note Payable, due in two years. 20,000 Advertising Expense 5,000 Prepaid Rent 20,500 Beginning Retained Earnings 97,000 Rent Expense 8,500 Buildings 119,000 Salaries Expense 3,400 Capital Stock 53,900 Salaries Payable 10,700 Cash 65,600 Supplies 24,500 Dividends 12,200 Supplies Expense 1,600 Required: Compute the dollar amount of the…arrow_forwardThe following data relates to the assets due within one year for Simons Co. Cash $56,000 Accounts receivable 325,000 Allowance for doubtful accounts 25,000 Interest receivable 3,000 Supplies 4,000 Inventory 45,000 Other current assets 10,000 Based on the data above, prepare a partial balance sheet in good form at December 31. Show total current assets. Simons Co. Balance Sheet December 31 Assets Current assets: Total current assetsarrow_forwardThe following items are taken from the financial statements of the Freight Service for the year ending December 31, 2021: Accounts payable Accounts receivable Accumulated depreciation-equipment Advertising expense Cash Owner's capital (1/1/16) Owner's drawings Depreciation expense Insurance expense Note payable, due 6/30/17 Prepaid insurance (12-month policy) Rent expense Salaries & wages expense Service revenue Supplies Supplies expense Equipment O $44,000 O $14,000 $33.000 $19,000 13,000 26,000 21,200 15,000 104,000 11,000 12,000 3,800 72,000 $135,000 7,200 16,000 32,000 135,000 What is the company's net income for the year ending December 31, 2016? 5,000 6,000 210,000arrow_forward

- The following accounts and account balances are available for Badger Auto Parts at December 31: Accounts Payable $9,000 Income Taxes Payable $3,600 Accounts Receivable 41,100 Interest Expense 6,650 Accumulated Depreciation (Furniture) 47,800 Interest Payable 1,800 Advertising Expense 29,200 Inventory 60,600 Cash 3,200 Notes Payable (Long-Term) 50,000 Common Stock 100,000 Prepaid Rent 15,250 Cost of Goods Sold 184,400 Retained Earnings, January 1 16,000 Depreciation Expense (Furniture) 10,400 Sales Revenue 264,100 Furniture 128,000 Utilities Expense 9,700 Income Taxes Expense 3,800 Required: Prepare a trial balance. Assume that all accounts have normal balances. If an amount box does not require an entry, leave it blank.arrow_forwardUse the adjusted trial balance and prepare a properly formatted Statement of Retained Earning Adjusted trial balance 30- APR Debit Credit Cash 68,000 accounts receivable 12,000 Prepaid insurance 850 Prepaid Advertising 13,250 Office Supplies 1,475 Merchandise inventory 27,850 Equipment 250,000 Accumulated Depreciation - Equipment 100,000 Music Copyrights 60,000 Accounts Payable 10,300 Salaries Payable 63,018 notes payable 7,500 long-term notes payable 92,500 common stock 25,000 retained earnings 173,862 dividends 30,000 sales 265,065 sales discount 25,702 Sales returns and allowances 4,370 cost of goods sold 124,209 insurance expense (on office) 3,000 Advertising expense 1,900 office salaries expense 23,000 Office supplies expense 13,319 Office rent 24,000 Depreciation expense - office building 5,000 royalties (an expense) 26,000 travel expenses (sales related)…arrow_forwardThe following accounts and corresponding balances were drawn from Marinelli Company's Year 2 and Year 1 year-end balance sheets. Account Title Accounts receivable Interest receivable Other operating expenses payable Salaries payable The Year 2 income statement is shown next. Sales Salary expense Income Statement Other operating expenses Operating income Nonoperating items: Interest revenue Net income Required Year 2 $48,000 Year 1 $38,900 4,550 6,650 28,400 21,000 10,850 15,400 $755,000 (163,000) (266,000) 326,000 22,000 $348,000 a. Use the direct method to compute the amount of cash inflows from operating activities. b. Use the direct method to compute the amount of cash outflows from operating activities. a Cash inflows from operating activities b. Cash outflows from operating activitiesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education