FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

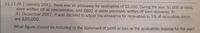

Transcribed Image Text:11.11 At 1 January 20X1, there was an allowance for receivables of $3,000. During the year, $1,000 of debts

were written off as irrecoverable, and $800 of debts previously written off were recovered. At

31 December 20X1, it was decided to adjust the allowance for receivables to 5% of receivables which

are $20,000.

What figure should be included in the statement of profit or loss as the receivables expense for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Brickman Corporation uses the allowance method to account for uncollectible receivables. At the beginning of the year, Allowance for Bad Debts had a credit balance of $1,000.During the year Brickman wrote off uncollectible receivables of $2,100. Brickman recorded Bad Debts Expense of $2,700. What is Brickman's year-end balance in Allowance for Bad Debts? $600 $3,700 $4,800 $1,600arrow_forward6 Mario Company's Accounts Receivable balance atDecember 31 was $300,000 and there was a credit balance of $1,400 in the Alowance for Doubtful Accounts, The year's sales were $1,800,000. Mario estimates credit losses for the year at 1.5% of sales. After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year- end? A) $300,000 B) $271,600 C) $325,400 D) $277,400arrow_forward17.The following information is provided: Unadjusted balance in Allowance for Doubtful Accounts $1,100 (debit)Accounts Receivable, December 31 245,500Sales Returns and Allowances 5,500Sales 850,000Sales Discounts 15,000 Required:1. Prepare the adjusting entry if bad debts are estimated to be 1.5% of net sales.2. Compute the amount of the adjusting entry if bad debts are estimated to be 3% of ending accounts receivable.arrow_forward

- 12/31/2020: During 2020, $10,000 in accounts receivable were written off. At the end of the second year of operations, Yolandi Company had $1,000,000 in sales and accounts receivable of $400,000. XYZ’s management has estimated that $17,000 in accounts receivable would be uncollectible. For the end of 2020, after the adjusting entry for bad debts was journalized, what is the balance in the following accounts: Bad debt expense: Allowance for doubtful accounts: For the end of 2020, what is the company's net realizable value?arrow_forward10- SK Inc, factors $400,000 of accounts receivable with Mars Finance Company on a without recourse basis on July 1,2020. The receivables records are transferred to Mars Finance, which will receive the collections. Mars Finance assesses a finance charge of 1 ½% of the amount of accounts receivable and retains an amount equal to 4% of accounts receivable to cover sales discounts, returns, and allowances. The transaction is to be recorded as a sale.Instructions:a) Prepare the journal entry on July1,2020, for SK Inc. to record the sale of receivables without recourse.b) Prepare the journal entry on July1,2020, for Mars Finance Company. to record the purchase of receivables without recouarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education