ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

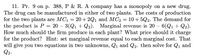

Transcribed Image Text:11. Pr. 9 on p. 388, P & R. A company has a monopoly on a new drug.

The drug can be manufactured in either of two plants. The costs of production

for the two plants are MC1 = 20+ 2Q1 and MC2 = 10+5Q2. The demand for

the product is P = 20 – 3(Q1 + Q2). Marginal revenue is 20 – 6(Q1 + Q2).

How much should the firm produce in each plant? What price should it charge

for the product? Hint: set marginal revenue equal to each marginal cost. That

will give you two equations in two unknowns, Q1 and Q2. then solve for Q1 and

Q2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 20arrow_forwardsuppose Rosaria is a simple monopolist who sells rose water measured in ounces. her marginal costs are constant and equal to $1, regardless of who she sells to, and she has no fixed costs to consider. the market for rose water has only two consumers, Ying and Kay. Ying's deman is Q^y = 10 - 2P, while Kay's deman is Q^k = 2 - P Rosalina is able to practice third degree price discrimination. Her total profits arearrow_forwardA monopolistic competitor has the following information about cost and demand. Quantity Price ($) Total Marginal Total Marginal Average Revenue Revenue Cost ($) Cost ($) Cost($) ($) (S) 0 19.00 30.00 2 18.00 36.00 18.00 35.00 2.50 17.50 4 17.00 68.00 16.00 45.00 5.00 11.25 6 16.00 96.00 14.00 60.00 7.50 10.00 8 15.00 120.00 12.00 77.00 10 14.00 140.00 10.00 12 13.00 156.00 8.00 14 12.00 168.00 6.00 16 11.00 176.00 4.00 18 10.00 180.00 2.00 8.50 9.63 100.00 11.50 10.00 126.00 13.00 10.50 165.00 19.50 11.79 210.00 22.50 13.13 260.00 25.00 14.44 20 9.00 180.00 320.00 30.00 16.00 If this industry was perfectly competitive, what price would the good sell for? $13 $12 $15 $14arrow_forward

- A monopolistic competitor has the following information about cost and demand. Quantity Price ($) Total Revenue ($) Marginal Revenue ($) Total Cost ($) Marginal Cost Average ($) Cost($) 0 25 0 25 30 2 24 48 23 35 2.5 175 4 23 92 21 45 5 11.25 6 22 132 19 60 7.5 10 8 21 168 17 77 8.5 9.63 10 20 200 15 100 11.5 10 12 19 228 13 126 13 10.5 14 18 252 11 165 19.5 11.79 16 17 272 9 210 22.5 13.13 18 16 288 7 260 25 14.44 20 15 300 5 320 30 16 If this industry was perfectly competitive, what price would the good sell for? $15 $19 $21 $23arrow_forwardA monopolistic competitor has the following information about cost and demand. Price ($) Marginal Revenue ($) Total Cost ($) Marginal Cost ($) Quantity Total Revenue Average Cost($) ($) 15 15 175 14 70 13 180 1 36 10 13 130 11 190 19 15 12 180 207 3.4 13.8 20 11 220 7 225 3.6 11.25 25 10 250 5 250 10 30 270 3 290 8. 9.67 35 8 280 335 9.57 40 7 280 -1 385 10 9.63 45 6. 270 -3 465 16 10.33 50 5 250 565 20 11.3 What will this firm's profits equal in the long run? -$55 $0 $250 $280arrow_forwardQuestion 10.10. The nondiscriminating pure monopolist must decrease price on all units of a product sold in order to sell more units. This explains why there are barriers to entry in pure monopoly. a monopoly has a perfectly elastic demand curve. marginal revenue is less than average revenue. total revenues are greater than total costs at the profit-maximizing level of output. Question 11.11. Which case below best represents a case of price discrimination? An insurance company offers discounts to safe drivers. A major airline sells tickets to senior citizens at lower prices than to other passengers. A professional baseball team pays two players with identical batting averages different salaries. A utility company charges less for electricity used during "off-peak" hours, when it does not have to operate its less-efficient generating plants. Question 12.12. In which industry is monopolistic competition most likely to be…arrow_forward

- Place the black point (plus symbol) on the graph to indicate the short-run profit-maximizing price and quantity for this monopolistically competitive company. Then, use the green rectangle (triangle symbols) to shade the area representing the company's profit or loss. Note: Dashed drop lines will automatically extend to both axes. Select and drag the rectangles from the palette to the graph. To resize, select one of the points on the rectangle and move to the desired position. PRICE (Dollars per bike) 500 450 400 350 PRICE (Dollars per bike) 300 250 200 150 100 50 0 0 MC + 50 100 AC MR 150 200 250 300 350 400 450 500 QUANTITY (Bikes) Demand Enjano Given the profit-maximizing choice of output and price, the shop is earning shops in the industry than in long-run equilibrium. + Monopolistically Competitive Outcome Now consider the long run in which bike manufacturers are free to enter and exit the market. QUANTITY (Bikes) Show the possible effect of free entry and exit by shifting the…arrow_forwardIn this question, I ask you to consider the market for flights from Seattle to Fresno (California). Alaska Airlines have a monopoly on this route. There are two types of travellers. Leisure travellers derive a value of $200 from flying this route if the itinerary includes a Saturday night stay, and $175 if the itinerary doesn’t include a Saturday night stay. Business travellers derive a value of $100 from flying this route if the itinerary includes a Saturday night stay, and $450 if the itinerary doesn’t include a Saturday night stay. What prices do you suggest that Alaska charge for itineraries that include a Saturday night stay, and those that do not include a Saturday night stay?How might business travellers respond to the pricing strategy you suggested?arrow_forwardA monopolist sells the same good in two geographically separated markets, market 1 and market 2. The firm maximizes its profit by charging different prices: p₁ = 37 in market 1 and p2 in market two. The own-price elasticity of the demand in market 1 is -27 and the own-price elasticity of the demand in market 2 is -13. Find the price the firm charges in market 2, P2, and enter it below. (Hint: Write down the inverse elasticity rule for each market. What "element" common to both expressions?)arrow_forward

- 9. A monopolistic producer of two goods, 1 and 2, has a joint total cost function TC = 100, + Q,0, +10Q, where 9 and 2: denote the quantity of items of goods 1 and 2, respectively that are produced. If P, and P, denote the corresponding prices then the demand equations are P = 50 -Q +Q. P, = 30 + 20, -Q, Using the Lagrange multiplier approach, find the maximum profit if the firm is contracted to produce a total of 15 goods of either type. Estimate the new optimal profit if the production quota rises by 1 unit.arrow_forwardThe table above is for a monopolistic competitive firm. What will the firm's profit equal in the short run? Question 3 options: $0 $91 $102 $228arrow_forwardA monopoly, unlike a perfectly competitive firm, has some market power. Thus, it can raise its price, within limits, without quantity demanded falling to zero. The main way monopolies retain their market power is through barriers to entry, which prevent other companies from entering monopolized markets and competing for customers. Consider the market for public water. In this industry, low average total costs are obtained only through large-scale production. In other words, the initial cost of setting up all the necessary pipes and treatment plants makes it risky and most likely unprofitable for a competitor to enter the market. Which of the following best explains the barriers to entry that exist in this scenario? O Legal barriers O Control over an important input O Increasing returns to scalearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education