FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

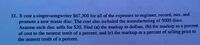

Transcribed Image Text:11. It cost a singer-songwriter $67,300 for all of the expenses to engineer, record, mix, and

promote a new music disc. The cost also included the manufacturing of 5000 discs.

Assume each disc sells for $20. Find (a) the markup in dollars, (b) the markup as a percent

of cost to the nearest tenth of a percent, and (c) the markup as a percent of selling price to

the nearest tenth of a percent.

Expert Solution

arrow_forward

Step 1

Given information is:

Cost of producing Discs = $67300

Discs produced = 5000

Selling price per disc = $20 per disc

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Adiwele Ltd has a financial year end of 31 March. The entity manufactures Compact Discs for resale. The manufacturing cost per compact disc is R2 per unit. Finished units of the compact disc are sold at R2.5 per unit. On 31 March 2021, Adiwele Ltd had 100 500 units of compact discs in stock. To sell this products Adiwele Ltd will incur the following costs: Sales commission of 20 cents per unit, Additional designing costs of 25 cents per unit, Advertising and packaging costs of 23 cents per unit, Salaries for administrative staff of R6 000 per month. Adiwele Ltd measures inventory at lower of cost and net realisable value as per IAS 2, Inventories according to IFRS at year end. What is the value of the closing inventory on 31 March 2021 as per IAS 2? 1.251 250 2. 201 000 3. 208 035 4. 136 035 5. 244 215arrow_forwardkasembe ltd is considering its plans for the year ending 3i december 2014. it makes and sells a single product, which has budgeted costs and selling price as follows: selling price $45 per unit, direct materials $11 per unit, direct labour $8 per unit. production overhead: variable $4000 per unit, fixed $$3000. Selling overhead: variable $5000, fixed $2000. Adminstration overhead: fixed $3000. fixed overhead costs per unit are based on a normal annual activity level of 96000 units. these costs are expected to be incured at a constant rate throughout the year. activity levels during january and february 2014 are expected to be:january sales 7000 units, production 8500 units; february sales 8750 units, production 7750 units. assume that there will be no stock held on 1 january 2014. required; a) prepare profit statements for each of the two months of january and february using; absorption costing and marginal costing. reconcile and explain the reasons for any differencesarrow_forward6. The Lantern Corporation has 1,000 obsolete lanterms that are carried in inventory at a manufacturing cost of P20,000. If the lanterns are re-machined for PS,000, they could be sold for P9,000. If the lanterns are scrapped, they could be sold for P1,000. What alternative is more desirable and what are the total relevant costs for the alternative? a. Re-machine and PS,000. b. Re-machine and P25,000. c. Scrap and P20,000. d. Neither, as there is an overall loss under either altematives.arrow_forward

- A company that sells radios has yearly fixed costs of $600,000. It costs the company $45 to produce each radio. Each radio will sell for $65. The company’s costs and revenue are modeled by the functions (see attached), where x represents the number of radios produced and sold. Then find and interpret (R - C)(20,000), (R - C)(30,000), and(R - C)(40,000).arrow_forwardThe cost to operate a clothes dryer for a year is $80.25. If the rate for electrical energy is 8.8¢/kWh, and the clothes dryer is used for 700 hours in a year, what is the power rating of the clothes dryer? Explain in depth and clearly.arrow_forwardAlphaBrona Industries manufactures 50,000 components per year. The manufacturing cost of the components was determined as follows: Direct materials $ 80,000 Direct labor 100,000 Variable overhead 30,000 Fixed overhead 60,000 Total $270,000 An outside supplier has offered to sell the component to AlphaBrona for $10 per unit. Fixed costs will remain the same if the component is purchased from an outside supplier. What will be the effect on income if AlphaBrona Industries purchases the component from the outside supplier? a. $290,000 decrease b. $290,000 increase c. $45,000 decrease d. $45,000 increasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education