Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

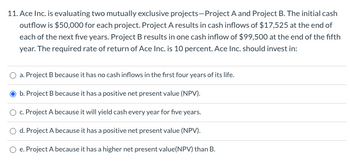

Transcribed Image Text:11. Ace Inc. is evaluating two mutually exclusive projects-Project A and Project B. The initial cash

outflow is $50,000 for each project. Project A results in cash inflows of $17,525 at the end of

each of the next five years. Project B results in one cash inflow of $99,500 at the end of the fifth

year. The required rate of return of Ace Inc. is 10 percent. Ace Inc. should invest in:

a. Project B because it has no cash inflows in the first four years of its life.

b. Project B because it has a positive net present value (NPV).

c. Project A because it will yield cash every year for five years.

d. Project A because it has a positive net present value (NPV).

e. Project A because it has a higher net present value(NPV) than B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have been offered a project paying $300 at the beginning of each year for the next 20 years. What is the maximum amount of money you would invest in this project if you require 9 percent rate of return to your investment? OA. $2,739 B. $2,985 C. $15,348 OD. $16,729arrow_forwardThe Square Box is considering two independent projects, both of which have an initial cost of $18,000. The cash inflows of Project A are $3,000, $7,000, and $10,000 over the next three years, respectively. The cash inflows for Project B are $3,000, $7,000, and $15,000 over the next three years, respectively. The required return is 12 percent and the required discounted payback period is 3 years. Based on discounted payback, which project(s), if either, should be accepted? Group of answer choices Project A should be rejected and Project B should be accepted. Both projects should be accepted. Project A should be accepted and Project B should be rejected. Both projects should be rejected. You should be indifferent to accepting either or both projects.arrow_forwardThe Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each costs $7,000 and has an expected life of 3 years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability distributions: Project A Project B Probability Cash Flows Probability Cash Flows 0.2 $6,250 0.2 $0 0.6 $7,000 0.6 $7,000 0.2 $7,750 0.2 $19,000 BPC has decided to evaluate the riskier project at 12% and the less-risky project at 10%. a. What is each project's expected annual cash flow? Round your answers to two decimal places. Project A: $ Project B: $ Project B's standard deviation (σB) is $6,131.88 and its coefficient of variation (CVB) is 0.77. What are the values of (σA) and (CVA)? Round your answers to two decimal places. σA = $ CVA = b. Based on the risk-adjusted NPVs, which project should BPC choose? c. If you knew that Project B's cash flows were negatively correlated with the firm's other cash flow, but Project A's cash flows…arrow_forward

- Determine which of the following independent projects should be selected for investment if a maximum of $240,000 is available and the MARR is 10% per year. Use the PW method to evaluate mutually exclusive bundles to perform your analysis. Construct the cash flow diagram for each. Investment, Net Cash Flow, $ per year Life, Project years S -100,000 50,000 8 M -125,000 24,000 8 A -120,000 75,000 8. -220,000 39,000 8 -200,000 82,000 8.arrow_forwardEmusk Inc. is evaluating two mutually exclusive projects. The required rate of return on these projects is 8%. Calculate the profitability index for project A. (Round to 3 decimals) Year 0 1 2 3 4 5 Project A -15,000,000 2,000,000 3,000,000 5,000,000 5,000,000 6,000,000 Project B -15,000,000 6,000,000 6,000,000 6,000,000 1,000,000 1,000,000arrow_forwardYou are required to investigate the following project: The initial Investment at n=0 is $100,000. The project life is 10 years. Estimated annual operating cost : 34,000. The required minimum return on the investment :14%. The salvage value 8,000. What is the minimum annual revenues that should be generated to make the project worthwhile? 97842 52758 81921 45716 O O O Oarrow_forward

- The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each project has an initial after-tax cash outflow of $6,500 and has an expected life of 3 years. Annual project after-tax cash flows begin 1 year after the initial investment and are subject to the following probability distributions: Project A Project B Probability Cash Flows Probability Cash Flows 0.2 $6,250 0.2 $ 0.6 6,500 0.6 6,500 0.2 6,750 0.2 19,000 BPC has decided to evaluate the riskier project at 11% and the less-risky project at 8%. a. What is each project's expected annual after-tax cash flow? Round your answers to the nearest cent. Project A: $ Project B: Project B's standard deviation (OB) is $6,185 and its coefficient of variation (CVB) is 0.80. What are the values of gg and CVA? Do not round intermediate calculations. Round your answer for standard deviation to the nearest cent and for coefficient of variation to two decimal places. OA: $ CVA:arrow_forwardKirklin Clinic is evaluating a project that costs $60,000 and has expected net cash inflows of $7,500 per year for eight years. The first inflow occurs one year after the cost outflow, and the project has a cost of capital of 12%. What is the project's MIRR? (hint: remember to put the answer as a percentage). O 13.9% 5.5% O 3.2% 22.1% harrow_forwardProject Alpha requires an initial outlay of $500,000 and has a profitability index of 1.5. The project is expected to generate equal annual cash flows over the next twelve years. The required return for this project is 18%. What is project Alpha’s net present value? Round to the nearest 1,000. $165,000 $170,000 $185,000 $200,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education