FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

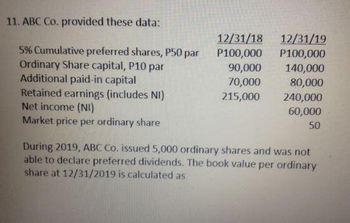

Transcribed Image Text:11. ABC Co. provided these data:

5% Cumulative preferred shares, P50 par

Ordinary Share capital, P10 par

Additional paid-in capital

Retained earnings (includes NI)

Net income (NI)

Market price per ordinary share

12/31/18

12/31/19

P100,000 P100,000

140,000

80,000

240,000

60,000

50

90,000

70,000

215,000

During 2019, ABC Co. issued 5,000 ordinary shares and was not

able to declare preferred dividends. The book value per ordinary

share at 12/31/2019 is calculated as

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Shown below is information relating to the stockholders' equity of Robertson Corporation at December 31, 2022: 12% cumulative preferred stock, $150 par Common stock, $1.50 par Additional paid-in capital: preferred stock Additional paid-in capital: common stock Treasury stock (at cost: 6,000 common shares) Retained earnings Refer to the above data. How many shares of common stock are outstanding? O a. 600,000 O b. 406,000 O c. 594,000 O d. 394,000 $1,500,000 600,000 300,000 900,000 180,000 1,350,000arrow_forwardThe information below pertains to Pierpont Corp. for 2020: Net income, $1,200,000. Common Stock, $10 par value per share, total par value $3,000,000. D% Convertible and Cumulative Preferred Stock, S100 par value per share, each share convertible into 3 shares of common stock. The preferred stock was issued in 2018. Total par value $4,000,000. 7% Convertible Bonds Payable, issued at face value of $1,000 per bond, in 2019. Each bond is convertible into 30 shares on common stock. Total face value $2,000,000. Stock options granted in 2019 to purchase 75,000 shares of common stock at $20 per share, none of which have been exercised to date. Income tax rate, 20%. Average market price of the common stock during 2020 was $25 per share. There were no changes during 2020 in the number of common shares outstanding, number of preferred shares outstanding, or number of convertible bonds outstanding. There are no treasury shares held by Pierpont. REQUIRED: 1. Calculate basic earnings per share for…arrow_forwardwinter provided the following shareholders’ equity on December 31, 2021: Preference share capital, 10% P50 par (noncumulative and nonparticipating) 1,000,000 Preference share capital, 8% P50 par (cumulative and nonparticipating) 1,500,000 Ordinary share capital, P100 2,500,000 Share premium 500,000 Retained earnings 600,000 Dividends have been paid on the preference share up to December 31, 2018. Book value per 8% preference sharearrow_forward

- On June 30, 2020, when ABC shares were selling for $ 65 each, the equity accounts had the following balances: Common shares (par value $ 50: 50,000 issued) $ 2,500,000 Capital contributed in excess of par value 600,000 Retained earnings 4,200,000 A 100% share dividend is declared and distributed, the balance of the Common Shares account after recording the dividend will be: a. $2,500,000 b. $7,300,000 c. $3,100,000 d. $5,000,000arrow_forwardAt 31 December 2019, B Plc had post-tax profits was $2,500,000 and had an issued share capital of $2,000,000 comprising 2,000,000 ordinary shares of 50p each and 1,000,000 $1 10% preference shares that are classified as equity. Assume that the post-tax profits for 2018 and 2019 were same at $ 2,500,000. The time-weighted number of shares was as follows: No. of Shares Shares (nominal value 50p) in issue at 01 January 2019 2,000,000 Shares issued for cash at market price on 30 September 2019 1,000,000 On 30 September 2019, B plc made a right issue of one share for every two shares (i.e one new share for every two shares held) at $3.25 per share. The following information is also given for B Plc as at 31 December 2019: Share option in existence 1,000,000 shares issuable in 2020 at $3.25 per share. An average market price per share of $4%; 1. Convertible 8% preference shares of $1 each totaling $2,000,000 convertible at one ordinary share for every five convertible preference shares. 2.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education