MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

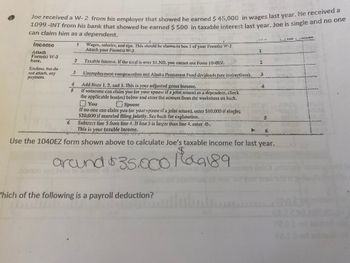

Transcribed Image Text:1099 -INT from his bank that showed he earned $ 500 in taxable interest last year. Joe is single and no one

can claim him as a dependent.

r.er

Income

Wages, salzries, and tips. This should be showa in box I of yoar Focm(s W-2.

Attach yout Forns(s) W-2.

Mtach

Formts) W-2

iere.

Taiable Interest If the total is ener $1.580, you caanot usc. Form 10:0E7.

ச

Seste

- ns men

Enclose, bs ds

s ch, zny

3

Lacmploytecnt compensulKI a0:l Alaka Pezenineal Ferds divideads (see isvustions).

Add tirea 1.2, 2nd 3. This is yoer adjusted gross inconte.

IK somcom cen claim you ( yuur spoue il sjaint return) es a depcadcat.cluck

tlhe appiicable koxfes) below 45d chiet the amount from the wertsleet ea bich.

口 You

f tw onc can ciairm you (x yoJ! sprIse if a joint return), cnter $10,000i(single%;

$20,000 if marrled fling Jointly. Sec heck for caplination.

6 Subtrzct tine 5 frot line 1, If ire Sis large than line 4, enler 0-.

This is your taxable Income.

Spouse

Use the 104OEZ form shown above to calculate Joe's taxable income for last year.

arand 35.0 agi

9189

up

bonu

erdinon

/hich of the following is a payroll deduction?

021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman