FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

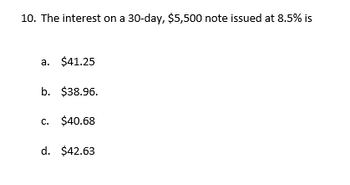

Transcribed Image Text:10. The interest on a 30-day, $5,500 note issued at 8.5% is

a. $41.25

b. $38.96.

c. $40.68

d. $42.63

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hw 2arrow_forward23 Business Mathematics II 02 (BINM Group 2) An interest-bearing note for 90 days at 8% p.a. has a face value of $80,000. If the note is discounted 70 days from maturity at a rate of 10% p.a., calculate the amount of proceeds. a. $80,043.01 b. $81,043.01 O C. $70,043.01 Follow Us You are logged in as Gurpreet ASUSarrow_forward35- Check if the cash flows A and B, in the following table, are equivalent for a rate of 2% p.m., under compound interest.arrow_forward

- Winett Corporation is considering an investment in special-purpose equipment to enable the company to obtain a four-year municipal contract. The equipment costs $222,000 and would have no salvage value when the contract expires at the end of four years. Estimated annual operating results of the project are as follows. Revenue from contract sales. Expenses other than depreciation Depreciation (straight-line basis) Increase in net income from contract work $211,000 55,500 All revenue and all expenses other than depreciation will be received or paid in cash in the same period as recognized for accounting purposes. Compute the following for Winett's proposal to undertake this contract. a. Payback period b. C. a. Payback period. b. Return on average investment. (Round your percentage answer to 1 decimal place (i.e., 0.123 to be entered as 12.3).) c. Net present value of the proposal to undertake contract work, discounted at an annual rate of 10 percent. (Refer to the annuity table in…arrow_forwardAn investor has asked for your help with the following time value of money applications. Table 6-4. (Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.) Required: a. What is the present value of $62,000 to be received in six years using a discount rate of 18%? (Round your answer to 1 decimal place.) Present value b. How much should be invested today at a return on investment of 18% compounded annually to have $62,000 in six years? (Round your answer to 1 decimal place.) Amount to be invested c. If the return on investment was greater than 18% compounded annually, would the amount to be invested today to have $62,000 in six years be more or less than the answer to part b? O More O Lessarrow_forwardPV Years Percent Compound FV $9,817.30 27 Weekly 14.59% O a. $288,108.80 O b. $501,663.75 O c. $439,829.35 O d. $48,490.59 thousand is:arrow_forward

- P7arrow_forwardProblem 5-7 Calculating Annuity Cash Flows [LO 1] For each of the following annuities, calculate the annuity payment. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Annuity Payment Future Value Years $ 24,350 $ 980,000 $ 796,000 $ 133,000 8 38 24 15 Interest Rate 7% 9 10 6arrow_forwardST Unit 8 Quest (11U) + pQLSf8ziezOsWz6j9T7OGVQSHI-6ls9bQrlQevfkKxle-RtQ3Rlg/formResponse Question 6: How much was the amount of the original loan? Regular Payment Rate of Compound Interest per Year Compounding Period semi-annual $1575 every 6 months 5.4% $8445.09 $17076.01 a. b. $14 444.94 $24 143.61 a b C. d. Time 6 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education