FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

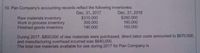

Transcribed Image Text:10. Pan Company's accounting records reflect the following inventories:

Dec 31, 2016

$260,000

160,000

150.000

Raw materials inventory

Work in process inventory

Finished goods inventory

Dec. 31, 2017

$310,000

300,000

190,000

During 2017, $800,000 of raw materials were purchased, direct labor costs amounted to $670,000,

and manufacturing overhead incurred was $640,000.

The total raw materials available for use during 2017 for Pan Company is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Coronado Industries's accounting records reflect the following inventories: Raw materials inventory Work in process inventory Finished goods inventory Dec. 31, 2020 O $2050000. $1910000. $2110000. $2010000. $310000 300000 190000 Dec. 31, 2019 $250000 160000 150000 During 2020, $800000 of raw materials were purchased, direct labor costs amounted to $670000, and manufacturing overhead incurred was $640000. Coronado Industries's total manufacturing costs incurred in 2020 amounted toarrow_forwardWachowski Company reported the following cost data for the year 2017. Factory maintenance costs $90,000 Direct labor, wages 352,000 Direct labor, health insurance 32,000 Indirect labor, health insurance 16,000 Health insurance for production supervisor 6,500 Administrative costs 54,000 Rental of office space for administrative staff 18,500 Sales commissions 52,000 Direct material 1,220,000 Indirect materials 633,000 Advertising expense 39,000 Depreciation on factory building 62,000 Indirect labor, wages 70,000 Production supervisor's salary 33,000 Use the above cost data to complete the table below. Total prime costs $4 Total manufacturing overhead costs $ Total product costs Total period costsarrow_forwardWachowski Company reported the following cost data for the year 2017. Factory maintenance costs $90,000 Direct labor, wages 352,000 Direct labor, health insurance 32,000 Indirect labor, health insurance 16,000 Health insurance for production supervisor 6,500 Administrative costs 54,000 Rental of office space for administrative staff 18,500 Sales commissions 52,000 Direct material 1,220,000 Indirect materials 633,000 Advertising expense 39,000 Depreciation on factory building 62,000 Indirect labor, wages 70,000 Production supervisor's salary 33,000 Use the above cost data to complete the table below. Total prime costs Total manufacturing overhead costs $ Total product costs $ Total period costsarrow_forward

- At the beginning of 2012, Conway Manufacturing Company had the following account balances: WIP Inventory 2,000 During the year, the following transactions took place: Direct materials placed in production: Direct labor incurred: FG Inventory 8,000 Select one: Oa. debit of $67,000 $80,000 $190,000 Manufacturing overhead incurred $300,000 Manufacturing overhead allocated to production: $295,000 Cost of Jobs Completed $500,000 Selling Price of Jobs Sold $750,000 Cost of Jobs Sold $440,000 After these transactions have been recorded, the balance in the Work in process account is a: O b. credit of $63,000 O c. debit of $72,000 O d. debit of $70,000* Manufacturing O/H 0arrow_forwardAt the beginning of 2012, Conway Manufacturing Company had the following account balances: WIP Inventory - DR 2,000 FG Inventory - DR 8,000 ( All T accounts) During the year the following transactions took place: Direct materials placed in production $80,000Direct labor incurred $190,00Manufacturing OH incurred $300,000Manufacturing OH allocated to production $295,000Costs of jobs completed $500,000Selling price of jobs sold $750,000Cost of jobs sold $440,000 After recording all these transaction the adjusted cost of goods sold account is: A) Debit of $445,000B) Debit of $440,000C) Credit of $445,000D) Debit of $435,000arrow_forwardAt May 31, 2020, the accounts of Sheffield Company show the following. 1. May 1 inventories—finished goods $ 14,800, work in process $ 17,600, and raw materials $ 8,600. 2. May 31 inventories—finished goods $ 9,600, work in process $ 17,000, and raw materials $ 8,000. 3. Increases to work in process were direct materials $ 64,300, direct labor $ 51,400, and manufacturing overhead applied $ 42,100. 4. Sales revenue totaled $ 217,000. (a) Prepare a condensed cost of goods manufactured schedule for May 2020. SHEFFIELD COMPANYCost of Goods Manufactured Schedulechoose the accounting periodchoose the accounting period select an opening section nameselect an opening section name $ enter a dollar amountenter a dollar amount select an account titleselect an account title $ enter a dollar amountenter a dollar amount select an account titleselect an account title enter a dollar amountenter a dollar amount…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education