ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

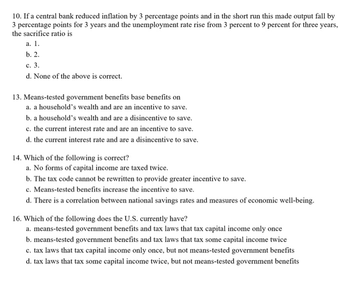

Transcribed Image Text:10. If a central bank reduced inflation by 3 percentage points and in the short run this made output fall by

3 percentage points for 3 years and the unemployment rate rise from 3 percent to 9 percent for three years,

the sacrifice ratio is

a. 1.

b. 2.

c. 3.

d. None of the above is correct.

13. Means-tested government benefits base benefits on

a. a household's wealth and are an incentive to save.

b. a household's wealth and are a disincentive to save.

c. the current interest rate and are an incentive to save.

d. the current interest rate and are a disincentive to save.

14. Which of the following is correct?

a. No forms of capital income are taxed twice.

b. The tax code cannot be rewritten to provide greater incentive to save.

c. Means-tested benefits increase the incentive to save.

d. There is a correlation between national savings rates and measures of economic well-being.

16. Which of the following does the U.S. currently have?

a. means-tested government benefits and tax laws that tax capital income only once

b. means-tested government benefits and tax laws that tax some capital income twice

c. tax laws that tax capital income only once, but not means-tested government benefits

d. tax laws that tax some capital income twice, but not means-tested government benefits

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- (a) What events of the 1970s and 1980s made economists believe that the shortrun relationship between inflation and unemployment was unstable (not fixed and permanent)? (b) Explain, using a diagram(s) and the concept of stagflation, the relationship between shifts in the SRAS curve and the position of the short-run Phillips curve.arrow_forwardUnanticipated inflation Unanticipated inflation penalises: A. those earning incomes that are taxed in nominal terms B. those who hold cash C. those who lend money at a fixed interest rate D. those earning incomes that are taxed in nominal terms, those who hold cash and those who lend money at a fixed interest ratearrow_forwardNegative real interest rates occur when the inflation rate is greater than the nominal interest rate. True or false? a. False b. Truearrow_forward

- Demand-pull inflation arises due to Part 2 A. a higher price level. B. a decrease in the short-run aggregate supply. C. a depreciation of the US$. D. a decrease in the aggregate demand. Part 3 Which of the following would create demand-pull inflation? Part 4 A. An increase in household income. B. A decrease in wages paid to workers. C. Increased international trade barriers. D. An increase in the real rate of interest.arrow_forwardWhich of the following economic changes are consistent with cost-push inflation? (More than one may apply) A. An increase in the price level B. A sudden and sharp decline in the quantity of money issued by the central bank C. Rising unemploymentarrow_forwardGuy Ferrell, a student who lives in the country Paragon, observes that analysts are cutting their growth forecasts for the economy for the coming year. Most of them based their analysis on the fact that the level of inflation in the economy would adversely affect economic growth. However, Guy looks up the weekly inflation data for the past couple of months and finds that inflation has been stable and low. Which of the following, if true, would explain the analysts' predictions? A. The Producer Price Index has been steadily increasing over the past few months. B. A recent revision of the previous year's CPI data showed that it was overstated by one percentage point. C. The Purchasing Manager's Index, published by a supply-chain management firm in Paragon has been stable for the past couple of months. D. The government recently increased its growth projections for the year by 100 basis points. E. Most of Paragon's trade partners have…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education