ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Can you please help solve question 10 a,b and c please show full working so I can compare it to my own work

Thank you

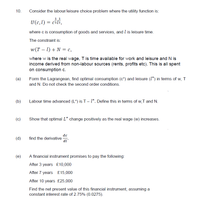

Transcribed Image Text:10.

Consider the labour/leisure choice problem where the utility function is:

1 1

U(c,l) = czl2,

where c is consumption of goods and services, and l is leisure time.

The constraint is:

w(T – 1) + N = c,

where w is the real wage, T is time available for work and leisure and N is

income derived from non-labour sources (rents, profits etc). This is all spent

on consumption c.

(a)

Form the Lagrangean, find optimal consumption (c*) and leisure (1*) in terms of w, T

and N. Do not check the second order conditions.

(b)

Labour time advanced (L*) is T- 1*. Define this in terms of w,T and N.

(c)

Show that optimal L* change positively as the real wage (w) increases.

dc

find the derivative -

di

(d)

(e)

A financial instrument promises to pay the following:

After 3 years £10,000

After 7 years £15,000

After 10 years £25,000

Find the net present value of this financial instrument, assuming a

constant interest rate of 2.75% (0.0275).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Give typing answer with explanation and conclusionarrow_forwardPro expert hero Hand written solution is not allowed.arrow_forwardCalculate and plot the following: No of units Total cost 0 2 1 9 2 12 3 15 4 20 5 30 6 42 Variable cost Fixed cost Average fixed cost Average variable cost Marginal costarrow_forward

- workers ouput marginal product total cost average total cost marginal cost 0 0 0 200 0 $0 1 20 20 300 $15 $5 2 50 30 400 $8 $3.33 3 90 40 500 $5.56 $2.50 4 120 30 600 $5 $3.33 5 140 20 700 $5 $5 6 150 10 800 $5.33 $10 7 155 5 900 $5.8 $20 can you explain diminishing marginal product based on these numbers?arrow_forwardPlease see attachment and table given in it .n solve part b asap within 40min. Will give you multiple upvotes only for the correct answer. Thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education