FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

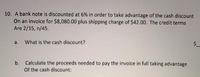

Transcribed Image Text:10. A bank note is discounted at 6% in order to take advantage of the cash discount

On an invoice for $8,080.00 plus shipping charge of $42.00. The credit terms

Are 2/15, n/45.

a. What is the cash discount?

$ _

Calculate the proceeds needed to pay the invoice in full taking advantage

Of the cash discount:

b.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Melody, Inc., accepts a national credit card. The collection fee is 6%. If credit card sales are $500, the correct journal is a. Accounts receivables 470 Sales 470 b. Accounts receivables 470 Credit card expense 30 Sales 500 c. Accounts receivables 500 Sales 500 d. Accounts receivable 500 Credit card discount 30 Sales 470arrow_forwardCalculate the cash discount and the net amount due the transaction (in $). (Round your answers to the nearest cent.) Amount ofInvoice Terms ofSale CashDiscount NetAmount Due $5,010.20 4/10, n/30 $ $arrow_forwardAn invoice dated April 22 shows a net price of $175.00 with the terms 3/10, n/30. What is the latest date the cash discount is allowed?arrow_forward

- Compute bank discount using (A) ordinary interest, (B) proceeds, and (C) effective interest rate to the nearest hundredth. Do not round denominator in your calculation. Face Value Discount Rate Time in Days $9,000 14% 110arrow_forwardCy loans Mookie The Beagle Concierge $1,000 at 6% annual interest. Record the transaction as a loan payable as follows. Required: 1. Complete a Deposit. a. Select (+) New icon > Bank Deposit b. Select Account: 1001 Checking c. Select Date: 01/12/2023 d. In Add Funds to This Deposit section, select Account: + Add New > Account Type: Other Current Liabilities > Detail Type: Loan Payable > Name: Loan Payable> Number: 2300 > Save and Close e. Select Payment Method: Check f. Enter Reference Number: 5002 g. Enter Amount: 1000.00 h. Select Save and close i. What is the Amount of the Loan Payable? Note: Answer this question in the table shown below. Round your answer to the nearest dollar amount. i. Amount of the loan payablearrow_forwardCompute bank discount using (A) ordinary interest, (B) proceeds, and (C) effective interest rate to nearest hundredth. Do not round denominator in your calculation. Face Value Discount Rate Time in Days $12,000 13% 120arrow_forward

- A $7,000, 4%, 120-day note dated March 20 is discounted on July 15. Assuming a 3% discount rate, the bank discount is: Multiple Choice $1.74 $1.77 $93.33 $70.00arrow_forwardCalculate the cash discount and the net amount due the transaction (in $). Amount ofInvoice Terms ofSale CashDiscount NetAmount Due $15,660.00 2/10, n/45 $ $arrow_forwardCalculate the cash discount and the net amount due the transaction (in $). (Round your answers to the nearest cent.) Amount of Terms of Cash Net Invoice Sale Discount Amount Due $5,010.20 4/10, n/30 2$arrow_forward

- As a company accounts payable manager, which of the following credit terms are most likely to entice you to take the cash discount? A. 2/10 net 90 B. 1/10 net 45 C. 2/10 net 60 D. 1/10 net 30arrow_forward10) Complete the table. Invoice Date Terms Last Date Last Date to Pay Invoice Date Paid Net Price Complement of Cash Price to Take Discount cash-discount rate 22-Nov. 7/10, n/30 1-Dec. $4,178.45arrow_forwardComplete the following table for the simple discount notes. Use the ordinary interest method. Note: Round your answers to the nearest cent. Amount due at maturity 4,400 Discount rate 6.25% Time 170 days Bank discount Proceedsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education