FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

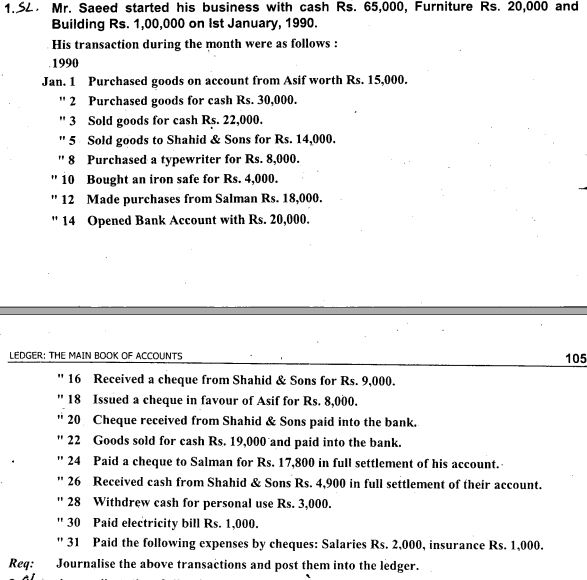

Transcribed Image Text:1.SL. Mr. Saeed started his business with cash Rs. 65,000, Furniture Rs. 20,000 and

Building Rs. 1,00,000 on Ist January, 1990.

His transaction during the month were as follows :

1990

Jan. 1 Purchased goods on account from Asif worth Rs. 15,000.

"2 Purchased goods for cash Rs. 30,000.

"3 Sold goods for cash Rs. 22,000.

"5 Sold goods to Shahid & Sons for Rs. 14,000.

"8 Purchased a typewriter for Rs. 8,000.

" 10 Bought an iron safe for Rs. 4,000.

" 12 Made purchases from Salman Rs. 18,000.

" 14 Opened Bank Account with Rs. 20,000.

LEDGER: THE MAIN BOOK OF ACCOUNTS

105

" 16 Received a cheque from Shahid & Sons for Rs. 9,000.

" 18 Issued a cheque in favour of Asif for Rs. 8,000.

20 Cheque received from Shahid & Sons paid into the bank.

" 22 Goods sold for cash Rs. 19,000 'and paid into the bank.

" 24 Paid a cheque to Salman for Rs. 17,800 in full settlement of his account.

" 26 Received cash from Shahid & Sons Rs. 4,900 in full settlement of their account.

" 28 Withdrew cash for personal use Rs. 3,000.

" 30 Paid electricity bill Rs. 1,000.

" 31 Paid the following expenses by cheques: Salaries Rs. 2,000, insurance Rs. 1,000.

Req:

Journalise the above transactions and post them into the ledger.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company reported the following transactions. Journalize transactions that should be recorded in a cash receipts journal. July 1 Smith, the owner, contributed $13,300 cash to the company. July 6 Sold merchandise costing $1,800 to Garcia for $2,030 on credit, terms n/20. July 8 Purchased merchandise for $10,600 on credit from Jones, terms n/30. July 23 Sold merchandise costing $1,030 to Taylor for $1,080 cash. July 25 Received $2,030 cash from Garcia in payment of the July 6 purchase. July 27 Purchased $565 of supplies on credit from a company, terms 1/10, n/30. July 30 Borrowed $9,800 cash in exchange for a note payable to a bank. Date July 01 July 06 July 08 July 23 July 25 July 27 July 30 Account Credited Smith, Capital Garcia Jones Cash Debit 13,300 CASH RECEIPTS JOURNAL Accounts Sales Discount Debit Receivable Credit 2,030 Sales Credit Other Accounts Credit Cost of Goods Sold Debit Inventory Credit 1,800arrow_forward16. Joseph Howard owns a bicycle parts business called Quality Bike Products. The following transactions took place during July the current year. July 5 Purchased merchandise on account from Wheeler Warehouse, $3,300. 8 Paid freight charge on merchandise purchased, $330. 12 Sold merchandise on account to Big Time Spoiler, $4,500. The merchandise cost $2,500. 15 Received a credit memo from Wheeler Warehouse for merchandise, $470. Required: 1. Journalize the above transactions in a general journal using the periodic inventory method. 2. Journalize the above transactions in a general journal using the perpetual inventory method. GENERAL JOURNAL (Periodic Inventory Method) Page 1 Post Date Description Ref. Debit Creditarrow_forwardDuring the months of January, Ava Corporation purchased goods from two suppliers. The sequence of events was as follows: Jan. 6 6 14 30 Purchased goods for $1320 from Noah with terms 2/10, n/30. Purchased goods from Emma for $860 with terms 1/10, n/30. Paid Emma in full. Paid Noah in full. On January 30, when Ava pays Noah, the debit to cash will be ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education