“Suppose that your parents are willing to lend you $20,000 for part of the cost of your college education and living expenses. They want you to repay them the $20,000 without any interest, in a lump sum 15 years after you graduate, when they plan to retire and move. Meanwhile, you will be busy repaying federally guaranteed loans for the first 10 years after graduation. But you realize that you won’t be able to repay the lump sum without saving up. So you decide that you will put aside money in an interest-bearing account every month for the first five years before the payment is due. You feel comfortable with setting aside $275 a month (the amount of the payment on your college loans, which will be paid off after 10 years).

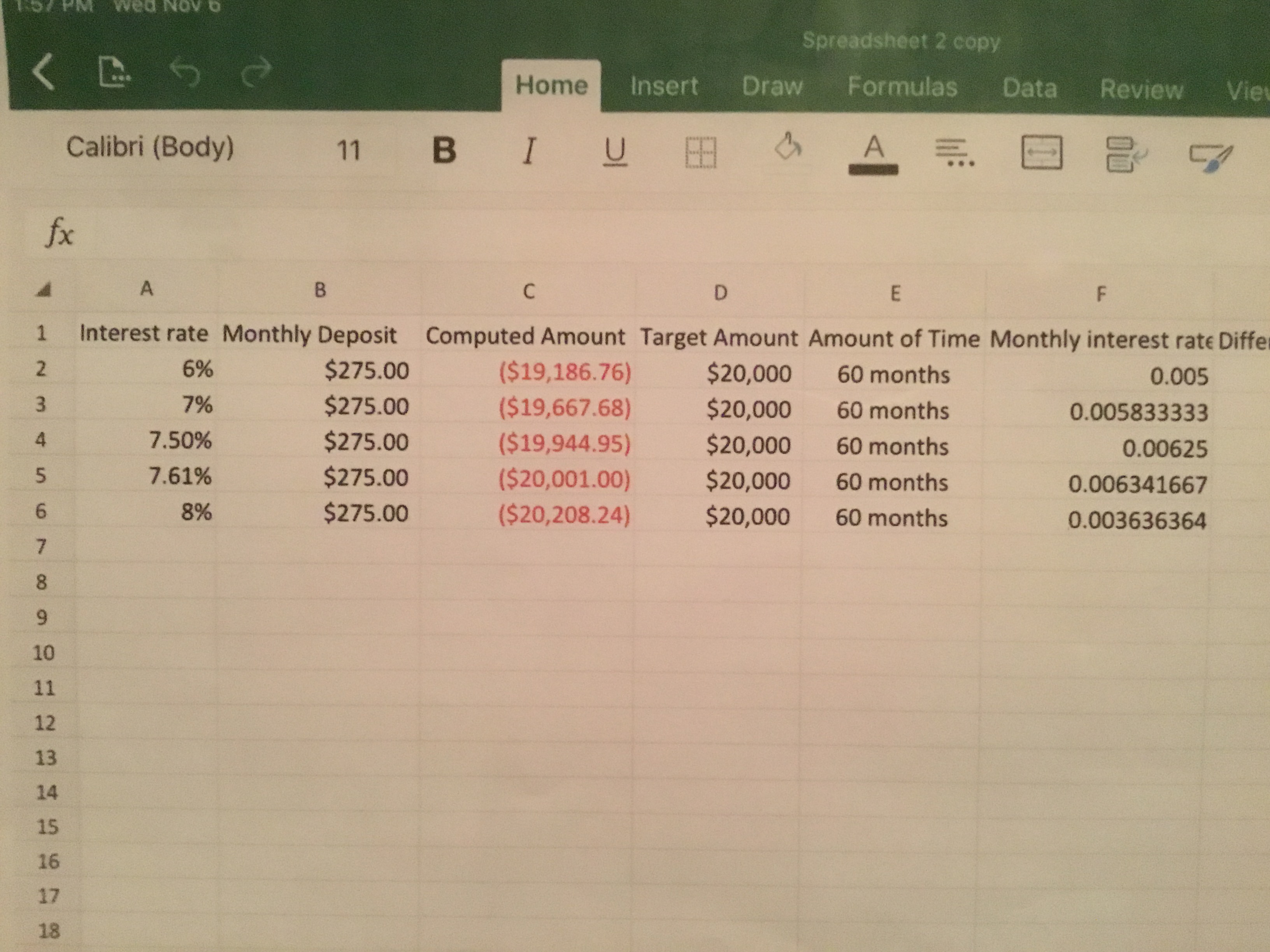

How high an annual nominal rate on savings do you need to accumulate the $20,000, in 60 months, if interest is compounded monthly? Enter into a spreadsheet the values of d = 275, r = 0.05 (annual rate), and n = 60, and the savings formula with r replaced by r/12 (the monthly interest rate). You will find that the amount accumulated is not enough. Change r to 0.09, it’s more than enough. Try other values until you determine r to two decimal places.”

I entered information in Excel spreadsheet and I am trying to see if I am doing it correctly. I have never used Excel.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- Your son just turned 4 years old. You anticipate he will start University when he turns 18. You would like to have funds in a registered education savings plan (RESP) to fund his education at that time. You anticipate he will spend 6 years in university, and it will cost $40,000 per year at the start of each school year. When he graduates (debt free) you would also like him to have $50,000 for a down payment on a condo or to travel. If the account promises to pay a fixed interest rate (APR) of 6% per year with monthly compounding, how much money do you have to deposit each quarter to ensure you will have enough when he starts university? Assume you will make the same deposit at the end of each quarter until he starts university.arrow_forward2. Wally wants to buy a house instead of renting, and has found a bank that is ready to loan him a sizable amount at 5% interest per year. He has identified a house that he would like to live in for 15 years. He thinks that with his carpentry skills he can easily upgrade the house to sell at the end of 15 years for $275,000. Presently, with the economy not doing so well, Wally believes that all he can afford to pay for the house every month-end is the rent that he presently pays his landlady of $750 per month. How much can he expect from the bank if he plans to use the entire amount that he will receive on selling the house after 15 years to make a balloon payment to the bank?arrow_forwardour grandparents just gave you $40,000 for your 21st birthday. You want to set aside some of that money so you can withdraw $1,500 per month for living experises for the 20 months you attend BCIT and still have $7,000 left at the end of the 20 months to pay for a trip after graduation. Your first withdrawal will be 1(1)/(2) years from now when you start BCIT. Assume both the money set aside and the annuity earns 65% compounded quarterly. (a) How much of the $40,000 must you set aside? (b) How much interest will you earnarrow_forward

- You decide to do some remodeling in the kitchen. Your parents agree to lend you the money, but you insist on paying them interest. The agreement is that they will lend you $8000.00 at a simple interest rate of 2% per year. Once the interest amounts to $480, you agree to pay them back the $8000 plus the $480 interest. After how many months will you have to pay them back? Please answer step by steparrow_forwardYou are thinking of buying a house beside the College which you will rent to students. You expect to receive $2,000 a month in rental income. Your real estate agent estimates that you will be able to sell the property for $250,000 at the end of 46 months. You'd like a return of at least 0.2% per month. What is the most that you should pay for the house, assuming that you will purchase the house today and receive the first (beginning of month) rental payment today. What is the most that you should pay for the property today? (Round to the nearest dollar.)arrow_forwardYour parents hope to sell their large home and net $380,000 and then retire to a nice Florida community that is valued at $150,000. After they sell the property, they plan to invest the $230,000 in equity and earn a 4 percent after-tax return. Approximately how much will this nest egg be worth in 5 years when they retire? Round to the nearest cent. DO NOT INCLUDE COMMAS OR $. Type your response Submitarrow_forward

- 6) Susan is looking to purchase her first home five years from today. The house costs $1,550,000. She will have to make a down payment of 10% of this amount and plans to take a loan from the bank for the difference. Bank charges are approximately 15% of the loan amount. She plans to start saving from today to cover both the down payment and the bank charges. a. How much will she need to save to cover both the down payment and bank charges? b. If she currently has $195,000 in her account and will make no further deposits over the next five years, what rate of interest must she earn on this account in order to achieve the savings target calculated in part (a) above?arrow_forwardChristina Sanders is concerned about the financing of a home. She saw a small Cape Cod–style house that sells for $90,000. If she puts 10% down, what will her monthly payment be at (a) 30 years, 5%; (b) 30 years, 512%512% ; (c) 30 years, 6%; and (d) 30 years, 612%612% ? What is the total cost of interest over the cost of the loan for each assumption? (Round your answers to the nearest cent.) can you please help me with all 4 answers? tyarrow_forward2. (a) A college student, Amy, decides to fund a retirement account with $2000 per year for 8 years, with the first deposit made one year from today. The rate of return will be 10%. How much will she have in her account when she retires in 40 years? (b) Amy’s friend, Dacio, decides he will start funding his retirement account 8 years from now (first payment in 9 years). He then will invest $2000 each year for 32 years. If his rate of return is 10%, how much will he have when he retires in 40 years?arrow_forward

- You are saving for the university education of your two children. They are two years apart in age; one will begin university 15 years from today and the other will begin 17 years from today. You estimate your children's university expenses to be $45,000 per year per child, payable at the beginning of each school year. The annual interest rate is 7.5 percent. Your deposits begin one year from today. You will make your last deposit when your older child enters university. Assume four years of university. How much money must you deposit in an account each year to fund your children's education? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Annual savings $arrow_forwardYou are thinking of purchasing a house. The house costs $350,000. You have $50,000 in cash that you can use as a down payment on the house, but you need to borrow the rest of the purchase price. The bank is offering a 30-year mortgage that requires annual payments and has an interest rate of 6% per year. What will be your annual payment if you sign this mortgage?arrow_forwardChristina Sanders is concerned about the financing of a home. She saw a small Cape Cod–style house that sells for $90,000. If she puts 10% down, what will her monthly payment be at (a) 30 years, 5%; (b) 30 years, 512%512% ; (c) 30 years, 6%; and (d) 30 years, 612%612% ? What is the total cost of interest over the cost of the loan for each assumption? (Round your answers to the nearest cent.)arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education