Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

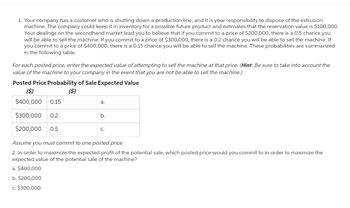

Transcribed Image Text:1. Your company has a customer who is shutting down a production line, and it is your responsibility to dispose of the extrusion

machine. The company could keep it in inventory for a possible future product and estimates that the reservation value is $100,000.

Your dealings on the secondhand market lead you to believe that if you commit to a price of $200,000, there is a 0.5 chance you

will be able to sell the machine. If you commit to a price of $300,000, there is a 0.2 chance you will be able to sell the machine. If

you commit to a price of $400,000, there is a 0.15 chance you will be able to sell the machine. These probabilities are summarized

in the following table.

For each posted price, enter the expected value of attempting to sell the machine at that price. (Hint: Be sure to take into account the

value of the machine to your company in the event that you are not be able to sell the machine.)

Posted Price Probability of Sale Expected Value

($)

($)

$400,000 0.15

$300,000 0.2

$200,000 0.5

a.

a. $400,000

b. $200,000

c. $300,000

b.

C.

Assume you must commit to one posted price.

2. In order to maximize the expected profit of the potential sale, which posted price would you commit to in order to maximize the

expected value of the potential sale of the machine?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Darren Mack owns the Gas n’ Go convenience store and gas station. After hearing a marketing lecture, he realizes that it might be possible to draw more customers to his high-margin convenience store by selling his gas at a lower price. However, the Gas n’ Go is unable to qualify for volume discounts on its gas purchases, and therefore, cannot sell gas for profit if the price is lowered. Each new pump will cost $95,000 to install but will increase customer traffic in the store by 12,000 customers per year. Also, because the Gas n’ Go would be selling its gasoline at no profit, Darren plans on increasing the profit margin on convenience store items incrementally over the next 5 years. Assume a discount rate of 7%. The projected convenience store sales per customer and the projected profit margin for the next 5 years are as follows: Year Projected Convenience Store Sales Per Customer Projected Profit Margin 1 $5.00 20% 2 $6.50 25% 3 $8.00 30% 4…arrow_forwardThe Lamar Company manufactures wiring tools. The company is currently producing well below its full capacity. The Boston Company has approached Lamar with an offer to buy 15,000 tools at $1.80 each. Lamar sells its tools wholesale for $1.90 each; the average cost per unit is $1.88, of which $0.32 is fixed costs. If Lamar were to accept Boston's offer, what would be the increase in Lamar's operating profits? Multiple Choice O O $1,500. $5,100. $1,200. $3,600.arrow_forwardDarren Mack owns the "Gas n' Go" convenience store and gas station. After hearing a marketing lecture, he realizes that it might be possible to draw more customers to his high-margin convenience store by selling his gasoline at a lower price. However, the "Gas n' Go' is unable to qualify for volume discounts on its gasoline purchases, and therefore cannot sell gasoline for profit if the price is lowered. Each new pump will cost $130,000 to install, but will increase customer traffic in the store by 13,000 customers per year. Also, because the "Gas n' Go" would be selling its gasoline at no profit, Darren plans on increasing the profit margin on convenience store items incrementally over the next five years. Assume a discount rate of 8 percent. The projected convenience store sales per customer and the projected profit margin for the next five years are given in the table below. Year Projected Convenience Store Sales Per Customer Projected Profit Margin 1…arrow_forward

- Marigold Corp. is unsure of whether to sell its product assembled or unassembled. The unit cost of the unassembled product is $27 and Marigold would sell it for $60. The cost to assemble the product is estimated at $13 per unit and the company believes the market would support a price of $64 on the assembled unit. What decision should Marigold make and why? Sell before assembly because the company will be better off by $9 per unit. Sell before assembly because the company will be better off by $4 per unit. Process further because the company will be better off by $18 per unit. Process further because the company will be better off by $20 per unit.arrow_forwardPlease don't copy from chegg and show formulasarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education