Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1.

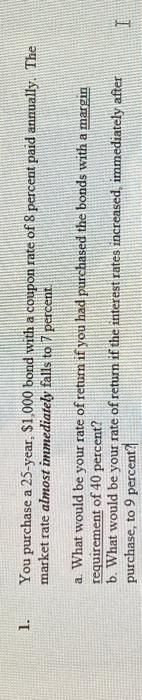

You purchase a 25-year, $1,000 bond with a coupon rate of 8 percent paid annually. The

market rate almost immediately falls to 7 percent.

a. What would be your rate of return if you had purchased the bonds with a margin

requirement of 40 percent?

b. What would be your rate of return if the interest rates increased, immediately after

purchase, to 9 percent?

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that your firm issued a bond with 10 years until maturity, a face value of $1000, and a coupon rate of 7% (annual payments). The yield to maturity on this bond when it was issued was 6%. a) What is the holding period return for investors immediately BEFORE the first coupon payment? Now, Assume that this bond DOES NOT pay any coupon b) What was its price when it was issued?arrow_forwardYou purchased a bond for 1,100. The bond has a coupon rate of 9 percent, which is paid semiannually. It matures in 17 years and has a par value of 1,000. What is your expected rate of return. How can i solve this with a financial calculator?arrow_forwardmukabhaiarrow_forward

- Ay 4.arrow_forwardsuppose you purchase a bond with a coupon of $50 for $1010 you sell it one year later for $900 What rate of return did you earn?arrow_forwardSuppose you purchased a ten-year, 8% coupon bond(annual coupon payment) at $980. Two years later, you decide to take a vacation and sell the bond to acquire the necessary funds. At the time you sell the bond, eight-year bonds with similar characteristics sell for yields of 9%. What is your realized yield on the bond?arrow_forward

- 3. What is the present value of a $20,000 payment you would receive 5 years from now, assuming an annual interest rate of 7%? 4. What is the future value 6 years from now of $15,000 you hold today when the annual interest rate is 4%? 5. What is the current price of a discount bond with a face value of $10,000 and an interest rate of 6%? 1arrow_forwardIf you purchased a bond one year ago for $1000 and just sold it for $1100 after receiving the $50 annual coupon payment, then what was your real return on the investment if theinflation rate was 2.1% for the same year?arrow_forwardYou are considering the purchase of a perpetual bond that pays you $174 per year for the foreseeable future. If you require a 5.85% rate of return on this bond investment, what is a fair price for the bond that you would be willing to pay today? To nearest $0.01arrow_forward

- Suppose you are interested in buying a 1.5% semi-annual coupon treasury bond maturing in exactly 10 years. You think appropriate discount rate for this bond (aka yield to maturity or YTM) is 3%. How much should you pay for this bond if its par value is $1,000?arrow_forward1. What is the yield to maturity on a simple loan for $3 million that requires a repayment of $6 million in three years? 2. What is the yield to maturity of a bond you buy for $900? You are promised to be paid $10 yearly coupon payments forever. The inflation rate is 6% in the economy. 3. What was the rate of return of a $1500 face value coupon bond that had a 6% coupon rate, bought for $1200 and sold for $1100 the next year?arrow_forwardAssume you can buy a bond that has a par value of $1000, matures in 10 years, yielding 6% and has a duration of 5. If you would like to use this bond to form a guaranteed investment contract “GIC” and offer a guaranteed rate of return to investors for certain years. a. what is the maximum yield you can offer? Why? Explain. b. For how many years would you make the guarantee? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education