FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

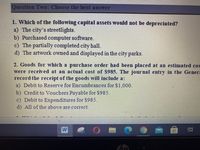

Transcribed Image Text:Question Two: Choose the best answer

1. Which of the following capital assets would not be depreciated?

a) The city's streetlights.

b) Purchased computer software.

c) The partially completed city hall.

d) The artwork owned and displayed in the city parks.

2. Goods for which a purchase order had been placed at an estimated cos

were received at an actual cost of $985. The journal entry in the Gener:

record the receipt of the goods will include a:

a) Debit to Reserve for Encumbrances for $1,000.

b) Credit to Vouchers Payable for $985.

c) Debit to Expenditures for $985.

d) All of the above are correct.

W

直

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rory City traded in a used pickup for a new pickup truck with a sticker price of $44,000. The old pickup had a fair value of $26,000, historical cost of $47,000, and accumulated depreciation of $18,000. The dealer took the old truck and $16,000 for the new truck. The new truck should be reported on the government-wide financial statements at A.) $15,000 B.) $42,000 C.) $44,000 D.) $41,000arrow_forwardConcord Corporation incurs these expenditures in purchasing a truck: cash price $54,000, accident insurance (during use) $3,900, sales taxes $1,800, motor vehicle license $400, and painting and lettering $1,600. What is the cost of the truck? Cost of the truck $arrow_forwardWhat is the cost of the land, based upon the following data? Land purchase price $179,980 Broker's commission 15,546 Payment for the demolition and removal of existing building 3,928 Cash received from the sale of materials salvaged from the demolished building 2,519 $fill in the blank 1arrow_forward

- Indicate whether each of the following expenditures should be classified as land, land improvements, buildings, equipment, or none of these. 1. 2. Parking lots Electricity used by a machine 3. Excavation costs 4. Interest on building construction loan 5. Cost of trial runs for machinery 6. Drainage costs 7. Cost to install a machine 8. Fences 9. Unpaid (past) property taxes assumed 10. Cost of tearing down a building when land and a building on it are purchasedarrow_forwardHallmark Furniture Company refinishes and reupholsters furniture. Hallmark Furniture uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the offer is accepted, a number is assigned to the job, and the costs incurred are recorded in the usual manner on the job cost sheet. After the job is completed, reasons for the variances between the estimated and actual costs are noted on the sheet. The data are then available to management in evaluating the efficiency of operations and in preparing quotes on future jobs. On February 14, 20Y1, an estimate of $3,318 for reupholstering a chair and couch was given to Millard Schmidt. The estimate was based on the following data: Estimated direct materials: 30 meters at $30 per meter $ 900 Estimated direct labor: 28 hours at $30 per hour 840 Estimated factory overhead (75% of direct labor cost) 630 Total estimated…arrow_forwardEquipment that had been acquired several years ago by a special revenue fund at a cost of $40,000 was sold for $15,000 cash. Accumulated depreciation of $30,000 existed at the time of the sale. What would be journal entry that should be made in the special revenue fund (in debit and credit form)?arrow_forward

- Pitney Company purchased an office building, land, and furniture for $728,100 cash. The appraised value of the assets was as follows. $ 138,630 195,713 481,128 $ 815,472 Land Building Furniture Total Required a. Compute the amount to be recorded on the books for each asset. b. Show the purchase in a horizontal statements model. c. Prepare the general journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the amount to be recorded on the books for each asset. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Allocated Cost Land Building Furniture Totalarrow_forwardSeveral expenditures are listed below. Indicate whether or not each expenditure would be included in the cost of acquisition for each item below. The answer box provides two options, Yes (if the expenditure would be included ) or No, (if the expenditure would not be included.) Cost testing materials and labor in testing a purchased machine Yes before use Compensation for injury to No construction worker Cost of overhaul to a used Yes machine purchased before initial use Cost of tearing down a building Yes on newly acquired land Repairs to a new machine Yes damaged while moving it into > > > > >arrow_forwardOwearrow_forward

- Please Solve In 20minsarrow_forwardBased on the following data, determine the cost of the land to be reported on the balance sheet. Land purchase price $177,668 Broker's commission 17,098 Payment for demolition and removal of existing building 5,376 Cash received from sale of materials salvaged from demolished building 1,031arrow_forwardasv.1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education