FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

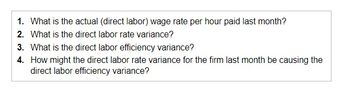

Transcribed Image Text:1. What is the actual (direct labor) wage rate per hour paid last month?

2. What is the direct labor rate variance?

3. What is the direct labor efficiency variance?

4. How might the direct labor rate variance for the firm last month be causing the

direct labor efficiency variance?

Transcribed Image Text:Malbasa Tax Services prepares tax returns for senior citizens. The standard in terms of (direct labor) time spent on each return is 4 hours. The direct labor standard wage rate at the firm is $16.50 per hour. Last month,

3,570 direct labor hours were used to prepare 900 tax returns. Total wages were $66,045.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Trini Company set the following standard costs per unit for its single product Direct materials (30 pounds @ $4.40 per pound) Direct labor (6 hours @ $14 per hour) Variable overhead (6 hours @ $8 per hour) Fixed overhead (6 hours @ $11 per hour) $ 132.00 84.00 48.00 66.00 $ 330.00 Standard cost per unit Overhead is applied using direct labor hours. The standard overhead rate is based on a predicted activity level of 80% of the company's capacity of 50,000 units per quarter. The following additional information is available. Production (in units) Standard direct labor hours (6 DLH per unit) Budgeted overhead (flexible budget) Fixed overhead Variable overhead Operating Levels 70% 80% 90% 35,000 210,000 40,000 240,000 45,000 270,000 $ 2,640,000 $ 1,680,000 $ 2,640,000 $ 2,640,000 $ 1,920,000 $ 2,160,000 During the current quarter, the company operated at 90% of capacity and produced 45,000 units; actual direct labor totaled 266,000 hours. Units produced were assigned the following…arrow_forwardWhich of the following is true of direct labor variances? a. The labor efficiency variance measures the difference between what was paid to direct laborers and what should have been paid. b. The labor rate variance measures the difference between the labor hours that were actually used and the labor hours that should have been used. c. The labor rate variance measures the difference between the labor hours that were originally budgeted and the labor hours that should have been used. d. The labor rate and labor efficiency variances will always add up to the total labor variance. e. The labor rate variance measures the difference between the labor hours that were actually used and the labor hours that were originally budgeted.arrow_forwardHi, How do you calculated variable production cost per unit?arrow_forward

- The direct labor rate variance is calculated by multiplying the standard hours that should have been worked for the actual output by the difference between the standard labor rate and the actual labor rate. O True O Falsearrow_forward1.What is the labor rate variance ( indicate the effect of each variance by selecting "f" for favorable, U for unfavorable, and None for no effect and round your final answer to the nearest whole number) 2. What is the variable overhead efficiency variance ? ( indicate the effect of each variance by selecting "f" for favorable, U for unfavorable, and None for no effect and round your final answer to the nearest whole number) 3. what is the variable overhead rate variance?arrow_forwardWhich of the following describes the behavior of total variable and total fixed costs when level of production increases?arrow_forward

- What is the Total equivalent annual cost?arrow_forwardThe following direct materials and direct labor data pertain to the operations of Sandhill Company for the month of August. Costs Actual labor rate Actual materials price Standard labor rate Standard materials price $13 $120 $12.50 $124 Quantities per hour per ton per hour per ton Actual hours incurred and used Actual quantity of materials purchased and used Standard hours used Standard quantity of materials used 4,900 hours 2,000 tons 4,960 hours 1,990 tonsarrow_forwardProblem 1-14 (AICPA Adapted) Dean Company has a P2,000,000 note payable due June 30. 2021. On December 31, 2020, the entity signed an agreement to borrow up to P2,000,000 to refinance the note payable on a long-term basis. The financing agreement called for borrowing not to exceed 80% of the value of the collateral the entity was providing. On December 31, 2020, the value of the collateral was P1,500,000. On December 31, 2020, what amount of the note payable should be reported as current liability? 2,000,000 1,500,000 800,000 500,000 a. b. с. 000 0600 d. Psoblem 1-15 (AICPA Adanted) Willem Company reported the following liabilities on December 31, 2020: Accounts payable Short-term borrowings Mortgage payable, current portion P100,000 Bank loan payable, due June 30, 2021 750,000 400,000 3,500,000 1,000,000 The P1,000,000 bank loan was refinanced with a 5-year loan on January 15, 2021, with the first principal payment due January 15, 2022. The financial statements were issued February…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education