Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

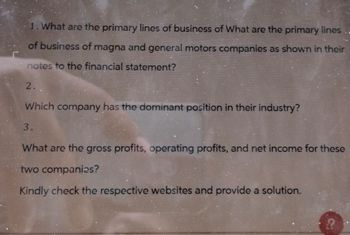

Transcribed Image Text:1. What are the primary lines of business of What are the primary lines

of business of magna and general motors companies as shown in their

notes to the financial statement?

2.

Which company has the dominant position in their industry?

3.

What are the gross profits, operating profits, and net income for these

two companies?

Kindly check the respective websites and provide a solution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Types of Businesses a. Indicate whether each of the following companies are primarily a service, merchandise, or manufacturing business. If you are unfamiliar with the company, use the Internet to locate the company's home page or use the finance Web site of Yahoo. 1. Alcoa Inc. 2. Boeing 3. Caterpillar 4. Citigroup Inc. 5. CVS 6. Delta Air Lines 7. eBay Inc. 8. Fed 9. Ford Motor Company 10. Gap Inc. 11. H&R Block J 12. Hilton Hospitality, Inc. 13. Procter & Gamble 14. SunTrust 15. Wal-Mart Stores. Inc. Check My Work 5 more Check My Work uses remaining. Next >arrow_forwardA concept of accounting that indicates that the financial records of the business should be kept separate from the personal financial records of the business owner is the ________________________. Group of answer choices business entity concept cost concept proprietorship concept asset conceptarrow_forwardDefine Income Statement, Statement of Owners Equity, Balance Sheet, and Cash Flow Statement. How do these impact a business? Which is the most critical, if any, to a new business?arrow_forward

- with the help of the statement of income of the company attached please answer the below: 1: evaluate the companies on the basis of its financial strenght for lending purposes. will you select this company for lending? Why?arrow_forwardUsing the following categories, discuss the differences that exist between accounting for these items in a personal context versus for a business. Specifically provide examples of the difference in account names or terms used to describe the eguivalent item when related to accounting for a business. 1. Assets & LIabilities 2. Net Worth 3. Surplus(deficit)arrow_forwardHere is question The purpose of this assignment is for you to demonstrate your ability to record business transactions and then prepare a properly formatted income statement and balance sheet. The one additional requirement is that you answer the questions that you find below. Questions to be answer 1. What is the company's ending Cash balance? What is the company's ending Equity? Why is cash not equal to equity? 2. What is the company's net income for the period? 3. If you had to repay your creditors today, could you? Explain. 4. The company made a small amount of net income over the month. Explain why the equity actually decreased over the period. 5. You have recorded journal entries for the period of a month. If you were told that the business license in T12 was a annual expense, would this impact the reported net income? Explain why or why not.arrow_forward

- 1. Using the information in appendix 1 only, comment on the financial performance of the business (briefly consider growth, profitability and credit management) II. Explain why non-financial information, such as the type shown in appendix 2, is likely to give a better indication of the likely future success of the business than the financial information given in appendix 1. III. Using the data given in appendix 2, comment on the performance of the business. Include comments on internal business processes, customer knowledge and learning/growth, and provide a concluding comment on the overall performance of the businessarrow_forwardOptions are: General Accounting principle Revenue recongnition principle Full disclosure principle Buisnmess entity assumption Going concern assumptionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education