ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

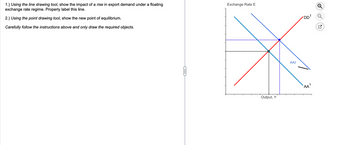

Transcribed Image Text:1.) Using the line drawing tool, show the impact of a rise in export demand under a floating

exchange rate regime. Properly label this line.

2.) Using the point drawing tool, show the new point of equilibrium.

Carefully follow the instructions above and only draw the required objects.

C

Exchange Rate E

Output, Y

AA2

DD¹ Q

AA¹

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Only like if no ai or downvoted for ai content Suppose that the equilibrium exchange rate between the United States and South African is 15.13 Rand per US dollar. Further suppose that the two countries are trading partners with each other. Inflation now rises in South Africa. Which of the following answer choices correctly represents the shift that would occur in the US foreign exchange market? The supply of US dollars would fall. The demand for South African Rands would rise. The supply of South African Rands would rise.arrow_forwardConsider avocado trading between you and nber. Your tree grows 100 this year and 10 next year.Nber's tree grows 20 this year and 50 next year.Let the equilibrium exchange rate be v. Consider a different scanerio: Your tree grows 100 this year and 10 next year.Nber's tree grows 20 this year and 60 next year.Let the equilibrium exchange rate be v'. Then v>v'. Hint: you can use your intuition to figure this out without any calculation. A. TrueB. Falsearrow_forwardAmerika lifts the quota that it applies on the products that it imports from Euro Area and at the same time there is a changing trend in the demand of Americans from EU products to the Japanese products, then how do you thing the following exchange rates will change under the conditions of floating exchange rate system?Sketch graphs a)Dollar/Yen b)Yen/Dollararrow_forward

- Exchange Rate Regime Assume interest parity condition as (see image) Under what circumstances will the domestic interest rate exceed the foreign interest rate?arrow_forwardSuppose that we observe the following change in the international market for USD: a USD B O The CAD woul appreciate. O The CAD woul depreciate. S₁ Q In this case, what wopuld we expect to happen to the price of CAD if the CAD-USD exchange rate was flexible?arrow_forwardPlease provide steps by step answer with proper explanation with final answer....arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education