FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

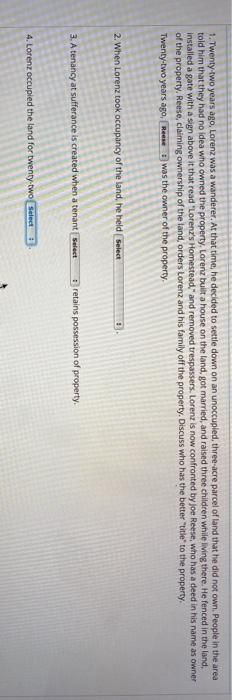

Transcribed Image Text:1. Twenty-two years ago, Lorenz was a wanderer. At that time, he decided to settle down on an unoccupied, three-acre parcel of land that he did not own. People in the area

told him that they had no idea who owned the property, Lorenz built a house on the land, got married, and raised three children while living there. He fenced in the land,

installed a gate with a sign above it that read "Lorenz's Homestead," and removed trespassers. Lorenz is now confronted by joe Reese, who has a deed in his name as owner

of the property, Reese, claiming ownership of the land, orders Lorenz and his family off the property. Discuss who has the better "title" to the property.

Twenty-two years ago, Reese

was the owner of the property.

2. When Lorenz took occupancy of the land, he held Select

3. A tenancy at sufferance is created when a tenant Select

retains possession of property.

4. Lorenz occupied the land for twenty-two select

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- • Aiden and Sophia are married and they have always filed Married Filing Jointly.• Aiden died May 5, 2020 at the age of 58. Sophia, age 56, has not remarried.• Aiden earned $5,000 in wages and Sophia earned $51,000 in wages.• Sophia paid all the cost of keeping up a home and provided all the support for theirtwo children, Mia and Oliver, who lived with them all year.• Mia is 11 years old and Oliver is 15 years old.• Sophia does not have enough deductions to itemize, but she did make a $500 cashcharitable contribution to a qualified charitable organization in tax year 2020.• Aiden, Sophia, Mia, and Oliver are all U.S. citizens with valid Social Securitynumbers. 5. What is most advantageous filing status allowable that Sophia can claim on the taxreturn for tax year 2020?a. Singleb. Head of Householdc. Qualifying Widow(er)d. Married Filing Jointly6. What amount can Sophia deduct as a charitable contribution adjustment?a. $0b. $250c. $300d. $500arrow_forwardDogarrow_forward14. Françoise has just inherited $90,000. In the event of her own death, she would like to leave this money to ensure the financial security of her son Maxime He is 18 years old and recently entered college to study philosophy. Françoise is a self-employed landscaper and snow-removal contractor. She recently had to take out loans to upgrade her equipment. Françoise is not sure whether she should invest her inheritance in a segregated fund with Maxime as the beneficiary or build an equity portfolio with better returns. Her priority is to provide for her son's future. If she were to one day declare bankruptcy, would the two investments Françoise is considering be protected from creditors? Only the segregated fund would be protected. Only the equity portfolio would be protected. O Both investments would be protected. ONeither investment would be protected. Choose 1 optionarrow_forward

- Cora, 79, has an estate that includes her personal residence valued at $120,000 and $18,000 in a bank account that is solely in her name. She would like to arrange her estate so that she maintains exclusive control of the assets during her lifetime, but at her death the assets will pass to her friend, Mabel, outside of probate. Based on Cora's goals and situation, which of the following are correct statements about will substitutes that she could use? She should put her bank account in tenancy in common with Mabel. She should title her personal residence in joint tenancy with her friend, Mabel. She should execute a will that names her friend, Mabel, as the legatee of the bank account and the devisee of the personal residence. She should place the bank funds in a payable on death (POD) account with Mabel as beneficiary. She should change the title on her personal residence to indicate a life estate reserved for her lifetime and a remainder to her friend, Mabel. A)IV and V…arrow_forwardSeveral years ago, Junior acquired a home that he vacationed in part of the time and rented out part of the time. During the current year, Junior: • Personally stayed in the home for 22 days. Rented it to his favorite brother at a discount for 10 days. ● . Rented it to his least-favorite brother for 8 days at the full market rate. • Rented it to his friend at a discounted rate for 4 days. . Rented the home to third parties for 58 days at the market rate. • Did repair and maintenance work on the home for 2 days. • Marketed the property and made it available for rent for 150 days during the year (but did not rent it out). How many days of personal use and how many days of rental use did Junior experience on the property during the year? Answer is complete but not entirely correct. Days of personal use Days of rental use 97 x 80 xarrow_forwardLO.2 Alfred owned a term life insurance policy at the time he was diagnosed with a terminal illness. After paying $18,300 in premiums, he sold the policy to a company that is authorized by the state of South Carolina to purchase such policies. The company paid Alfred $125,000. When Alfred died 18 months later, the company collected the face amount of the policy, $150,000. As a result of the sale of the policy, how much is Alfred required to include in his gross income?arrow_forward

- Glen Campbell owns a small office building adjacent to an airport. He acquired the property 10 years ago at a total cost of $608,000—that is, $70,000 for the land and $538,000 for the building. He has just received an offer from a realty company that wants to purchase the property; however, the property has been a good source of income over the years, and so Campbell is unsure whether he should keep it or sell it. His alternatives are as follows: a. Keep the property. Campbell's accountant has kept careful records of the income realized from the property over the past 10 years. These records indicate the following annual revenues and expenses: Campbell makes a $13,450 mortgage payment each year on the property. The mortgage will be paid off in eight more years. He has been depreciating the building by the straight-line method, assuming a salvage value of $80,700 for the building, which he still thinks is an appropriate figure. He feels sure that the building can be rented for another…arrow_forwardJared and Melissa are married. They have owned their primary residence for 10 years and have lived in it the entire time. They paid $350,000 for the house and land and it is now worth $ 900,000. Due to the property's prime location in Stephenville, the City of Stephenville has decided to "take" the property and turn it into a public park and venue. The City sends Jared and Melissa a letter offering to buy the property for $800,000. Jared and Melissa reject the offer and the case goes to trial where a judge determines the value to be $950,000 and orders the City to pay that amount for the property it claimed using eminent domain. After Jared and Melissa receive the $950,000, they decide not to buy a new house and instead they live in their camper and travel around the country. Do Jared and Melissa have to pay tax on the money they received? Be sure to fully explain your analysis.arrow_forwardAshley Panda lives at 1310 Meadow Lane, Wayne, OH 43466, and her Social Security number is 123-45-6777. Ashley is single and has a 20-year-old son, Bill. His Social Security number is 111-11-1112. Bill lives with Ashley, and she fully supports him. Bill spent 2019 traveling in Europe and was not a college student. He had gross income of $4,655 in 2019. Bill paid $4,000 of lodging expenses that Ashley reimbursed after they were fully documented. Ashley paid the $4,000 to Bill using a check from her sole proprietorship. That amount is not included in the items listed below. Ashley had substantial health problems during 2019, and many of her expenses were not reimbursed by her health insurance. Ashley owns Panda Enterprises, LLC (98-7654321), a data processing service that she reports as a sole proprietorship. Her business is located at 456 Hill Street, Wayne, OH 43466. The business activity code is 514210. Her 2019 Form 1040, Schedule C for Panda Enterprises shows revenues of $315,000,…arrow_forward

- Fifteen years ago Sam, a life insurance agent, sold his good friend Tanya a twenty year term life insurance policy in which she was both the policy holder and the life insured. Tanya designated her best friend Julia as beneficiary. Tanya died, and the insurance company received notice of her death from her executor. Given this scenario, what was the next step in this process? Select onet a. Julia had to contact the insurer to requesta claim form b. Sam contacted the insurer to request the notice of death c. The insurer contacted Sam to help Julia complete the claim form d. The insurer notified Julia so that she could complete the claim formarrow_forwardYour great-uncle Buford just passed on. You didn't even know you had a great-uncle Buford. In his will, he left you the proceeds from the sales of some land. It was just sold for $16,880. Unfortunately, you can't get your hands on the money for another 6 years (Uncle Buford thought you would just blow it all on partying with college friends if you got it now). The executor of Uncle Buford's estate tells you that the proceeds will be invested between now and when you get access to the proceeds in 6 years. If the proceeds are invested at 11.52% annually, how much will you have access to in 6 years? Please respond to the nearest penny.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education