MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

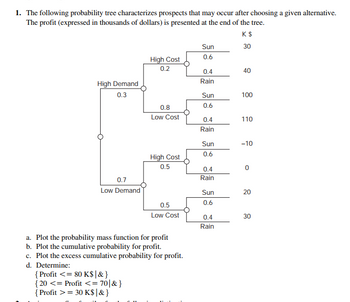

Transcribed Image Text:1. The following probability tree characterizes prospects that may occur after choosing a given alternative.

The profit (expressed in thousands of dollars) is presented at the end of the tree.

K $

30

High Demand

0.3

0.7

Low Demand

High Cost

0.2

{Profit <= 80 K$|& }

{20 <= Profit <= 70|& }

{Profit >= 30 K$|& }

0.8

Low Cost

High Cost

0.5

0.5

Low Cost

a. Plot the probability mass function for profit

b. Plot the cumulative probability for profit.

c. Plot the excess cumulative probability for profit.

d. Determine:

Sun

0.6

0.4

Rain

Sun

0.6

0.4

Rain

Sun

0.6

0.4

Rain

Sun

0.6

0.4

Rain

40

100

110

-10

0

20

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 26 images

Knowledge Booster

Similar questions

- The accompanying data represent the annual rates of return of two companies' stock for the past 12 years. Complete parts (a) through (k). O A. OB. 0.50- 0.50- 0.00- 0.00- -0.50- -0.50- -0.3 RR of Company 2 0.0 0.3 -0.3 0.0 0.3 RR of Company 1 OC. 0.30- 0.50- 0.00- 0.00- -0.30- -0.50- o.0 0'5 0.0 0.3 -0.5 RR of Company 2 0.5 -0.3 RR of Company 1 (b) Determine the correlation coefficient between rate of return of Company 1 and Company 2. The correlation coefficient is 0.966. (Round to three decimal places as needed.) (c) Based on the scatter diagram and correlation coefficient, is there a linear relation between rate of return of Company 1 and Company 2? Yes No (d) Find the least-squares regression line treating the rate of return of Company 1 as the explanatory variable. y=x+O (Round to four decimal places as needed.) RR of Company 1 RR of Company 1 RR of Company 2 RR of Company 2arrow_forward1. ABC inc. stock is currently selling for $30, one year from today the stock price can either increase by 20% or decrease by 15%. The probability of an increase in the stock price is equal to 0.3. The one-year risk-free rate is 5% What is the value of a European put that expires in one year with an exercise price of $24. 2. Graphically, show the value and the profit and loss of the following butterfly position: Long in a call with an exercise price of $30, short in 2 calls with an exercise price of $45, and long in a call with an exercise price of 60. All calls are written on the same stock and have the same maturity. 3. "Early exercise of an American option on a stock that does not pay any dividend is not optimal regardless of whether the option is a Call or a Put". True, False, or Uncertain. Explain.arrow_forwardConsider the following data: Stock M N Average return 26% 16% Risk (Std. Dev.) 20% 10% If the return on stocks M and N are perfectly negatively correlated, what is the range of risk (std dev) associated with all possible portfolio combinations? A. Range of the risk: between 0= risk s10 % OB. Range of the risk: between 0 < risk 10% OC. Range of the risk: between 5% and 10%. OD. Range of the risk (std. dev): between 15% to 20% OE. None of the abovearrow_forward

- The lowest portfolio risk will result when the asset returns are perfectly positively correlated. Select one: True Falsearrow_forwardWhat is the probability that the total of two randomly chosen numbers exceeds 3, where the first number is chosen from a uniform distribution between 0 and 2, and the second number is selected from an exponential distribution with a mean of 1?arrow_forwardRecall that Benford's Law claims that numbers chosen from very large data files tend to have "1" as the first nonzero digit disproportionately often. In fact, research has shown that if you randomly draw a number from a very large data file, the probability of getting a number with "1" as the leading digit is about 0.301. Now suppose you are the auditor for a very large corporation. The revenue file contains millions of numbers in a large computer data bank. You draw a random sample of n = 226 numbers from this file and r = 87 have a first nonzero digit of 1. Let p represent the population proportion of all numbers in the computer file that have a leading digit of 1. 1) Test the claim that p is more than 0.301. Use α = 0.10. 2) What is the value of the sample test statistic? (Round your answer to two decimal places.) 3) Find the P-value of the test statistic. (Round your answer to four decimal places.) 4) If p is in fact larger than 0.301, it would seem there are too many numbers in…arrow_forward

- The useful life of Johnson rods for use in a particular vehicle follows an exponential distribution with an average useful life of 5.2 years.You have a three-year warranty on your vehicle’s Johnson rod. What is the probability that the Johnson rod doesn’t fail before then? That is, what is the probability that its useful life doesn’t end before three years?b.If the vehicle manufacturer wants to limit the number of claims on the three-year warranty to 20%, what should the average useful life of the Johnson rod be?arrow_forward(first part of question is attached) (e) What is the probability that the sample proportion of students of adults living with parents or other relatives is higher than 0.3? (f) What is the probability that the sample proportion of adults living alone is between 0.1 and 0.15?arrow_forwardBenford's Law claims that numbers chosen from very large data files tend to have "1" as the first nonzero digit disproportionately often. In fact, research has shown that if you randomly draw a number from a very large data file, the probability of getting a number with "1" as the leading digit is about 0.301. Suppose you are an auditor for a very large corporation. The revenue report involves millions of numbers in a large computer file. Let us say you took a random sample of n = 250 numerical entries from the file and r = 60 of the entries had a first nonzero digit of 1. Let p represent the population proportion of all numbers in the corporate file that have a first nonzero digit of 1. Test the claim that p is less than 0.301 by using α = 0.01. What does the area of the sampling distribution corresponding to your P-value look like? a. The area in the right tail of the standard normal curve. b. The area not including the right tail of the standard normal curve.…arrow_forward

- Please solve (b) only!arrow_forwardQuestion 15 The percent of fat calories that a person in America consumes each day is normally distributed with a mean of about 36 and a standard deviation of 10, Suppose that one individual is randomly chosen. Let X percent of fat calories. FEB 7. sC 80 000 000 F1 F2 F3 F4 F5 F6 ! @ % 1 2 3 4 5 6 %24arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman