FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

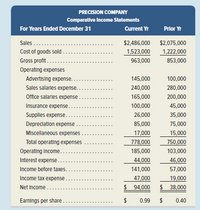

Use the following financial statements of Precision Co. to complete these requirements.

Transcribed Image Text:1. Prepare comparative income statements showing the percent increase or decrease for the current year

in comparison to the prior year.

2. Prepare common-size comparative balance sheets for both years.

3. Compute the following ratios for the current year and identify each one's building block category for

financial statement analysis.

a. Current ratio

g. Debt-to-equity ratio

h. Times interest earned

i. Profit margin ratio

j. Total asset turnover

k. Return on total assets

I. Return on common stockholders' equity

b. Acid-test ratio

Accpunts receivable turnover

d. Days' sales uncollected

e. Inventory turnover

c.

f. Debt ratio

Transcribed Image Text:PRECISION COMPANY

Comparative Income Statements

For Years Ended December 31

Current Yr

Prlor Yr

Sales .....

$2,486,000

$2,075,000

Cost of goods sold ...

Gross profit....

1,523,000

1,222,000

963,000

853,000

Operating expenses

Advertising expense..

Sales salarles expense..

145,000

100,000

240,000

280,000

Office salarles expense.

165,000

200,000

Insurance expense.

100,000

45,000

Supplles expense..

26,000

35,000

Depreciation expense

85,000

75,000

Miscellaneous expenses

17,000

15,000

Total operating expenses

778,000

750,000

Operating Income..

185,000

103,000

Interest expense..

Income before taxes...

Income tax expense .

Net Income .....

44,000

46,000

141,000

57,000

47,000

19,000

$ 38,000

$ 94,000

Earnings per share....

2$

$

0.99

0.40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following best describes what we mean when we refer to the quality of financial statements? O A. Showing only revenue from product sells. B. Presenting all relevant information in a fair and complete manner. O C. Listing all assets in alphabetical order. OD. All of the above.arrow_forwardPlease analyze, assess, and synthesize the Annual Report or Form 10-K or Form 20 - F (whatever they call it in that jurisdiction) of the company you choose. You can usually find it on the Company's website in Investor R. Introduction 2. Industry situation and company plans A. Management Letter B. B. Review Company's Products and Services 3. Financial Statements A. Income Statement B. Cash Flow Statement C. Balance Sheet D. Accounting Policies 4. Financial Analysis & Ratio A. Financial Analysis B. Ratio C. Market Indicator Financial Ratios 5. References 6. Complete Calcuation of Part 4 in excelLimiarrow_forwardProviding information to external users for decision making is the purpose of which of the following?A) Management reportsB) Tax formsC) Financial statementsD) Inventory reports Group of answer choices A B C Darrow_forward

- Describe the basic financial statements , their purpose and their importance to various internal and external users. Clearly discuss which users are most interested in which financial statement and why.arrow_forwardWhat are the major components of a company's financial statements and what information does each component provide?arrow_forwardWhich of the following is the most useful in analyzing companies of different sizes? a.comparative statements b.common-sized financial statements c.price-level accounting d.audit reportarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education