Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

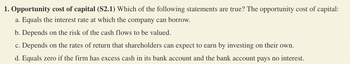

Transcribed Image Text:1. Opportunity cost of capital (S2.1) Which of the following statements are true? The opportunity cost of capital:

a. Equals the interest rate at which the company can borrow.

b. Depends on the risk of the cash flows to be valued.

c. Depends on the rates of return that shareholders can expect to earn by investing on their own.

d. Equals zero if the firm has excess cash in its bank account and the bank account pays no interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- When a profitable business has no mandated loan capital but there are non-mandated liabilities a. the return on equity always exceeds the return on total capitalb. the return on equity always equals the return on total capitalc. the return on equity may be equal to the return on total capitald. the return on equity always lags behind the return on total capitalarrow_forwardConsider the following statement: "The estimation of the Free Cash Flow to the Firm (FCF) considers investment decisions but ignores financing decisions." Is this statement true or false? Explain your answer.arrow_forwardMf1.arrow_forward

- Question A Explain how a company can report a positive net income and yet still have a negative net operating cash flow. Question B What is the marrow_forwardwith the help of the statement of income attached please answer the below: explain the trend in the net borrowing (proceeds from borrowing less payments of short- and long-term debt) of the firm? explain the trend in working capital accounts? Critically evaluate the financial strength of each of the companie based on the evidence presented in the Statement of Cash Flow.arrow_forwardWhat are some tools that companies have to manage their (net operating) working capital? Provide examples of inventory and receivables management techniques. What is the Cash Conversion Cycle and why is this a useful metric? Are there risks if this is too low?arrow_forward

- Which of the following statements is FALSE?i. Using the payback rule, you can calculate how much profits are earned over the investment period.ii. The IRR is sensitive to the timing of the cash flows.iii. Shareholders have the first claim on the cash flows of the company.arrow_forwardWhich of these is a main characteristic of debt capital?(a) Investors in debt participate in the ownership of the firm.(b) Investors in debt are paid interest.(c) Debt is more risky for the investor and less risky for the firm.(d) If dividends are not paid, this can lead to foreclosure, legal proceeding and financial distress.arrow_forwardAll the statements are incorrect regarding current ratio except? a. The more predictable a firm's cash flows, the higher the acceptable current ratio. b. A higher current ratio indicates a higher return on equity. c. The more predictable a firm's current ratio, the higher the clyrent liabilities. d. A higher current ratio indicates a greater degree of liquidity.arrow_forward

- Can a firm have income without also having a positive cash flow? Explain.arrow_forwardWhen a profitable business has no mandated loan capital but there are non-mandated liabilities a. the return on equity always exceeds the return on total capitalb. the return on equity always equals the return on total capitalc. the return on equity may be equal to the return on total capitald. the return on equity always lags behind the return on total capital choose onearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education