FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

N1

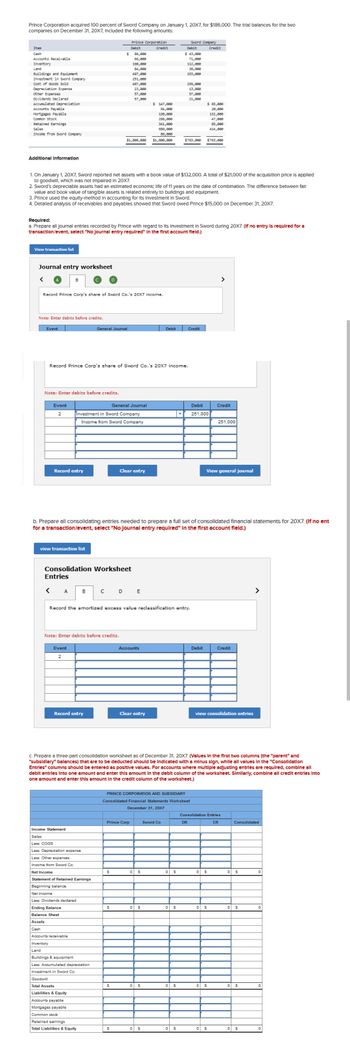

Transcribed Image Text:Prince Corporation acquired 100 percent of Sword Company on January 1, 20X7, for $186,000. The trial balances for the two

companies on December 31, 20X7, Included the following amounts:

Item

Cash

Accounts Receivable

Inventory

Land

Buildings and Equipment

Investment in Sword Company

Cost of Goods Sold

Depreciation Expense

other Expenses

Dividends Declared

Accumulated Depreciation

Accounts Payable

Mortgages Payable

Common stock

Retained Earnings

Sales

Income from Sword Company

Additional Information

View transaction list

1. On January 1, 20X7, Sword reported net assets with a book value of $132,000. A total of $21,000 of the acquisition price is applied

to goodwill, which was not Impaired In 20X7.

Journal entry worksheet

2. Sword's depreciable assets had an estimated economic life of 11 years on the date of combination. The difference between fair

value and book value of tangible assets is related entirely to buildings and equipment.

3. Prince used the equity-method in accounting for its Investment In Sword.

4. Detailed analysis of receivables and payables showed that Sword owed Prince $15,000 on December 31, 20X7.

Required:

a. Prepare all journal entries recorded by Prince with regard to Its Investment in Sword during 20X7. (If no entry is required for a

transaction/event, select "No Journal entry required" In the first account field.)

Record Prince Corp's share of Sword Co.'s 20X7 income.

Note: Enter debits before credits.

Event

B

Event

2

Note: Enter debits before credits.

Record entry

Prince Corporation

Debit

Credit

$ 86,000

66,000

190,000

190,000

112,000

84,000

38,000

497,000

153,000

251,000

497,000

255,000

23,000

13,000

IN

57,088

57,888

57,000

21,000

$ 147,000

64,000

198,000

286,000

341,000

686,000

86,000

$1,800,000 $1,806,000

Record Prince Corp's share of Sword Co.'s 20X7 income.

view transaction list

< A

Investment in Sword Company

Income from Sword Company

Event

2

General Journal

B

Consolidation Worksheet

Entries

Record entry

с

Income Statement

Sales

Less: COGS

Less: Depreciation expense

Less: Other expenses

Income from Sword Co.

Net Income

Statement of Retained Earnings

Beginning balance

Net income

Less: Dividends declared

Note: Enter debits before credits.

Ending Balance

Balance Sheet

Assets

Cash

Accounts receivable

Inventory

Land

Buildings & equipment

Less: Accumulated depreciation

Investment in Sword Co.

Goodwill

Total Assets

Liabilities & Equity

Accounts payable

Mortgages payable

Common stock

Retained earnings

Total Liabilities & Equity

General Journal

b. Prepare all consolidating entries needed to prepare a full set of consolidated financial statements for 20X7. (If no ent

for a transaction/event, select "No Journal entry required" in the first account field.)

Clear entry

Record the amortized excess value reclassification entry.

S

D E

S

$

S

Accounts

Prince Corp

Clear entry

PRINCE CORPORATION AND SUBSIDIARY

Consolidated Financial Statements Worksheet

December 31, 20X7

Debit

0 $

Sword Company

Debit

Credit

$ 43,000

0 S

0 $

0 $

Sword Co

71,000

132,000

47,000

85,000

414,000

$763,000 $763,000

c. Prepare a three-part consolidation worksheet as of December 31, 20X7. (Values in the first two columns (the "parent" and

"subsidiary" balances) that are to be deducted should be Indicated with a minus sign, while all values in the "Consolidation

Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all

debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into

one amount and enter this amount in the credit column of the worksheet.)

0 S

0 S

0 $

Credit

0 S

$ 65,000

20,000

DR

Debit

251,000

Debit

View general journal

0 S

0

>

Credit

view consolidation entries

Consolidation Entries

CR

251,000

S

0 S

0 S

Credit

Consolidated

0 S

0 S

>

0 $

0 S

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Req1-Req2 were incorrect. Can you try the problem again ?arrow_forwardsolve it using this method: S2 = (((1+S1)*(1+F2))1/2 )– 1 S3 = ((1+S1)*(1+F3)) 1/3 - 1 P = 50/(1+S1)+50 / (1+S2) 2 + 1050 / (1+S3) 3 and find the value of parrow_forwardG and H are mutually exclusive events. P (G) = 0.5 P (H) = 0.3 P( H | G) = 0.6 Find P (H OR G) Are G and H independent or dependent events? why?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education