FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I humble request answer fast please

Transcribed Image Text:-dl

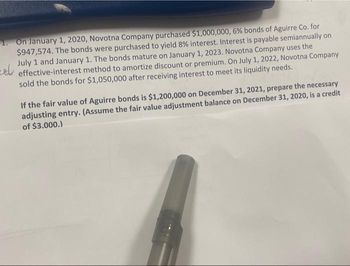

1. On January 1, 2020, Novotna Company purchased $1,000,000, 6 % bonds of Aguirre Co. for

$947,574. The bonds were purchased to yield 8% interest. Interest is payable semiannually on

July 1 and January 1. The bonds mature on January 1, 2023. Novotna Company uses the

effective-interest method to amortize discount or premium. On July 1, 2022, Novotna Company

sold the bonds for $1,050,000 after receiving interest to meet its liquidity needs.

If the fair value of Aguirre bonds is $1,200,000 on December 31, 2021, prepare the necessary

adjusting entry. (Assume the fair value adjustment balance on December 31, 2020, is a credit

of $3.000.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need answer typing clear urjent no chatgpt used i will give upvotes full explanation plzarrow_forwardo Mail O Launc - Proble O Cours O Quest C Get H Bb Join L O Cisco Onel X - ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activi.. O Microsoft Office Ho.. E My Shelf | Brytewav. 国Rea >> 0 Mail - Soares, Marc. 6 Massbay Nav OneLogin D ADP ail O YouTube 6 MassBay Curriculum Saved Help Save & Exit Submit - quick study Check my work QS 1-10 Identifying effects of transactions using accounting equation-Revenues and Expenses LO P1 The following transactions were completed by the company. a. The company completed consulting work for a client and immediately collected $7,000 cash earned. b. The company completed commission work for a client and sent a bill for $5,500 to be received within 30 days. c. The company paid an assistant $2,150 cash as wages for the period. d. The company collected $2,750 cash as a partial payment for the amount owed by the client in transaction b. e. The company paid $1,000 cash for…arrow_forwardJasmine Thompson AutoSave Document4 Word O Search B Share Comment File Insert Draw Design Layout References Mailings Review View Help Home O Find X Cut Calibri (Body) A A Aa A EE v E EE T AaBbCcDd AaBbCcDd AaBbC AABBCCC AaB AaBbCcD AaBbCcDd AaBbCcDd v 12 S Replace Dictate Editor Copy Paste Emphasis BIU ab x, x' A ~ A EEEE E - 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em... A Select V Format Painter Styles Editing Voice Editor Clipboard Font Paragraph 3 4 5. 6. 1 2. In Year 2, Chalon Company records the payment of $450 cash for an expense accrued in Year 1 and records the accrual of $425 for another expense. Additionally, Chalon Company pays $475 for supplies that were purchased in Year 1 on account. The impact of these three entries on Year 2 total expenses and total liabilities is: Total Expenses Liabilities a. increase by $425 decrease by $500 b. increase by $450 decrease by $25 c. increase by $425 increase by $25 d. increase by $900 decrease by $500 e. increase…arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardNot a previously submitted question. Thank youarrow_forwardanswer ed is coming back incorrect please helparrow_forward

- I need answer typing clear urjent no chatgpt used i will give upvotesarrow_forwardNot a previously submitted question. Thank youarrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education