FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

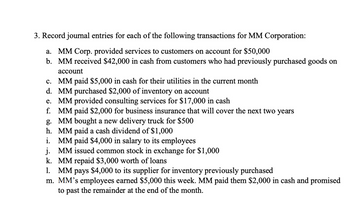

Transcribed Image Text:3. Record journal entries for each of the following transactions for MM Corporation:

a. MM Corp. provided services to customers on account for $50,000

b. MM received $42,000 in cash from customers who had previously purchased goods on

account

c. MM paid $5,000 in cash for their utilities in the current month

d. MM purchased $2,000 of inventory on account

e. MM provided consulting services for $17,000 in cash

f. MM paid $2,000 for business insurance that will cover the next two years

g. MM bought a new delivery truck for $500

h.

MM paid a cash dividend of $1,000

i. MM paid $4,000 in salary to its employees

j.

MM issued common stock in exchange for $1,000

k. MM repaid $3,000 worth of loans

1. MM pays $4,000 to its supplier for inventory previously purchased

m. MM's employees earned $5,000 this week. MM paid them $2,000 in cash and promised

to past the remainder at the end of the month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Monty Corporation shipped $20,600 of merchandise on consignment to Gooch Company. Monty paid freight costs of $1,800. Gooch Company paid $550 for local advertising, which is reimbursable from Monty. By year-end, 63% of the merchandise had been sold for $21,500. Gooch notified Monty, retained a 10% commission, and remitted the cash due to Monty.Prepare Monty’s journal entry when the cash is received. (Round answers to 0 decimal places, e.g. 1,525. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.)arrow_forwardHalifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2024 with a refund liability of $420,000. During 2024, Halifax sold merchandise on account for $12,700,000. Halifax's merchandise costs are 60% of merchandise selling price. Also during the year, customers returned $619,000 in sales for credit, with $342,000 of those being returns of merchandise sold prior to 2024, and the rest being merchandise sold during 2024. Sales returns, estimated to be 5% of sales, are recorded as an adjusting entry at the end of the yeararrow_forwardPlease provide working also i post this 3rd timearrow_forward

- ded Carnegie Corp. commissions, produces, and sells books through faith-based nonprofit organizations. The books are sold on the basis that a maximum of 50% of the quantity purchased can be returned within six months. The contract with the customer outlines the amount of consideration and the return policy and that payment is due within 30 days of the end of the return period. Carnegie has a good historical record of the proportion of books returned, on average. On 1 June, Carnegie sold $86,000 worth of books. On 15 August, $8,600 were returned, and on 3 October, an additional $17,200 were returned. The payment for the balance owing was received on 20 December. The cost of the books is 55% of the selling price. All of the returns are put back into inventory and can be resold. Required: 1. This part of the question is not part of your Connect assignment. 2. Prepare the appropriate journal entries that are required for the described transactions. (If no entry is required for a…arrow_forwardCabanes Factors provides financing to other companies by purchasing their accounts receivable on a non-recourse basis. Cabanes charges a commission to its clients of 15% of all receivables factored. In addition, Cabanes withholds 10% of receivables factored for protection against sales returns or adjustments. Cabanes credits the 10% withheld to Client Retainer and makes payments to clients at the end of each month so that the balance in the retainer is equal to 10% of unpaid receivables at the end of the month. Cabanes recognizes its 15% commissions as revenue at the time the receivables are factored. Also, experience has led Cabanes to establish allowance for bad debts of 4% of all receivables purchased. On January 2, 2021, Cabanes purchased receivables from Cabana Company totaling P3,000,000. Cabana has previously established an allowance for bad debts for these…arrow_forward11. The sales clerks of Teresa's Treasures are paid a salary of $225 per week plus a commission of 8% on all sales they make. Find the amount of commission and gross earnings for these employees. (Round your answers to 2 decimal places. Omit the "$" sign in your response.) Sales for the Week Name Commission Gross Earnings Tina Valendez $2,392.50 $4 Jan Yarrow $3,480.75 2$ $4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education