Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

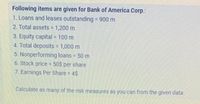

Transcribed Image Text:Following items are given for Bank of America Corp.:

1. Loans and leases outstanding 900 m

2. Total assets 1,200 m

3. Equity capital = 100 m

4. Total deposits 1,000 m

5. Nonperforming loans 50 m

%3D

6. Stock price 50$ per share

7. Earnings Per Share 4$

Calculate as many of the risk measures as you can from the given data.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose you came up with the following calculations; Assume your utlity function is represented by U E(Rp) 1/2A\sigma_p^2 where your risk aversion parameter A = 25. What is the weight that you must invest in Stock C in order to create your Optimal Portfolio? Present result in decimals, for example, 0.78, not 78 %. Round to 4 decimals. Your Answer: Answerarrow_forwardSuppose you have the follow information about Intrinsic Co. and the market. What is the Beta of Intrinsic Co.? Probability 0.48 0.35 0.17 a) 1.39 Ob) 1.13 c) 1.00 d) 1.26 Intrinsic Co. Returns 15.4% 17.9% 21.5% Market Returns 9.1% 10.8% 13.5%arrow_forwardWhat is the beta of a portfolio comprised of the following securities? Stock Amount Invested Security Beta- 0.86 1.76 1.35 A B C $3600 $ 2800 $ 9000 Beta of portfolio to 2 decimal places is Numeric Responsearrow_forward

- Kindly explain all steps please, concept plsss stepwise.arrow_forward2. Assuming the following: Average Return (Risky Portfolio) 3.86% Standard Dev (Risky Portfolio) 10.56% Average Risk Free Rate 2.18% Return on Risk Free Asset Avg 4.15% Using the formula: E(rc)=rf + y* (E(rp) - rf) Solve for: 1. % of Risky Assets (y): 2. % of Risk Free Assets (1-y): Note: You wish to generate a 7% return for your complete portfolio E(rc)arrow_forward30. Gamma: Look at the following chart. Based only on this information, which underlying equity is the riskiest? UNDERLYI NG: A B C D DELT GAMM A: .51 .54 .50 .54 A: .09 .10 .12 .08arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education