FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

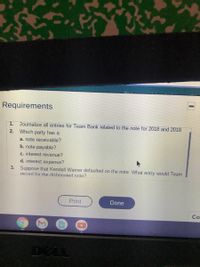

Transcribed Image Text:Requirements

1.

Journalize all entries for Team Bank related to the note for 2018 and 2019.

2. Which party has a

a. note receivable?

b. note payable?

c. interest revenue?

d. interest expense?

3. Suppose that Kendall Warner defaulted on the note. What entry would Team

record for the dishonored note?

Print

Done

Co

DELL

Transcribed Image Text:On September 30, 2018, Team Bank loaned $94,000 to Kendall Warner on a one-year, 6% note. Team's fiscal year ends on December 31.

Read the requirements.

Requirement 1. Journalize all entries for Team Bank related to the note for 2018 and 2019. (Record debits first, then credits. Select the explanation on the last line of the joumal

entry table.)

Begin by recording the loan on September 30, 2018.

Date

Accounts and Explanation

Debit

Credit

2018

Sep. 30

Course Chat

Time

GB V

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you please show your work on how you came up with the balance per bank and the balance per book on the reconciliation statement? Branson Co. received its bank statement for the month ending May 31, 2019, and reconciled the statement balance to the May 31, 2019, balance in the Cash account. The reconciled balance was determined to be $36,400. The reconciliation recognized the following items: A deposit made on May 31 for $22,700 was included in the Cash account balance but not in the bank statement balance. Checks issued but not returned with the bank statement were No. 673 for $4,550 and No. 687 for $9,700. Bank service charges shown as a deduction on the bank statement were $110. Interest credited to Branson Co.'s account but not recorded on the company's books amounted to $88. Returned with the bank statement was a "debit memo" stating that a customer's check for $3,240 that had been deposited on May 23 had been returned because the customer's account was overdrawn. During a…arrow_forwardHi, How do I organize these transactions ? Thanksarrow_forwardWhich option below correctly indicates how an unfavourable balance of the bank account in the general ledger at 31 May 2021 should be dealt with when doing a bank reconciliation? Select one: a. By debiting the bank reconciliation statement as at 31 May 2021 b. By crediting the bank statement for May 2021 c. By crediting the bank reconciliation statement as at 31 May 2021 d. By debiting the bank statement for Please don't provide solution image based thnkuarrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education