FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

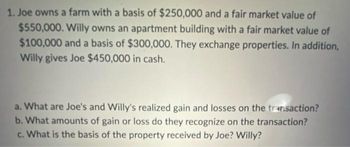

Transcribed Image Text:1. Joe owns a farm with a basis of $250,000 and a fair market value of

$550,000. Willy owns an apartment building with a fair market value of

$100,000 and a basis of $300,000. They exchange properties. In addition,

Willy gives Joe $450,000 in cash.

a. What are Joe's and Willy's realized gain and losses on the transaction?

b. What amounts of gain or loss do they recognize on the transaction?

c. What is the basis of the property received by Joe? Willy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Explanationarrow_forwardJennifer transferred land with an adjusted basis of $15,000 and a fair market value of $25,000 to ABC Corporation in return for all of its stock. Jennifer also received a $1,000 short-term note (boot). Please calculate the following for Jennifer. You must show your all of your work. 1) Her realized gain 2) Her recognized gain 3) Her basis in the stock 4) Her basis in the notearrow_forwardWhich of the following taxpayers would be most likely to benefit from an installment sale? (a) Allan. He sold a business-use car at a net gain that was less than the amount of depreciation claimed. (b) Kayla. She sold business-use land for a gain. (c) Marie. She sold property she had held in inventory in her business at a net gain. (d) Robert. He sold a fishing boat at a net loss.arrow_forward

- Charles exchanged land used in his business plus 26,000 in cash for like-kind real estate. Charles had an adjustment basis in the land of 27,000 and its fair value was 32,000 at the date of exchange. the new property that Charles received had a fair value of 58,000. What is Charles's recognized gain on this exchange and his tax basis of the new property he received?arrow_forwardNiels died with a receivable collectible from Ernest Rutherford. Ernest Rutherford has assets amounting to P400,000, and liabilities amounting to P1,000,000, and included among Ernest's liabilities is an obligation on unpaid taxes payable to the government amounting to P100,000. Neils also mortgaged his property to the bank in consideration for a loan worth P1,000,000. The property is worth P1,500,000. P300,000 of the loan was paid by Niels before her death. In relation to the mortgage, how much may be claimed as a deduction? P700,000 P1,000,000 P1,200,000 P1,500,000arrow_forwardBrenda Baines sells land to Carla Chandler for $15,000 cash and a piece of equipment with an adjusted basis of 43. $15,000 and a fair market value of $20,000. The land was subject to a $25,000 mortgage which Carla assumed. Brenda incurred $2,500 in selling expenses. What is the amount realized by Brenda? a. $55,000 b. $60,000 c. $52,500 d. $57,500arrow_forward

- Question: Sam wants to purchase land owned by Kiara for use in his trade or business. Kiara's basis in the land is $350,000, and Sam has offered to pay $980,000 if she will sell within the next ten days. Kiara is interested in selling but wants to avoid gain recognition on the sale. Is there any way that Kiara could sell to Sam and still avoid gain recognition? Give Short Explanation of Capital Gains and 1031 exchange.arrow_forwardWhich of the following is true with respect to the related party rules? a.A disallowed loss on a related party transaction can be used to offset any future gain when the property is sold to an unrelated party. b.Bill sells stock to his sister for a $3,000 loss. Bill can deduct the loss on his tax return. c.A taxpayer's uncle is a related party for purposes of Section 267. d.Under the constructive ownership rules of Section 267, a shareholder owns 10 percent of the stock owned by a corporation in which he or she is a shareholder. e.None of these choices are correct.arrow_forwardLO.5Miller owns a personal residence with a fair market value of $195,000 and an outstanding first mortgage of $157,500, which was used entirely to acquire the residence. This year, Miller gets a home equity loan of $10,000 to purchase a new fishing boat. How much of this mortgage debt is treated as qualified residence indebtedness?arrow_forward

- Rafael sold an asset to Jamal. What is Rafael's amount realized on the sale in each of the following alternative scenarios? c. Rafael received $20,000 cash, a parcel of land worth $50,000, and marketable securities of $10,000. Rafael also paid a commission of $8,000 on the transaction.arrow_forwardJane doe and lisa maria entered into a qualified exchange of like-kind property. 1. what is the gain realized by Jane on the exchange?arrow_forwardLO.5Miller owns a personal residence with a fair market value of $195,000 and an outstanding first mortgage of $157,500, which was used entirely to acquire the residence. This year, Miller gets a home equity loan of $10,000 to purchase a new fishing boat. How much of this mortgage debt is treated as qualified residence indebtedness?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education