FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

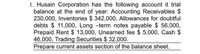

Transcribed Image Text:1. Husain Corporation has the following account it trial

balance at the end of year: Accounting Receivables $

230,000, Inventories $ 342,000, Allowances for doubtful

debts $ 11,000, Long -term notes payable $ 56,000,

Prepaid Rent $ 13,000, Unearned fee $ 5,000, Cash $

46,000, Trading Securities $ 32,000.

Prepare current assets section of the balance sheet.

Transcribed Image Text:2. Rasheed Company uses net method to record the

sales made on credit. On June 30, 2019, it made sales

of $25,000 with term 3/15, n/45.

Prepare the required journal entries, if: On July 22

Rasheed company received full payment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- This is the financial position of Hospital AMIH, Inc. regarding the repayment of its debts. These are the most relevant data of its financial statements: Total revenues $ 245,000 Total expenses $ 145,000 Depreciation $ 10,000 Changes in receivable accounts +$ 50,000 Changes in inventory ($ 20,000) Changes in accounts payable ($ 25,000) Total current liabilities $ 30,000 Total long-term debt $ 45,000 cash flow (total margin + depreciation expense) + interest expense/principal payment + interest expense Calculate the operating cash flow.arrow_forwardConsider the following financial data for Larry’s Computer Stores: Statement of Financial Position as of December 31, 2012 Cash & equivalents $ 94,500 Accounts payable $ 122,500 Receivables 202,500 Short-term bank note 162,500 Inventories 364,000 Accrued wages and taxes 110,500 Total current assets $ 661,000 Total short-term liab. $ 395,500 Long-term debt 418,000 Net fixed assets 468,500 Common equity 316,000 Total assets $ 1,129,500 Total liabilities & equity $ 1,129,500 Statement of Earnings for the Year Ended December 31, 2012 Sales revenue $ 450,000 Cost of merchandise sold 250,000 Gross profit $ 200,000 Operating expenses 97,500 Earnings before interest and taxes (EBIT) $ 102,500 Interest expense 46,500 Earnings before taxes (EBT) $ 56,000 Federal and state income taxes (45 percent) 25,200 Net earnings $ 30,800…arrow_forwardPlease help mearrow_forward

- The companys balance sheet showed an accounts receivble balance of $80,000 at the begininng of the year and $47,000 at the end of the year. The company reported $720,000 in credit sales for the year. What was the amount of cash collected on account receivables durig the yeararrow_forwardThe balance sheet of RS Corp. as at December 31, 1979 contained the following current assets: Cash 96, 578 Accounts receivable 452,800 Inventories 376,300 925,678 An examination of the accounts disclosed that the accounts receivable consisted of the following items: Trade customers’ accounts 357,742 Due from employees – current 43,658 Equity in 50,000 of uncollected accounts receivable assigned under guaranty 16,000 Selling price of merchandise on consignment at 140% of cost and not sold 50,400 Allowance for doubtful accounts…arrow_forwardThe following information relates to a company’s accounts receivable: accounts receivable balance at the beginning of the year, $360,000: allowance for uncollectible accounts at the beginning, $30,000, credit sales during the year, $1,800,000; accounts receivable written off during the year $19,200; cash collections from customers; $1,740,000. the company estimates that the required year-end balance in the allowance for uncollectible accounts should be $40,080. What is the year-end gross and net accounts receivable balance?arrow_forward

- Record the Year 1 transactions in general journal form.arrow_forwardSherwood, Inc., had the following current assets and current liabilities at the end of two recent years: Year 2(in millions) Year 1(in millions) Cash and cash equivalents $4,165 $4,528 Short-term investments, at cost 2,958 8,408 Accounts and notes receivable, net 9,404 8,624 Inventories 1,771 787 Prepaid expenses and other current assets 590 291 Short-term obligations (liabilities) 315 3,342 Accounts payable and other current liabilities 7,453 6,813 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Year 2 Year 1 Current ratio fill in the blank 1 fill in the blank 2 Quick ratio fill in the blank 3 fill in the blank 4arrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: Beginning balances: Inventory $200,000 Accounts receivable 300,000 Ending balances: Inventory 250,000 Accounts receivable 400,000 Cash 100,000 Marketable securities (short-term) 200,000 Prepaid expenses 50,000 Accounts payable 175,000 Taxes payable 85,000 Wages payable 90,000 Short-term loans payable 50,000 During the year, Arnn had net sales of $2.45 million. The cost of goods sold was $1.3 million. Required: When required, round your answers to two decimal places. Assume 365 days per year. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. times 4. Compute the accounts receivable turnover in days. days 5. Compute the inventory turnover ratio. times 6. Compute the inventory turnover in days. daysarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education