FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

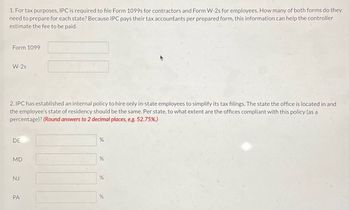

Transcribed Image Text:1. For tax purposes, IPC is required to file Form 1099s for contractors and Form W-2s for employees. How many of both forms do they

need to prepare for each state? Because IPC pays their tax accountants per prepared form, this information can help the controller

estimate the fee to be paid.

Form 1099

W-2s

2. IPC has established an internal policy to hire only in-state employees to simplify its tax filings. The state the office is located in and

the employee's state of residency should be the same. Per state, to what extent are the offices compliant with this policy (as a

percentage)? (Round answers to 2 decimal places, e.g. 52.75%.)

DE

MD

%

%

%

NJ

%

PA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The official document issued by the CIR or his authorized representative authorizing the examination of taxpayer records is called: a.Authorization letter b.Letter Notice c.Letter of Authority d.Mission Order Which is NOT a power of the Commissioner? a.The power to abandon previous rulings b.The power to enter into a compromise c.The power to issue revenue regulations d.The power to issue rulings of first impressionarrow_forwardWhat is a key step in the tax audit process? a) Submitting financial statements to the tax authority b) Reviewing the taxpayer's records and documents c) Negotiating a settlement with the tax authority d) Publishing the audit findings to the publicarrow_forwardIndicate whether the following statements are "True" or "False" regarding the administrative powers of the IRS. a. If the taxpayer meets the record-keeping requirement and substantiates income and deductions properly, the IRS bears the burden of proof in establishing a tax deficiency during litigation. b. The Code permits the IRS to assess a deficiency and to demand payment for the tax. However, no assessment or effort to collect the tax may be made until 30 days after a statutory notice of a deficiency (a 30-day letter) is issued. c. If the taxpayer neglects or refuses to pay the tax after receiving the demand for payment, a lien in favor of the IRS is placed on all property (realty and personalty, tangible and intangible) belonging to the taxpayer.arrow_forward

- You are in the tax department at a large public accounting firm and you are working with your new client, Big Corporation. Big Corporation prepares their financial statements (Book Income) based on US Generally Accepted Accounting Principles (GAAP). The Controller is very familiar with GAAP accounting but is unsure about this need to adjust Book Income to Taxable Income and wants to understand it better. You have already identified five questions that the Controller has concerning these Book to Tax Differences from your first meeting. You are planning to meet again with the Controller to discuss those listed five items identified below, Items 1 to 5. For that upcoming meeting, please write in a paragraph or so for each item (i.e. 1, 2, 3, 4 and 5) so you can be prepared to verbally discuss with the Controller each item. There is no need for any references to tax law and do not worry about grammar or spelling since this will be your notes only for the upcoming discussion and the…arrow_forwarda. Use Georgia's Corporate Income Tax Form 600 and Instructions to determine what federal-to-state adjustments Bulldog needs to make for Georgia. Bulldog's federal taxable income was $194,302. Calculate its Georgia state tax base.arrow_forwardA friend says to you, “I don’t understand how taxable temporary differences can be ‘liabilities’ and how deductible temporary differences can be ‘assets.’ It seems to me that these temporary differences relate only to the future and that accounting is based on ‘historical cost.’ In addition, the government frequently changes the tax laws, so no one knows what the future tax laws will be.” Required: Prepare a written response for your friend that explains why deferred tax assets and deferred tax liabilities are recognized and reported on a corporation’s balance sheet. Include a discussion of a valuation allowance.arrow_forward

- The salaries of the Chief Justice and associate justice of the Supreme Court are tax-exempt because they are employees of the government. TRUE OR FALSE?arrow_forwardPlease do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forwardThe IRS spends considerable time and effort trying to distinguish whether a person is an employee or an independent contractor. Why? What standards does the IRS use to determine whether a person is an employee or independent contractor? If self-employment tax and social security tax/medicare tax are equal in amounts, why does the IRS care whether a person is an employee or independent contractor? Please answer all questions.arrow_forward

- Which of the following is not a true statement regarding revenues from various types of nonexchange transactions? Derived tax revenues occur as a result of sales and or income tax. Imposed nonexchange revenues consist of only fines and penalties assessed by the governing agency. Government mandated nonexchange transactions includes grants from the federal government to the local public-school system for a free lunch program. Voluntary nonexchange transactions can originate from a governmental agency or private citizen organization. Imposed nonexchange transactions revenue recognition is made in the time period when the resulting resources are required to be used or in the first period in which use is permitted.arrow_forwardThe S-corporation is a flow-through business entity under Subchapter S of the IRC. Go to the IRS websiteLinks to an external site. and search for a corporation's tax return (Form 1120) and an S-corporation tax return (Form 1120-S). Discuss one similarity or difference that you notice between the two returns. In that discussion, include why the similarity or difference exists.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education