FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Subject : Accounting

Transcribed Image Text:ces

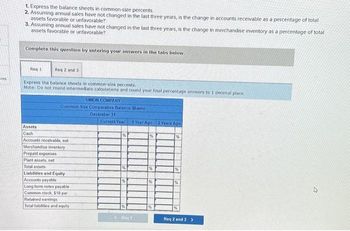

1. Express the balance sheets in common-size percents

2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total

assets favorable or unfavorable?

3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total

assets favorable or unfavorable?

Complete this question by entering your answers in the tabs below.

Req 1

Req 2 and 3

Express the balance sheets in common-size percents.

Note: Do not round intermediate calculations and round your final percentage answers to 1 decimal place.

SIMON COMPANY

Common Size Comparative Balance Sheets

December 31

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Liabilities and Equity

Accounts payable

Long term notes payable

Common stock, $10 par

Retained earnings

Total liabilities and equity

Current Year 1 Year Ago 2 Years Ago

%

Reg 1

%

Req 2 and 3>

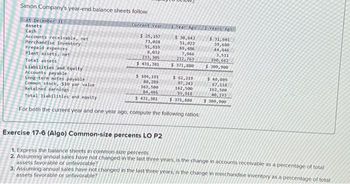

Transcribed Image Text:Simon Company's year-end balance sheets follow.

At December 31

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Liabilities and Equity

Accounts payable

Current Year

$ 25,197

73,028

91,819

8,032

233,305

$ 431,381

1 Year Ago

$ 30,643

51,022

69,486

7,966

212,763

$ 371,880

$ 104, 191

Long-tera notes payable

Common stock, $10 par value

80,289

162,500

84,401

$ 62,219

87,243

162,500

59,918

Retained earnings

Total liabilities and equity

$ 431,381

$ 371,880

For both the current year and one year ago, compute the following ratios

2 Years Ago

$ 31,601

39,680

44,446

3,511

190,662

$309,900

$ 40,089

67,118

162,500

40,193

$ 309,900

Exercise 17-6 (Algo) Common-size percents LO P2

1. Express the balance sheets in common-size percents

2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total

assets favorable or unfavorable?

3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total

assets favorable or unfavorable?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Skip to question [The following information applies to the questions displayed below.] The following is financial information describing the six operating segments that make up Chucktown Sauce Company (in thousands): Segments Red $ 1,817 22 Sales to outside parties Intersegment revenues Salary expense Rent expense Interest expense (92) Income tax expense (savings) 147 Consider the following questions independently. None of the six segments have a primarily financial nature. c. What volume of revenues must a single customer generate to necessitate disclosing the existence of a major customer? Note: Enter your answer in dollars but not in thousands. 620 145 Blue Green Pink Black White $ 818 $520 $315 $127 $ 105 97 115 0 308 71 385 408 318 172 87 65 93 88 67 22 55 323 98 48 37 68 20 11 (70) 0arrow_forwardDefine Proprietorshiparrow_forwardDefinitions of Common Income and Expense Itemsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education